Concept explainers

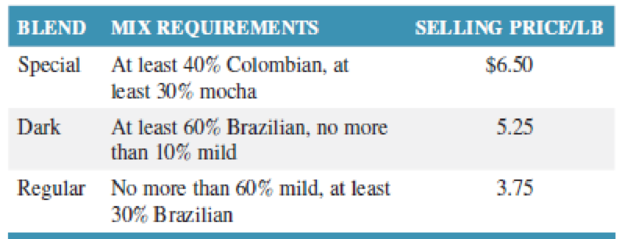

The Mystic Coffee Shop blends coffee on the premises for its customers. It sells three basic blends in one-pound bags: Special, Mountain Dark, and Mill Regular. It uses four different types of coffee to produce the blends: Brazilian, mocha, Colombian, and mild. The shop used the following blend recipe requirements:

The cost of Brazilian coffee is $2.00 per pound, the cost of mocha is $2.75 per pound, the cost of Colombian is $2.90 per pound, and the cost of mild is $1.70 per pound. The shop has 110 pounds of Brazilian coffee, 70 pounds of mocha, 80 pounds of Colombian, and 150 pounds of mild coffee available per week. The shop wants to know the amount of each blend it should prepare each week in order to maximize profit.

Formulate and solve a linear programming model for this problem.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Operations and Supply Chain Management, 9th Edition WileyPLUS Registration Card + Loose-leaf Print Companion

Additional Business Textbook Solutions

Principles of Economics (MindTap Course List)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Operations Management

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- What is the first thing a leader should do when moving through a cultural change? conduct an assessment comparing the practices to other high-performing organizations learn about the current organizational culture continue to monitor key metrics define expectationsarrow_forwardThe third change leadership strategy, Collaborate on Implementation, is designed to address what type of concerns? impact concerns personal concerns refinement concerns collaboration concernsarrow_forwardIf team members are concerned with specifics such as their tasks, contingency plans, resources, and timeline, what concerns do they have? implementation concerns impact concerns refinement concerns personal concernsarrow_forward

- At the developing stage of organizational development, which leadership style is most appropriate? supporting coaching delegating directingarrow_forwardDuring the start-up phase of organizations, which leadership style is appropriate? supporting coaching directing delegatingarrow_forwardRegarding relationships and results, what is typically seen in start-up orgnanizations? low results/high relationships low results/low relationships high results/high relationships high results/ low relationshipsarrow_forward

- What issues lie within Employee and Labor relations with hours worked and how to solve the issues effectively.arrow_forwardName the key stakeholders in the case. Consider the stakeholder map in the lecture material. Which stakeholders would be the most important under your default lens?arrow_forwardresearch Walmart as chosen organization through primary and secondary sources, investigate the organization's mission and vision statement and code of ethics. What is a potential social cause that can be recommend to Walmart that is different than any current social cause Walmart pursues. Research a variety of sources, including the Walmarts website, social media sites, company blogs, industry and trade sources, and other sources, provide a summary of the organization, including Walmarts products or services, customer or client base, areas of operation or distribution, history, main competition, and the organization's current situation. Analyze the mission, vision, and values of Walmart. Evaluate the ethical principles and policy under which Walmart works.arrow_forward

- Read Himachal Fertilizer Corporation (B) and critique the decision he actually made after reading Part B. Was your recommendation similar to what Neil did...how was it the same or how did it differ? Explain why with details from course materials and the case.arrow_forwardName the key stakeholders in the Himachal Fertilizer Corporation Part A case. Consider the stakeholder map in the image below. Which stakeholders would be the most important under your default lens?arrow_forwardThis crosstab shows product sub-category sales within categories, broken out by sales quarter. The quarterly values for each sub-category increase within each category, with the largest value at the bottom. Using Running Total as the calculation type, which scope and direction option gives this result?arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Management, Loose-Leaf VersionManagementISBN:9781305969308Author:Richard L. DaftPublisher:South-Western College Pub

Management, Loose-Leaf VersionManagementISBN:9781305969308Author:Richard L. DaftPublisher:South-Western College Pub