Concept explainers

Activity-based costing, service company. Speediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint’s simple

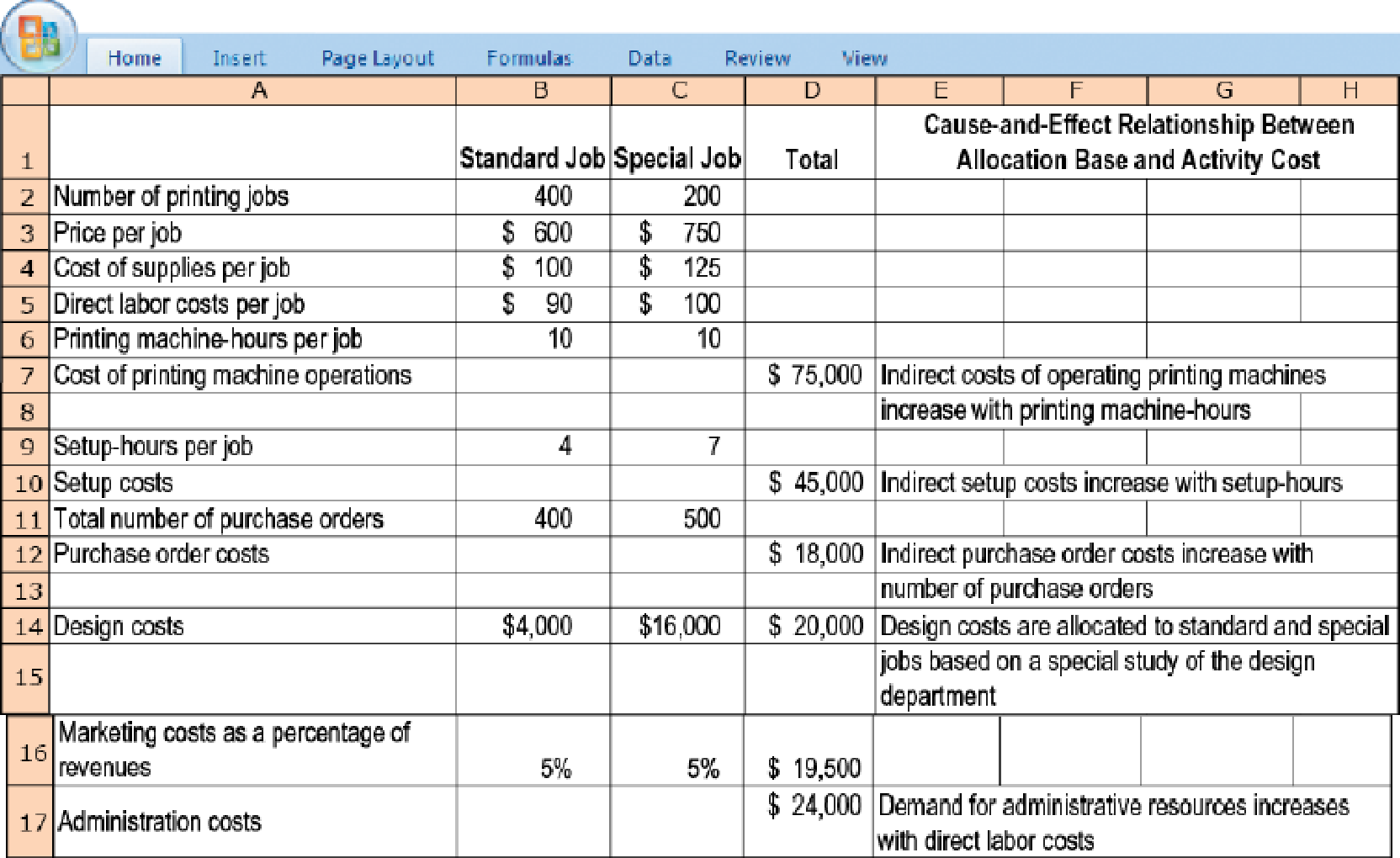

Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint’s ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs. Speediprint collects the following information for the fiscal year 2017 that just ended.

- 1. Calculate the cost of a standard job and a special job under the simple costing system.

Required

- 2. Calculate the cost of a standard job and a special job under the activity-based costing system.

- 3. Compare the costs of a standard job and a special job in requirements 1 and 2. Why do the simple and activity-based costing systems differ in the cost of a standard job and a special job?

- 4. How might Speediprint use the new cost information from its activity-based costing system to better manage its business?

Trending nowThis is a popular solution!

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Can you please help me on these two questions. I have been receive incorrect answers from the AI and other experts. Question 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments.…arrow_forwardGive true answer this financial accounting questionarrow_forwardQuestion 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Annual rental payment is…arrow_forward

- kindly help me with accounting questionarrow_forwardQuestion 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Annual rental payment is…arrow_forwardCompute the following amounts of this accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning