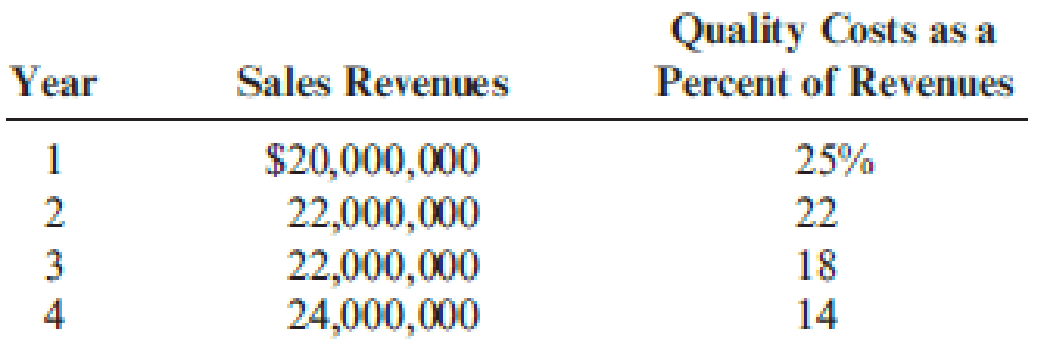

Gagnon Company reported the following sales and quality costs for the past four years. Assume that all quality costs are variable and that all changes in the quality cost ratios are due to a quality improvement program.

Required:

- 1. Compute the quality costs for all four years. By how much did net income increase from Year 1 to Year 2 because of quality improvements? From Year 2 to Year 3? From Year 3 to Year 4?

- 2. The management of Gagnon Company believes it is possible to reduce quality costs to 2.5 percent of sales. Assuming sales will continue at the Year 4 level, calculate the additional profit potential facing Gagnon. Is the expectation of improving quality and reducing costs to 2.5 percent of sales realistic? Explain.

- 3. Assume that Gagnon produces one type of product, which is sold on a bid basis. In Years 1 and 2, the average bid was $400. In Year 1, total variable costs were $250 per unit. In Year 3, competition forced the bid to drop to $380. Compute the total contribution margin in Year 3 assuming the same quality costs as in Year 1. Now, compute the total contribution margin in Year 3 using the actual quality costs for Year 3. What is the increase in profitability resulting from the quality improvements made from Year 1 to Year 3?

1.

Compute the quality costs for all four years and calculate the amount of increase in net income from year 1 to year 2, from year 2 to year 3, and from year 3 to year 4.

Explanation of Solution

Quality costs: Quality costs are costs that are incurred to avoid, identify and eliminate defects from products. Quality costs are classified into four components namely;

- “Prevention costs”.

- “Appraisal costs”.

- “Internal failure costs”.

- “External failure costs”.

Calculate the quality costs for all the four years:

| Year | Percent of revenues | × | Sales revenues | = | Quality costs |

| Year 1 | 25% | $20,000,000 | $5,000,000 | ||

| year 2 | 22% | $22,000,000 | $4,840,000 | ||

| Year 3 | 18% | $22,000,000 | $3,960,000 | ||

| Year 4 | 14% | $24,000,000 | $3,960,000 |

Table (1)

Calculate the increase in net income from year 1 to year 2:

Calculate the increase in net income from year 2 to year 3:

Calculate the increase in net income from year 3 to year 4:

2.

Calculate the additional profit potential facing Company G and state whether expecting improved quality and reduced costs to 2.5 percent of sales is realistic.

Explanation of Solution

Calculate the profit potential:

Therefore, from the above calculation, it is ascertained that amount of profit potential is $2,760,000.

The 2.5 percent goal is the level identified by several quality experts that a company must strive to obtain. The experience of company G shows that it is an achievable goal

3.

Calculate the total contribution margin in year 3 assuming the same quality costs as in year 1 compute the total contribution margin in year 3 using the actual quality costs for year 3 and calculate the increase in profitability resulting from the quality improvements made from year 1 to year 3.

Explanation of Solution

Contribution Margin: The process or theory which is used to judge the benefit given by each unit of the goods produced is called as contribution margin.

Calculate the total contribution margin in year 3 assuming the same quality costs as in year 1 compute the total contribution margin in year 3 using the actual quality costs for year 3:

| Year 3-No change | Year 3-change | |

| Sales | $22,000,000 | $22,000,000 |

| Variable expenses | (1)$14,473,684 | (6)$11,764,210 |

| Contribution margin | $7,526,316 | $10,235,790 |

Table (2)

Calculate the increase in profitability:

Therefore, the amount of increase in profitability is $2,709,474.

Working notes:

(1)Calculate the variable expenses in year 3 assuming the same quality costs as in year 1:

(2)Calculate the quality cost per unit for year 1:

(3)Calculate the quality cost per unit for year 3:

(4)Calculate the decrease in per-unit variable quality cost:

(5)Calculate the decrease in per-unit total variable cost:

(6)Calculate the total variable cost for year 3:

Want to see more full solutions like this?

Chapter 14 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- You are the owner of Veiled Wonders, a firm that makes window treatments. Some merchandise is custom-made to customer specifications, and some are mass-produced in standardized measurements. There are production workers who work primarily on standardized blinds and some employees who work on custom products on an as-needed basis. How should you structure the pay methods for these production workers?arrow_forwardGeneral Accounting questionarrow_forwardWilson Corporation acquires Greatbatch Company for $80 million cash in a merger. The balance sheets of both companies at the date of acquisition are as follows: Balance Sheet (in millions) Wilson Greatbatch Current assets $96 $8 Property and equipment 800 144 Intangibles 32 4.8 Total assets $928 $156.8 Current liabilities $40 $3.2 Long-term debt 640 104 Capital stock 80 19.2 Retained earnings 192 24 Accumulated other comprehensive income (loss) (24) 6.4 Total liabilities and equity $928 $156.8 Greatbatch's property and equipment is overvalued by $48 million, its reported intangibles are undervalued by $32 million, and it has unreported intangibles, in the form of customer databases and marketing agreements, valued at $11.2 million. Required Prepare Wilson's balance sheet immediately following the merger. Use a negative sign with your answer for AOCI if the balance is a loss.arrow_forward

- Compare and contrast experiences you have had with your own and other people’s monochromic time orientation and polychronic time orientation and how you can account for any differences in time orientation in your workplace communications in the future.arrow_forwardI need this question answer general Accountingarrow_forwardFinancial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning