Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.39P

ABC, health care. Crosstown Health Center runs two programs: drug addict rehabilitation and aftercare (counseling and support of patients after release from a mental hospital). The center’s budget for 2017 follows.

| Professional salaries: | ||

| 4 physicians × $150,000 | $600,000 | |

| 12 psychologists × $75,000 | 900,000 | |

| 16 nurses × $30,000 | 480,000 | $1,980,000 |

| Medical supplies | 242,000 | |

| Rent and clinic maintenance | 138,600 | |

| Administrative costs to manage patient charts, food, laundry | 484,000 | |

| Laboratory services | 92,400 | |

| Total | $2,937,000 |

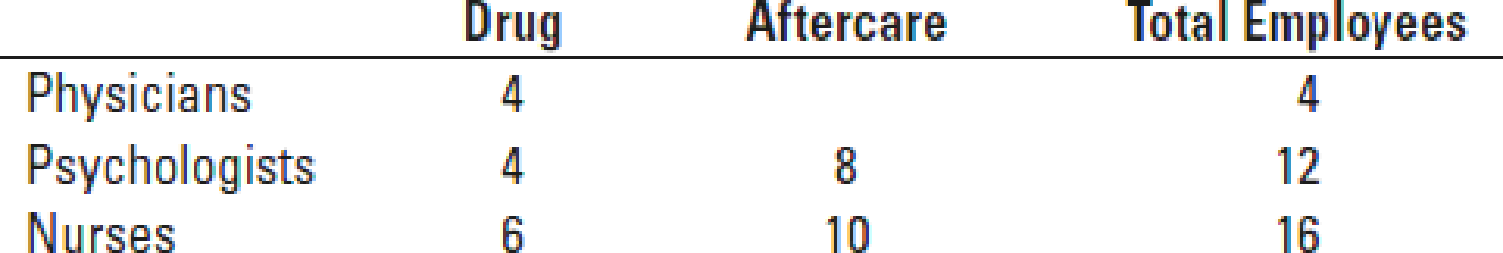

Kim Yu, the director of the center, is keen on determining the cost of each program. Yu compiles the following data describing employee allocations to individual programs:

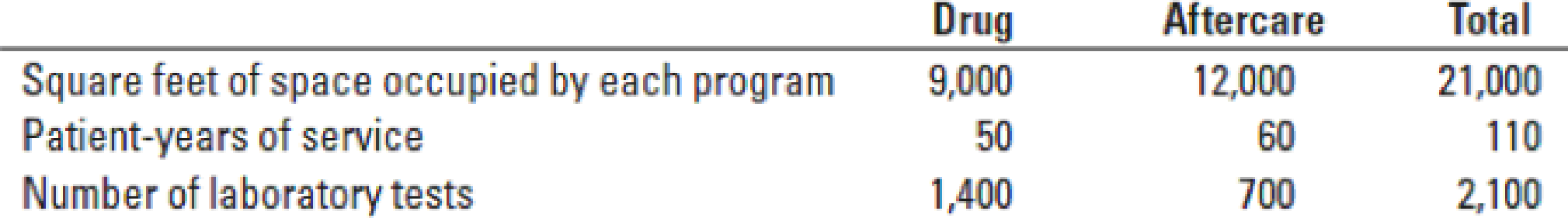

Yu has recently become aware of activity-based costing as a method to refine costing systems. She asks her accountant, Gus Gates, how she should apply this technique. Gates obtains the following budgeted

- a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to programs, calculate the budgeted indirect cost rates for medical supplies: rent and clinic maintenance; administrative costs for patient charts, food, and laundry; and laboratory services.

Required

- b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each program and the budgeted cost per patient-year of the drug program.

- c. What benefits can Crosstown Health Center obtain by implementing the ABC system?

- 2. What factors, other than cost, do you think Crosstown Health Center should consider in allocating resources to its programs?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

?

15℅

AT THE HIGH LEVEL OF ACTIVITY IN NOVEMBER, 10,300 MACHINE HOURS WERE RUN AND POWER COSTS WERE $20,600. IN APRIL, A MONTH OF LOW ACTIVITY, 3,800 MACHINE HOURS WERE RUN AND POWER COSTS AMOUNTED TO $8,000. USING THE HIGH-LOW METHOD, THE ESTIMATED FIXED COST ELEMENT OF POWER COSTS IS_____.

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 5 - What is broad averaging, and what consequences can...Ch. 5 - Why should managers worry about product...Ch. 5 - What is costing system refinement? Describe three...Ch. 5 - What is an activity-based approach to designing a...Ch. 5 - Describe four levels of a cost hierarchy.Ch. 5 - Why is it important to classify costs into a cost...Ch. 5 - What are the key reasons for product cost...Ch. 5 - Prob. 5.8QCh. 5 - Department indirect-cost rates are never...Ch. 5 - Prob. 5.10Q

Ch. 5 - Prob. 5.11QCh. 5 - Prob. 5.12QCh. 5 - Activity-based costing is the wave of the present...Ch. 5 - Increasing the number of indirect-cost pools is...Ch. 5 - The controller of a retail company has just had a...Ch. 5 - Conroe Company is reviewing the data provided by...Ch. 5 - Prob. 5.17MCQCh. 5 - Cost hierarchy. Roberta, Inc., manufactures...Ch. 5 - ABC, cost hierarchy, service. (CMA, adapted)...Ch. 5 - Alternative allocation bases for a professional...Ch. 5 - Plant-wide, department, and ABC Indirect cost...Ch. 5 - Plant-wide, department, and activity-cost rates....Ch. 5 - ABC, process costing. Sander Company produces...Ch. 5 - Department costing, service company. DLN is an...Ch. 5 - Activity-based costing, service company....Ch. 5 - Activity-based costing, manufacturing. Decorative...Ch. 5 - ABC, retail product-line profitability. Fitzgerald...Ch. 5 - Prob. 5.28ECh. 5 - Activity-based costing. The job-costing system at...Ch. 5 - ABC, product costing at banks,...Ch. 5 - Problems 5-31 Job costing with single direct-cost...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - Department and activity-cost rates, service...Ch. 5 - Activity-based costing, merchandising. Pharmahelp,...Ch. 5 - Choosing cost drivers, activity-based costing,...Ch. 5 - ABC, health care. Crosstown Health Center runs two...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - ABC, implementation, ethics. (CMA, adapted) Plum...Ch. 5 - Activity-based costing, activity-based management,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- D.C Company disposed of an asset at the end of the eighth year of its estimated life for $11,500 cash. The asset's life was originally estimated to be 10 years. The original cost was $53,300 with an estimated residual value of $5,300. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardGive me answerarrow_forwardA company manufactured 50,000 units of product at a cost of $450, 000. It sold 45,000 units at $ 15 each. The gross profit is _.arrow_forward

- General accounting questionarrow_forwardProvide answer this financial accounting questionarrow_forwardWhy do you think accountants came up with this concept of "fund accounting" for non for profit organizations? Why couldn't they just use the same accounting methods for corporations for governmental units, hospitals, colleges, or charities?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License