Concept explainers

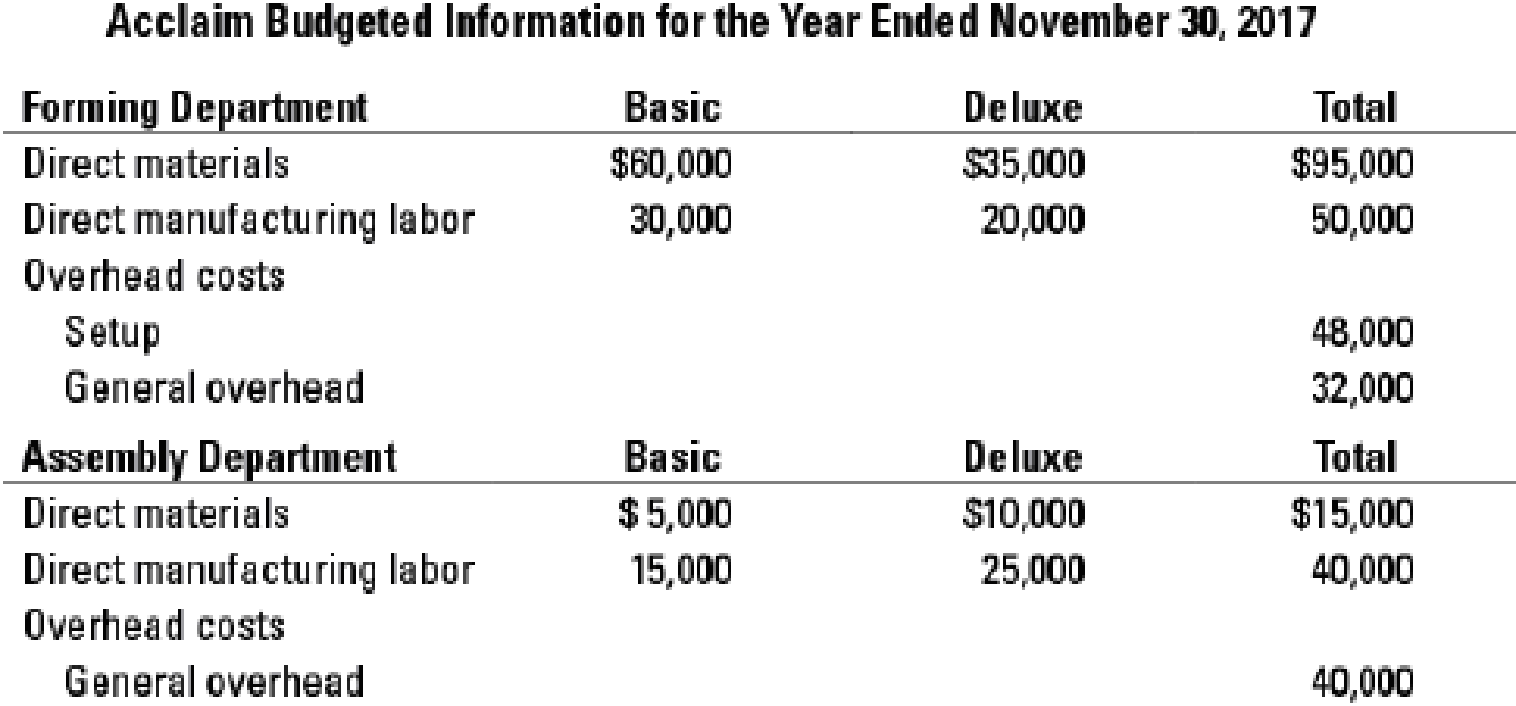

Plant-wide, department, and activity-cost rates. Acclaim Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Acclaim does large custom orders. Acclaim budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect

The controller has asked you to compare plant-wide, department, and activity-based cost allocation.

- 1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead rate, if total overhead is allocated based on total direct costs. (Don’t forget to include direct material and direct manufacturing labor cost in your unit cost calculation.)

Required

- 2. Calculate the budgeted unit cost of basic and deluxe trophies based on departmental overhead rates, where forming department overhead costs are allocated based on direct manufacturing labor costs of the forming department and assembly department overhead costs are allocated based on total direct manufacturing labor costs of the assembly department.

- 3. Calculate the budgeted unit cost of basic and deluxe trophies if Acclaim allocates overhead costs in each department using activity-based costing, where setup costs are allocated based on number of batches and general overhead costs for each department are allocated based on direct manufacturing labor costs of each department.

- 4. Explain briefly why plant-wide, department, and activity-based costing systems show different costs for the basic and deluxe trophies. Which system would you recommend and why?

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Fundamentals of Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Accounting (12th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- 8. When should equitable accounting principles override strict legal interpretations? (A) Court decisions dictate all entries (B) Legal form always determines treatment (C) Substance of economic relationships demands fair representation (D) Statutory rules apply without exceptionarrow_forwardGeneral Accountingarrow_forwardPlease given correct option general accountingarrow_forward

- Question: What characterizes the accounting treatment for redeemable preferred stock at issuance? a) Record as standard equity only b) Split between debt and equity c) Classify as liability if redemption is required d) Present as hybrid instrumentarrow_forwardA California based manufacturers had the following data solve this accounting questionsarrow_forwardWhat amount is reported for net income? General accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College