Concept explainers

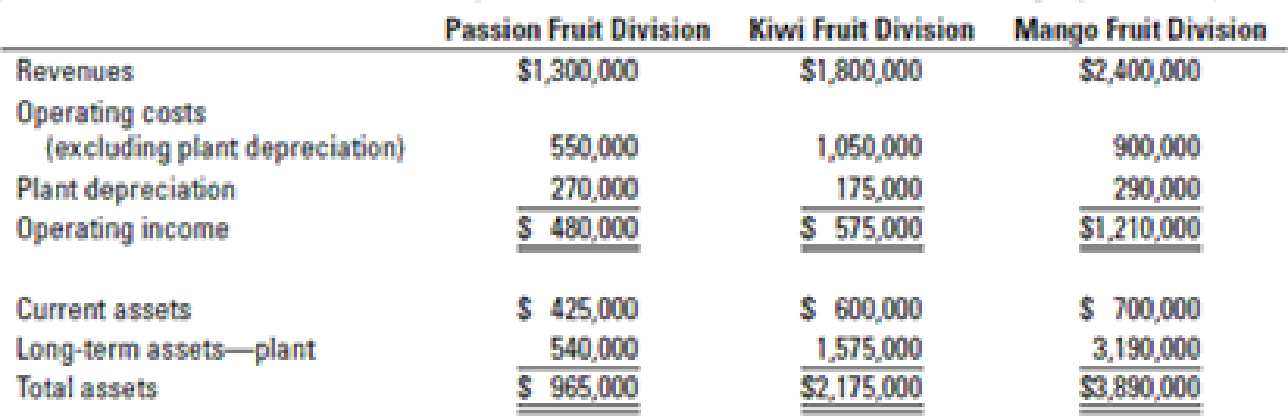

Nature’s Juice estimates the useful life of each plant to be 12 years, with no terminal disposal value. The

| 2007 | 2014 | 2016 | 2017 |

| 100 | 120 | 185 | 200 |

Given the high turnover of current assets, management believes that the historical-cost and current-cost measures of current assets are approximately the same.

- 1. Compute the ROI ratio (operating income to total assets) of each division using historical-cost measures. Comment on the results.

Required

- 2. Use the approach in Figure 23-2 (page 902) to compute the ROI of each division, incorporating current-cost estimates as of 2017 for depreciation expense and long-term assets. Comment on the results.

- 3. What advantages might arise from using current-cost asset measures as compared with historical-cost measures for evaluating the performance of the managers of the three divisions?

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education