Concept explainers

First-stage allocation, time-driven activity-based costing, service sector. LawnCare USA provides lawn care and landscaping services to commercial clients. LawnCare USA uses activity-based costing to bid on jobs and to evaluate their profitability. LawnCare USA reports the following budgeted annual costs:

| Wages and salaries | $360,000 |

| 72,000 | |

| Supplies | 120,000 |

| Other |

288,000 |

| Total overhead costs | $840,000 |

John Gilroy, controller of LawnCare USA, has established four activity cost pools and the following budgeted activity for each cost pool:

| Activity Cost Pool | Activity Measure | Total Activity for the Year |

| Estimating jobs | Number of job estimates | 250 estimates |

| Lawn care | Number of direct labor-hours | 10,000 direct labor-hours |

| Landscape design | Number of design hours | 500 design hours |

| Other | Facility-sustaining costs that are not allocated to jobs | Not applicable |

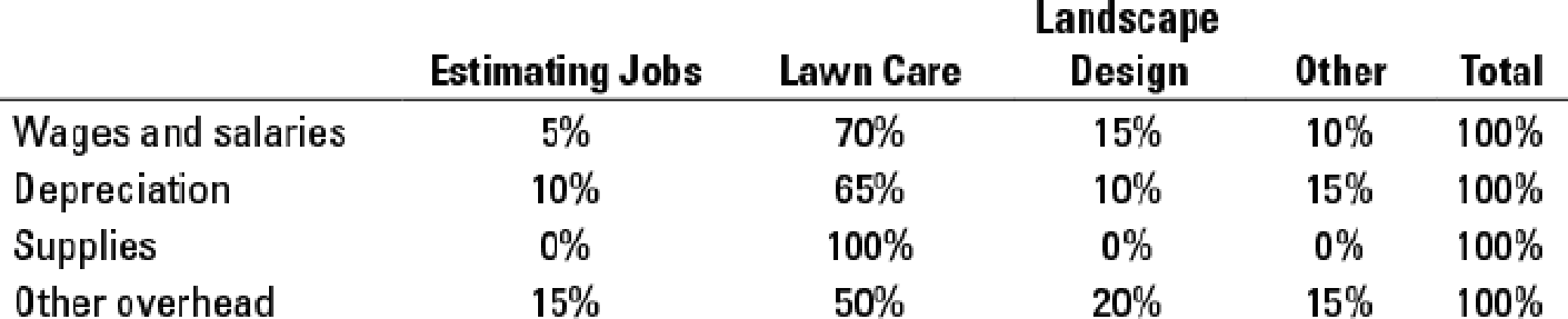

Gilroy estimates that LawnCare USA’s costs are distributed to the activity-cost pools as follows:

Sunset Office Park, a new development in a nearby community, has contacted LawnCare USA to provide an estimate on landscape design and annual lawn maintenance. The job is estimated to require a single landscape design requiring 40 design hours in total and 250 direct labor-hours annually. LawnCare USA has a policy of pricing estimates at 150% of cost.

- 1. Allocate LawnCare USA’s costs to the activity-cost pools and determine the activity rate for each pool.

Required

- 2. Estimate total cost for the Sunset Office Park job. How much would LawnCare USA bid to perform the job?

- 3. LawnCare USA does 30 landscape designs for its customers each year. Estimate the total cost for the Sunset Office park job if LawnCare USA allocated costs of the Landscape Design activity based on the number of landscape designs rather than the number of landscape design-hours. How much would LawnCare USA bid to perform the job? Which cost driver do you prefer for the Landscape Design activity? Why?

- 4. Sunset Office Park asks LawnCare USA to give an estimate for providing its services for a 2-year period. What are the advantages and disadvantages for LawnCare USA to provide a 2-year estimate?

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Intermediate Accounting (2nd Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- In a goal to expand their user base, social media giant OneWorld acquired a small start-up company MyLife for $51,100,000 cash. An appraiser assessed the fair market value of the tangible assets of MyLife at $25,110,000 at the date of acquisition. The deal stipulated that OneWorld will not assume any responsibility for the liabilities of MyLife. A decade later, much of the data provided to OneWorld through the acquisition has also been acquired by their competitors. An appraiser determined that the current fair value of the goodwill to be $5,110,000. Required: a. Determine the amount of goodwill OneWorld should recognize at the date of acquisition. b. Should OneWorld recognize an impairment loss related to the change in value? If so, how much? a. Goodwill b. Is goodwill impaired? b. Impairment lossarrow_forwardPlease given correct answer general Accountingarrow_forwardFinancial accountingarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning