Concept explainers

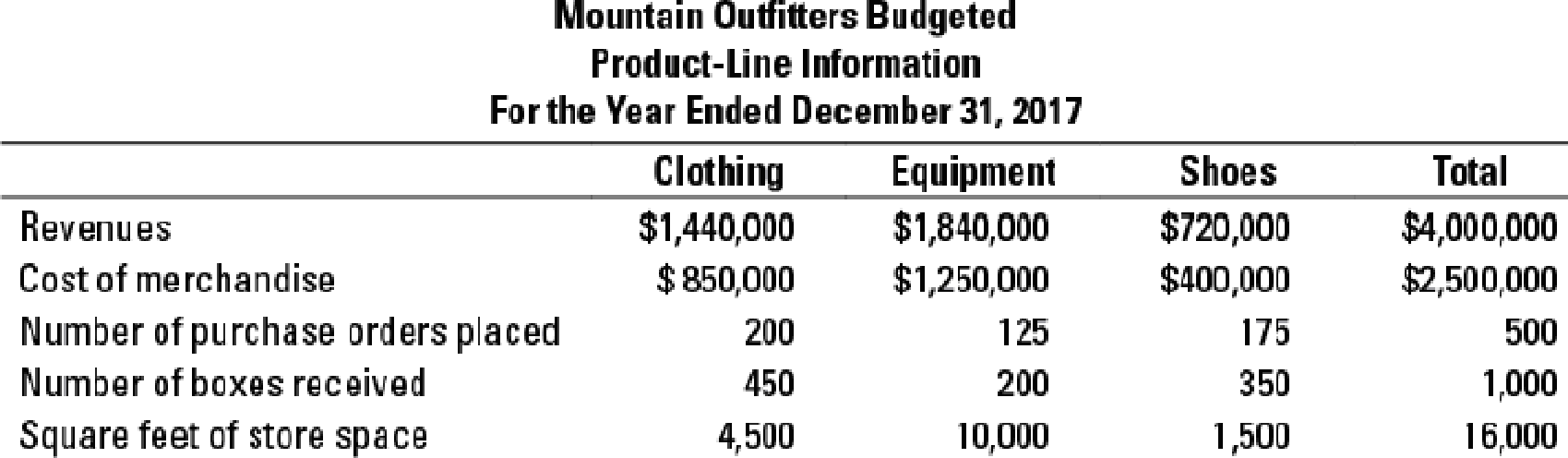

Activity-based costing, activity-based management, merchandising. Mountain Outfitters operates a large outdoor clothing and equipment store with three main product lines: clothing, equipment, and shoes. Mountain Outfitters operates at capacity and allocates selling, general, and administration (S, G & A) costs to each product line using the cost of merchandise of each product line. The company wants to optimize the pricing and cost management of each product line and is wondering if its accounting system is providing it with the best information for making such decisions. Store manager Aaron Budd gathers the following information regarding the three product lines:

For 2017, Mountain Outfitters budgets the following selling, general, and administration costs:

| Mountain Outfitters Selling, General, and Administration (S, G & A) Costs For the Year Ended December 31, 2017 | |

| Purchasing department expense | $ 320,000 |

| Receiving department expense | 210,000 |

| Customer support expense (cashiers and floor employees) | 250,000 |

| Rent | 240,000 |

| General store advertising | 100,000 |

| Store manager’s salary | 125,000 |

| $1,245,000 | |

- 1. Suppose Mountain Outfitters uses cost of merchandise to allocate all S, G & A costs. Prepare budgeted product-line and total company income statements.

Required

- 2. Identify an improved method for allocating costs to the three product lines. Explain. Use the method for allocating S, G & A costs that you propose to prepare new budgeted product-line and total company income statements. Compare your results to the results in requirement 1.

- 3. Write a memo to Mountain Outfitters management describing how the improved system might be useful for managing the store.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Subject:-- financial accountingarrow_forwardBlossom Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are estimated to total $293,250 for the year, and machine usage is estimated at 127,500 hours. For the year, $328,440 of overhead costs are incurred, and 132,600 hours are used. Manufacturing overhead rate $ Manufacturing Overhead $ -23,460 2.3 per machine hour Underapplied Prepare the adjusting entry to assign the under- or overapplied overhead for the year to cost of goods sold. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward1. Country Income Tax Acts Section # List of Items in emoluments Trinidad and Tobago Barbados Guyana St. Vincent and the Grenadines Antigua and Barbuda St. Lucia St. Kitts and Nevis Bermuda Anguilla Jamaica Aruba Martinique For the countries listed in the table above, search the respective Income Tax Acts and identify the sections that deal with emoluments. List the items that should be included in the emoluments as determined by the respective Acts. 2. Peter Small is an Accountant at Jumbo Products Ltd. (Jumbo). He receives an annual salary of $1,080,000. Although Peter does not require a cellular phone to effectively perform his duties, his employer provides him with one and agrees to pay a maximum bill of $30,000 per year. For the year, Peter’s cellular phone bill totals $38,100. He receives $4,500 per month for entertainment.…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning