Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.27E

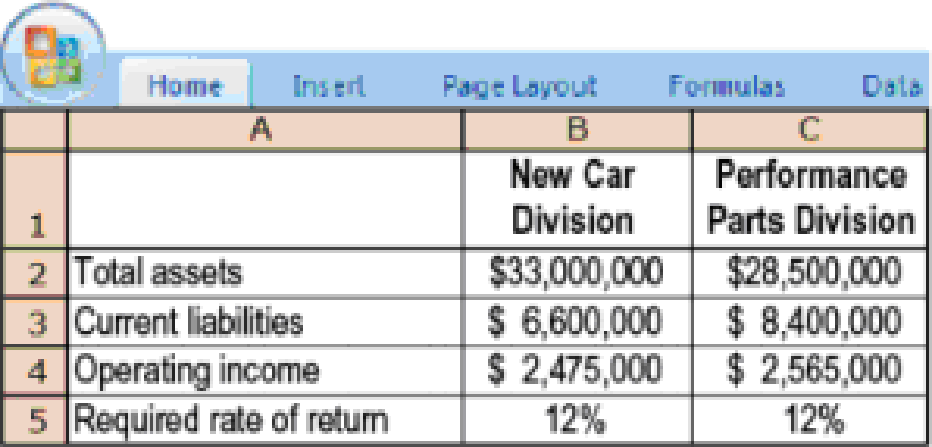

ROI, RI, EVA. Performance Auto Company operates a new car division (that sells high-performance sports cars) and a performance parts division (that sells performance-improvement parts for family cars). Some division financial measures for 2017 are as follows:

- 1. Calculate

return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. - 2. Calculate residual income (RI) for each division using operating income as a measure of income and total assets minus current liabilities as a measure of investment.

- 3. William Abraham, the new car division manager, argues that the performance parts division has loaded up on a lot of short-term debt” to boost its RI. Calculate an alternative RI for each division that is not sensitive to the amount of short-term debt taken on by the performance parts division. Comment on the result.

- 4. Performance Auto Company, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $18,000,000 at an interest rate of 10% and equity capital with a market value of $12,000,000 and a

cost of equity of 15%. Applying the same weighted-average cost of capital (WACC) to each division, calculate EVA for each division. - 5. Use your preceding calculations to comment on the relative performance of each division.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the amount to be paid in full settlement of each invoice, assuming that credit for returns and

allowances was received prior to payment and that all invoices were paid within the discount period.

Freight Paid

Returns and

Merchandise

by Seller

Freight Terms

Allowances

a.

$9,400

$282

FOB Shipping Point, 1/10, net 30

$900

b.

$8,600

$60

FOB Destination, 2/10, net 45

$1,900

a. $

b. $

Travis Company purchased merchandise on account from a supplier for $13,200, terms 2/10, net 30 on December 26. Travis Company paid for the merchandise on December 31, within the discount period.

Required:

Under a perpetual inventory system, record the journal entries required for the above transactions. Refer to the Chart of Accounts for exact wording of account titles.

Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1,

2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800,

direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was

part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1.

During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and

50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during

the month.

1.

Purchased additional raw materials of $75,600 on account.

2.

Incurred factory labor costs of $58,800.

3.

Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…

Chapter 23 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forwardWhat Is the correct answer A B ?? General Accounting questionarrow_forward

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forwardNot need ai solution please correct answer general Accountingarrow_forward

- Accounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forwardAns plzarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License