1.

Compute the new cost per pound for each product.

1.

Explanation of Solution

Environmental costs: Environmental costs are incurred due to poor environmental quality that may or may not exist.

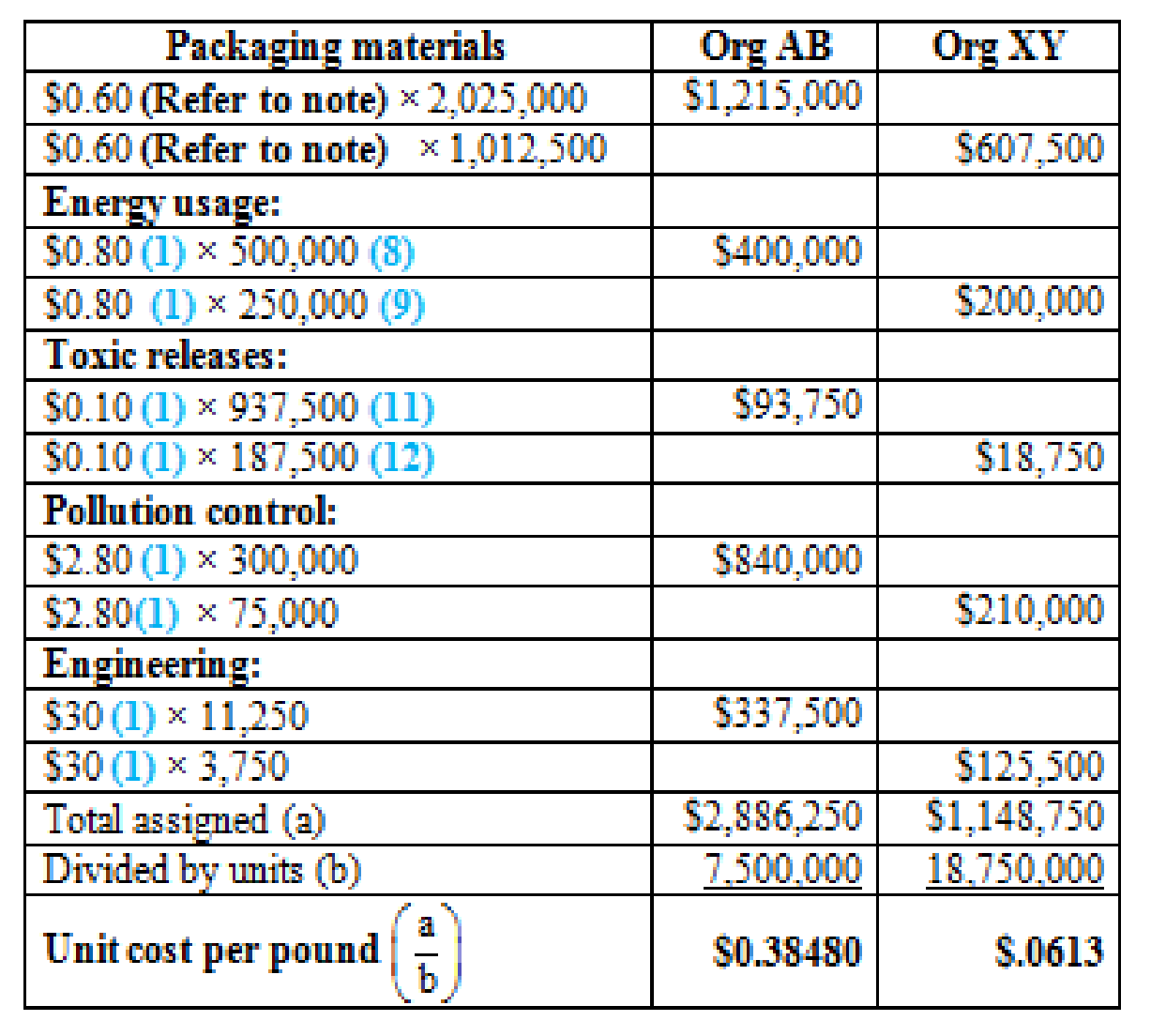

Compute the new cost per pound for each product:

Figure (1)

Note: Pounds of packaging is the driver for both packaging and packaging treatment, therefore the rates can be combined

Working notes:

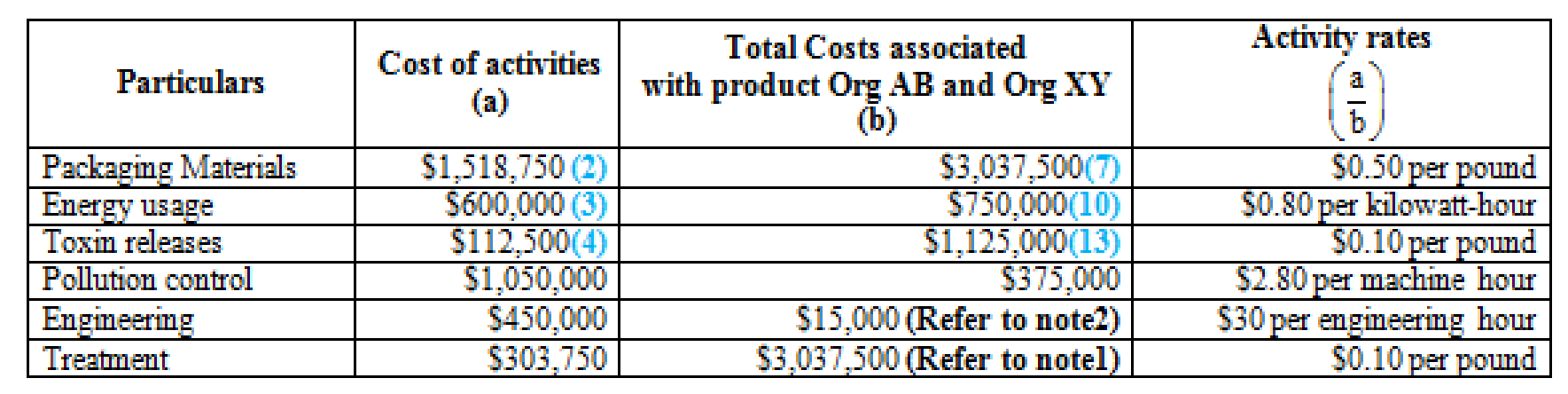

Calculate the activity rates:

Figure (2)

Note 1: Since pounds of packaging are the driver for both packaging and packaging treatment, $3,037,500 is the total costs associated with product Org AB and Org XY.

Note 2: Total engineering hours are 15,000 (11,250 for Org AB and 3,750 for Org XY).

(2)Calculate the new cost of activity-packaging materials:

(3)Calculate the new cost of activity-Energy usage:

Note:

(4)Calculate the new cost of activity-Toxin releases:

Note:

(5)Calculate the cost of packaging materials for Org AB:

Note:

(6)Calculate the cost of packaging materials for Org XY:

Note:

(7)Calculate the total costs associated with packaging materials for both products Org AB and Org XY:

(8)Calculate the cost of energy usage for Org AB:

Note:

(9)Calculate the cost of energy usage for Org XY:

Note:

(10)Calculate the total costs associated with energy usage for both products Org AB and Org XY:

(11)Calculate the cost of toxin releases for Org AB:

Note:

(12)Calculate the cost of toxin releases for Org XY:

Note:

(13)Calculate the total costs associated with toxin releases for both products Org AB and Org XY:

2.

Compute the net savings produced by the environmental changes for each product in total and on a per-unit basis and explain whether this supports the concept of eco-efficiency.

2.

Explanation of Solution

Eco-efficiency: Eco-efficiency is referred as the capability to produce competitively priced goods and services that satisfies the needs and wants of the customer while simultaneously decreasing undesirable environmental impacts.

Compute the net savings produced by the environmental changes for each product in total and on a per-unit basis:

| Particulars | Org AB | Org XY | Total |

| Before |

$4,065,000 (Refer to note) |

$1,710,000 (Refer to note) | $5,775,000 |

| After | 2,886,250 | $1,148,750 | $4,035,000 |

| Total savings (a) | $1,178,750 | $561,250 | $1,740,000 |

| Pounds (b) | 7,500,000 | 18,750,000 | |

| Unit savings | $0.1572 | 0.0299 |

Table (1)

Note: Refer to 23E for the value of amounts.

According to the above calculation, it is noted that eco-efficiency can be improved by improving environmental performance.

3.

Categorize the activities as prevention, detection, internal failure or external failure.

3.

Explanation of Solution

Classify the activities:

| Particulars | Classification |

| Excessive energy and materials | External failure |

| Releasing toxins | External failure |

| Operating pollution control equipment | Internal failure |

| Engineering | Prevention |

Table (2)

4.

Explain the manner n which the environmental improvements can contribute for improving the competitive position of the company.

4.

Explanation of Solution

- The reduced environmental damage may also enhance product and company images, with the potential of attracting more customers. Other possible benefits that may contribute to a competitive advantage include a lower cost of capital and lower insurance costs.

- Product and company reputation can be enhanced by reducing environmental damage, with the idea of attracting more number of customers. Other probable advantage that might contribute to a competitive advantage is by including a lower cost of insurance and lower cost of capital.

Want to see more full solutions like this?

Chapter 14 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- LUKE CO's warehouse was severely damaged by flashflood on June 15, 2023. In the process of gathering the available information to file the insurance claim, LUKE was able to summarize the following: -The last physical inventory was taken on December 31, 2022 and actual count report showed P220,000. -Accounts payable amounted to P109,000 on January 1, 2023 and P126,000 at the time of the flashflood. -Tracing of bank statements showed that payments made to vendors and collections from customers aggregated P641,000 and P875,000, respectively, from January 1, 2023 up to the date of the flashflood. -All sales are on account and outstanding balance of accounts receivables amouted to P135,700 as at January 1, 2023, and P107,000 on June 15, 2023. -All inventory items are sold approximately 30% in excess of cost. -As at June 15, 2023, the cost of inventories that were salvaged and not destroyed amounted to P144,000. How much is the amount of inventory loss as a result of the flashflood?…arrow_forwardWhat was the investor's rate of return on these financial accounting question?arrow_forwardSUBJECT: GENERAL ACCOUNTINGarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning