Activity-based costing, merchandising. Pharmahelp, Inc., a distributor of special pharmaceutical products, operates at capacity and has three main market segments:

- a. General supermarket chains

- b. Drugstore chains

- c. Mom-and-pop single-store pharmacies

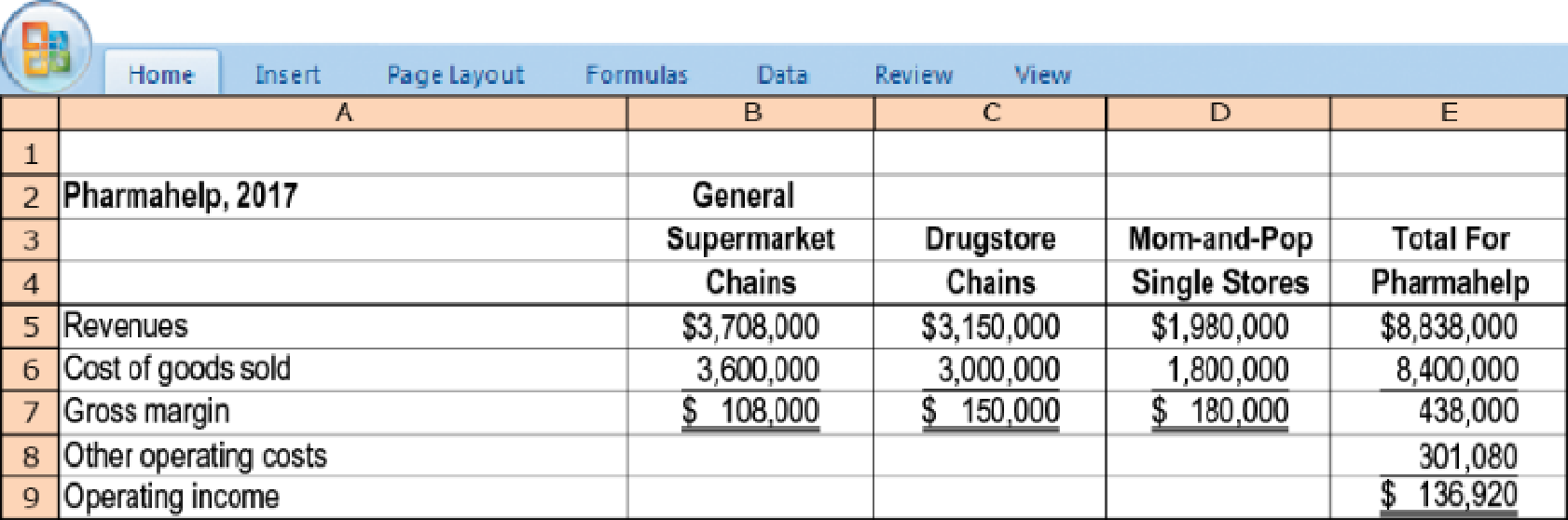

Rick Flair, the new controller of Pharmahelp, reported the following data for 2017.

For many years, Pharmahelp has used gross margin percentage

[(Revenue– Cost of goods sold) ÷ Revenue] to evaluate the relative profitability of its market segments. But Flair recently attended a seminar on activity-based costing and is considering using it at Pharmahelp to analyze and allocate “other operating costs.” He meets with all the key managers and several of his operations and sales staff, and they agree that there are five key activities that drive other operating costs at Pharmahelp:

| Activity Area | Cost Driver |

| Order processing | Number of customer purchase orders |

| Line-item processing | Number of line items ordered by customers |

| Delivering to stores | Number of store deliveries |

| Cartons shipped to store | Number of cartons shipped |

| Stocking of customer store shelves | Hours of shelf-stocking |

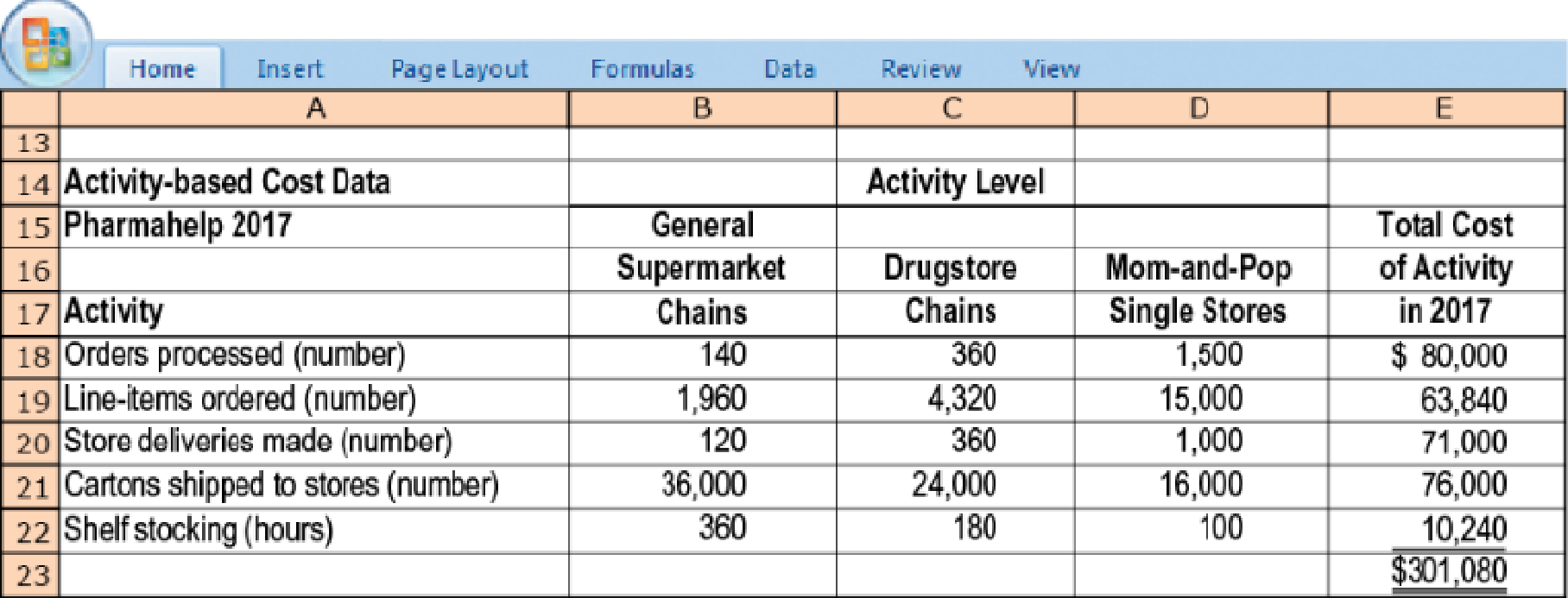

Each customer order consists of one or more line items. A line item represents a single product (such as Extra-Strength Tylenol Tablets). Each product line item is delivered in one or more separate cartons. Each store delivery entails the delivery of one or more cartons of products to a customer. Pharmahelp’s staff stacks cartons directly onto display shelves in customers’ stores. Currently, there is no additional charge to the customer for shelf-stocking and not all customers use Pharmahelp for this activity. The level of each activity in the three market segments and the total cost incurred for each activity in 2017 is as follows:

- 1. Compute the 2017 gross-margin percentage for each of Pharmahelp’s three market segments.

Required

- 2. Compute the cost driver rates for each of the five activity areas.

- 3. Use the activity-based costing information to allocate the $301,080 of “other operating costs” to each of the market segments. Compute the operating income for each market segment.

- 4. Comment on the results. What new insights are available with the activity-based costing information?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Hi expert please provide correct answer general Accountingarrow_forwardWanted This General Account solution ASAParrow_forwardWhich of the following most accurately describes the federal tax consequences of a partnership/LLC? O O A. Partnerships are disregarded as entities for tax purposes. B. LLCs are subject to the same tax consequences as partnerships. O C. The characteristics of income and deduction items flow through to the partners of a partnership. D. Partnerships are subject to double taxation. Earrow_forward

- Nabais Corporation uses the weighted-average method in its process costing system. Operating data for the Lubricating Department for the month of October appear below: (Units Percent Complete with Respect to Conversion) Beginning work in process inventory 3,300 80%; Transferred in from the prior department during October 30,700; Completed and transferred to the next department during October 32,200; Ending work in process inventory 1,800 60% .What were the Lubricating Department's equivalent units of production for October?arrow_forwardGeneral Accountarrow_forwardFinancial accountingarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning