Concept explainers

Return on Investment An investment broker is instructed by her client to invest up to , some in a junk bond yielding per annum and some in Treasury bills yielding per annum. The client wants to invest at least in T-bills and no more than in the junk bond.

(a) How much should the broker recommend that the client place in each investment to maximize income if the client insists that the amount invested in T-bills must equal or exceed the amount placed in the junk bond?

(b) How much should the broker recommend that the client place in each investment to maximize income if the client insists that the amount invested in T-bills must not exceed the amount placed in the junk bond?

To solve: The given linear programming problem.

Answer to Problem 23AYU

Solution:

a. The maximum return on investment is , when is invested in T-Bills and is invested in junk bond.

Explanation of Solution

Given:

- Total investment upto .

- Minimum investment in Treasury Bills .

- Maximum investment in junk bond .

- Interest from Treasury Bills .

- Interest from junk bond .

Calculation:

Begin by assigning symbols for the two variables.

Amount invested in T-Bills.

Amount invested in junk bond.

a. If is the total return from both the investment, then

The goal is to maximize subject to certain constraints on and . Because and represents the amount, the only meaningful values of and are non-negative.

Therefore, .

From the given data we get

Therefore, the linear programming problem may be stated as

Maximize

Subject to

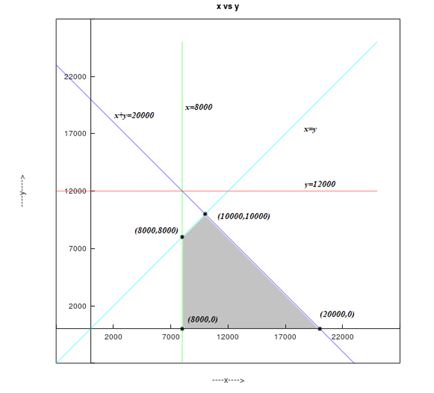

The graph of the constraints is illustrated in the figure below.

| Corner points are | Value of objective function |

The maximum return on investment is , when is invested in T-Bills and is invested in junk bond.

To solve: The given linear programming problem.

Answer to Problem 23AYU

Solution:

b. The maximum return on investment is , when is invested in T-Bills and is invested in junk bond.

Explanation of Solution

Given:

- Total investment upto .

- Minimum investment in Treasury Bills .

- Maximum investment in junk bond .

- Interest from Treasury Bills .

- Interest from junk bond .

Calculation:

Begin by assigning symbols for the two variables.

Amount invested in T-Bills.

Amount invested in junk bond.

b. If is the total return from both the investment, then

The goal is to maximize subject to certain constraints on and . Because and represents the amount, the only meaningful values of and are non-negative.

Therefore, .

From the given data we get

Therefore, the linear programming problem may be stated as

Maximize

Subject to

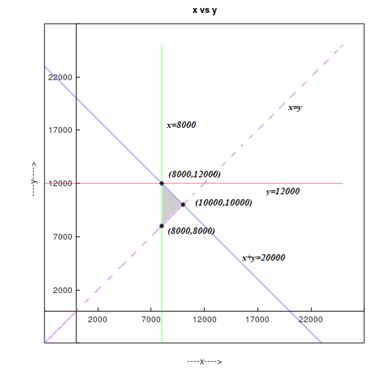

The graph of the constraints is illustrated in the figure below.

| Corner points are | Value of objective function |

The maximum return on investment is , when is invested in T-Bills and is invested in junk bond.

Chapter 11 Solutions

Precalculus Enhanced with Graphing Utilities

Additional Math Textbook Solutions

Calculus, Single Variable: Early Transcendentals (3rd Edition)

Calculus: Early Transcendentals (3rd Edition)

Single Variable Calculus: Early Transcendentals (2nd Edition) - Standalone book

University Calculus: Early Transcendentals (4th Edition)

Glencoe Math Accelerated, Student Edition

Precalculus: Concepts Through Functions, A Unit Circle Approach to Trigonometry (4th Edition)

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning