Concept explainers

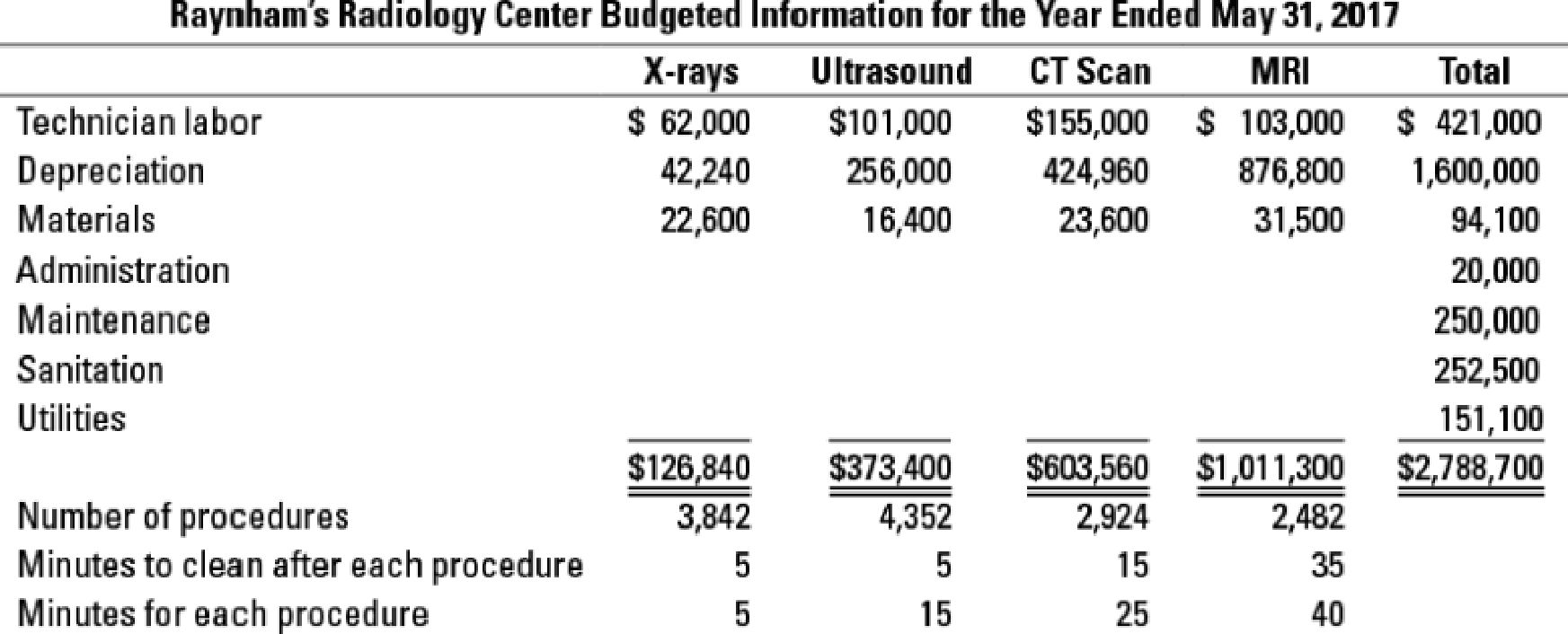

Department and activity-cost rates, service sector. Raynham’s Radiology Center (RRC) performs X-rays. ultrasounds, computer tomography (CT) scans, and magnetic resonance imaging (MRI). RRC has developed a reputation as a top radiology center in the state. RRC has achieved this status because it constantly reexamines its processes and procedures. RRC has been using a single, facility-wide

RRC operates at capacity. The proposed allocation bases for overhead are:

| Administration | Number of procedures |

| Maintenance (including parts) | Capital cost of the equipment (use |

| Sanitation | Total cleaning minutes |

| Utilities | Total procedure minutes |

- 1. Calculate the budgeted cost per service for X-rays, ultrasounds, CT scans, and MRI using direct technician labor costs as the allocation basis.

Required

- 2. Calculate the budgeted cost per service of X-rays, ultrasounds, CT scans, and MRI if RRC allocated overhead costs using activity-based costing.

- 3. Explain how the disaggregation of information could be helpful to RRC’s intention to continuously improve its services.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- 25.arrow_forwardAnswer this financial accounting problemarrow_forwardDuring FY 2022 Munjya Manufacturing had total manufacturing costs are $408,000. Their cost of goods manufactured for the year was $431,000. The January 1, 2023 balance of the Work-in-Process Inventory is $42,000. Use this information to determine the dollar amount of the FY 2022 beginning Work-in-Process Inventory.arrow_forward

- Question 5 Marks: BigBoss Inc. provides the following extracts from income statement for the year 2009: Net sales $500,000, Cost of Goods Sold (150,000), Gross profit $350,000, Calculate the gross profit percentage.arrow_forwardThe ROA for 2020 was?arrow_forwardPROVIDE ANSWER: On June 30, 2009, Straight Movers had $243,000 in current assets and $211,000 in current liabilities. On August 1, 2009, Straight received $50,000 from an issue of promissory notes that will mature in 2012. The notes pay interest on February 1 at an annual rate of 6 percent. Straights' fiscal year ends on December 31. What is the interest expense for December 31?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,