Financial and nonfinancial performance measures, goal congruence. (CMA, adapted) Precision Equipment specializes in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately 2 years ago, Pedro Mendez, president of Precision, decided to revise the bonus plan (based, at the time, entirely on operating income) to encourage division managers to focus on areas that were important to customers and that added value without increasing cost. In addition to a profitability incentive, the revised plan includes incentives for reduced rework costs, reduced sales returns, and on-time deliveries. The company calculates and rewards bonuses semiannually on the following basis: A base bonus is calculated at 2% of operating income; this amount is then adjusted as follows:

- i. Reduced by excess of rework costs over and above 2% of operating income

- ii. No adjustment if rework costs are less than or equal to 2% of operating income

- i. Increased by $4,000 if more than 98% of deliveries are on time and by $1,500 if 96–98% of deliveries are on time

- ii. No adjustment if on-time deliveries are below 96%

- i. Increased by $2,500 if sales returns are less than or equal to 1.5% of sales

- ii. Decreased by 50% of excess of sales returns over 1.5% of sales

If the calculation of the bonus results in a negative amount for a particular period, the manager simply receives no bonus, and the negative amount is not carried forward to the next period.

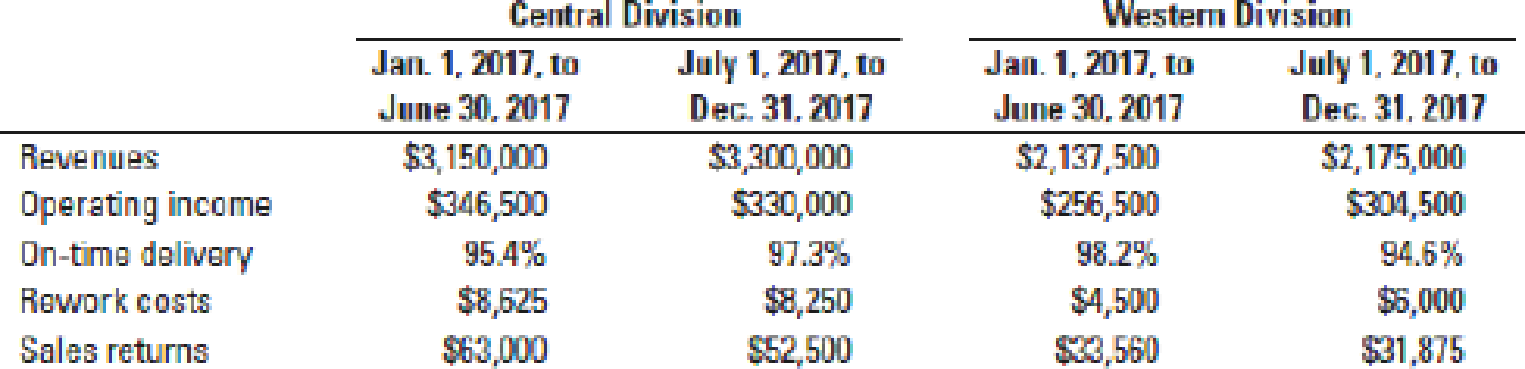

Results for Precision’s Central division and Western division for 2017, the first year under the new bonus plan, follow. In 2016, under the old bonus plan, the Central division manager earned a bonus of $20,295 and the Western division manager received a bonus of $15,830.

- 1. Why did Mendez need to introduce these new performance measures? That is, why does Mendez need to use these performance measures in addition to the operating-income numbers for the period?

- 2. Calculate the bonus earned by each manager for each 6-month period and for 2017 overall.

- 3. What effect did the change in the bonus plan have on each manager’s behavior? Did the new bonus plan achieve what Mendez wanted? What changes, if any, would you make to the new bonus plan?

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning