Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.42P

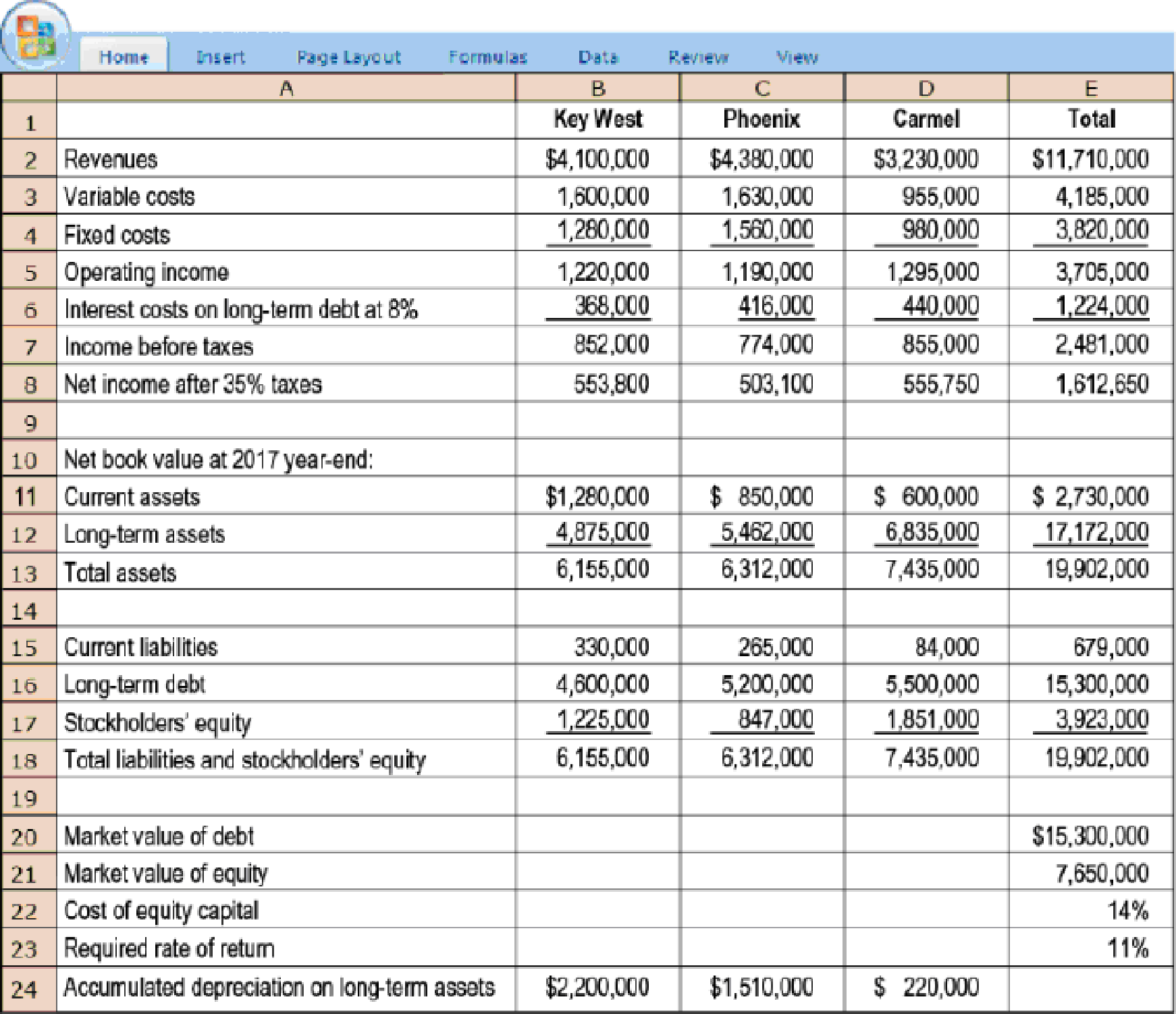

RI, EVA, measurement alternatives, goal congruence. Refresh Resorts, Inc., operates health spas in Key West, Florida; Phoenix, Arizona; and Carmel, California. The Key West spa was the company’s first and opened In 1991. The Phoenix spa opened in 2004, and the Carmel spa opened in 2013. Refresh Resorts has previously evaluated divisions based on RI, but the company is considering changing to an EVA approach. All spas are assumed to face similar risks. Data for 2017 are:

- 1. Calculate RI far each of the spas based on operating income and using total assets as the measure of investment Suppose that the Key West spa is considering adding a new group of saunas from Finland that will cost $225,000. The saunas are expected to bring in operating income of $22,000. What effect would this project have on the RI of the Key West spa? Based on RI, would the Key West manager accept or reject this project? Without resorting to calculations, would the other managers accept or reject the project? Why?

Required

- 2. Why might Refresh Resorts want to use EVA instead of RI for evaluating the performance of the three spas?

- 3. Refer back to the original data. Calculate the WACC for Refresh Resorts.

- 4. Refer back to the original data. Calculate EVA for each of the spas, using net book value of long-term assets. Calculate EVA again, this time using gross book value of long-term assets. Comment on the differences between the two methods.

- 5. How does the selection of asset measurement method affect goal congruence?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I want to this question answer of this general Accounting question

Hii expert please given true answer general Accounting

On December 31, Year 8, Suzi McDowell wants to have $60,000. She plans to make 6 deposits in a fund to provide this amount. Interest compounds annually at 12%.

Required:

Compute the equal annual amounts that Suzi must deposit assuming that he makes the first deposit on:

December 31, Year 3

December 31, Year 2

Chapter 23 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E14.10 (LO 1) (Information Related to Various Bond Issues) Pawnee Inc. has issued three types of debt on January 1, 2022, the start of the company's fiscal year. a. $10 million, 10-year, 13% unsecured bonds, interest payable quarterly. Bonds were priced to yield 12%. b. $25 million par of 10-year, zero-coupon bonds at a price to yield 12% per year. c. $15 million, 10-year, 10% mortgage bonds, interest payable annually to yield 12%. Instructions Prepare a schedule that identifies the following items for each bond: (1) maturity value, (2) number of interest periods over life of bond, (3) stated rate per each interest period, (4) effective-interest rate per each interest period, (5) payment amount per period, and (6) present value of bonds at date of issue. Hint: you don't need to prepare the amortization schedule to answer this question. Just a simple table is enough.arrow_forwardNeed correct answer of this question general Accountingarrow_forwardNeed help this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Business Analysis?; Author: WolvesAndFinance;https://www.youtube.com/watch?v=gG2WpW3sr6k;License: Standard Youtube License