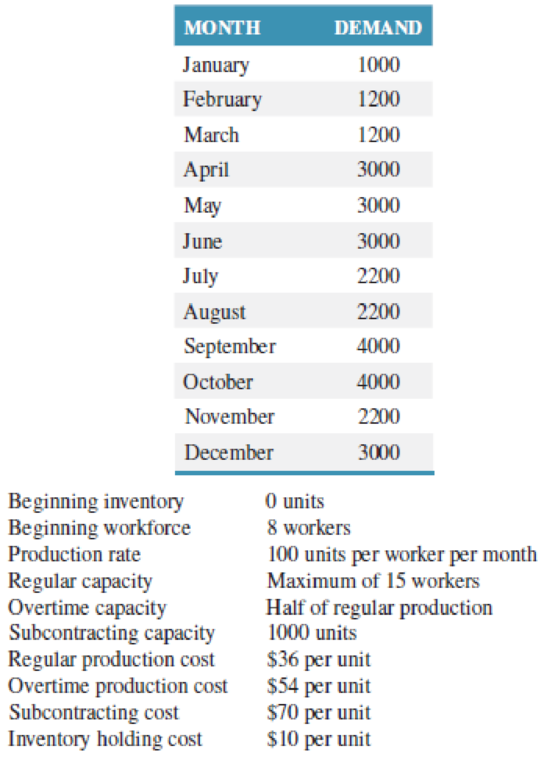

Midlife Shoes, Inc, is a manufacturer of sensible shoes for aging baby-boomers. The company is having great success, and although demand is seasonal, it is expected to increase steadily over the next few years. The company is purchasing a new facility to accommodate the increase in demand, but the facility will not open until 13 months from now. The current facility can only accommodate 15 workers. Hiring and firing costs are negligible. Using the information below, help Midlife manage this transition year by deriving a production plan that will meet demand at the lowest cost. With the limited workforce size, neither chase demand nor level production is viable.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Operations and Supply Chain Management, 9th Edition WileyPLUS Registration Card + Loose-leaf Print Companion

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Management (14th Edition)

Principles of Economics (MindTap Course List)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Fundamentals of Management (10th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- Travelling and working internationally can lead to a life of adventure and unique career experiences. For businesses, selecting the right candidates to take on foreign assignments can propel, delay, or deny the success of the international ventures. As an international manager, identify key competencies you would look for in choosing expatriates. What might be some of their concerns in taking on overseas assignments? What are some best practices in supporting expats during and after their assignments?arrow_forwardResearch proposal: The Investigation of Career Development and Job satisfaction atEskom Rotek Industries 1. Introduction (250 words) 2. Research Context: Background (Research Context: Background (250 words) 3. The Research Problem (The Research Problem) 4. Aim of the study (Maximum 50 words) 5. Research Objectives (3 in total) 6. Research Questions (3 in total) 7. Justification or rationale of the study (150 words) 8. Literature Review (2-3 pages / 1000-1500 words) 9. Research Design and Methodology (1 - 2 page in total, from 9.1 to 9.6) 9.1 Research Philosophy 9.2 Research Methodology 9.3 Target Population and Sampling strategy 9.4 Data Collection 9.5 Data Analysis (100 words) 9.6 Pilot Study 10. Ethical considerations 11. Referencearrow_forwardWith your experience and research, discuss;(a) what type of “Leadership Style” is used in communications services (Digicel Group Limited)?(b) whether the style used is successful or not and why. Justify your position with relevant citation and references ( Rubic is attached to guide the essay ) NOTE: NO AI RESPONSES PLEASEarrow_forward

- by the end of 2013, the IPL port was operational and the naphtha was flowing to the Himachal Fertilizer Corporation (HFC) plant in Central India after being granted the port contract in Summer 2012. The plant was located in an industrial area that had several pipelines in the general geographic area including a crude oil pipeline leading to a refinery, and a pipeline carrying pesticides to be processed and redistributed to local farms in the area. In July 2014, Ajay Patel, the logistics general manager received notification that there were some minor leaks along the pipeline that were being fixed. Workers in the area had experienced sudden headaches and lightheadedness and the company immediately moved to investigate the leak and address faulty seams that had eroded and weakened. The flow of naphtha was temporarily stopped for 72 hours so two portions of the pipeline could be removed, and the eroded portions replaced. Patel put enormous pressure on the repair team to get the repair…arrow_forwardin the MABE: learning to be multinational case report, what is the reccomended course of action?arrow_forwardIn the MABE case report what would be the reccomened course of action?arrow_forward

- Question 6. An electrical engineering company is designing two types of solar panel systems: Standard Panels (S) and High-Efficiency Panels (H). The company has certain constraints regarding the hours of labor and material available for production each week. Each Standard Panel requires 4 hours of labor and 2 units of material and each High-Efficiency Panel requires 3 hours of labor and 5 units of material. The company has a maximum of 60 hours of labor and 40 units of material available per week. The profit from each Standard Panel is GH¢80, and the profit from each High-Efficiency Panel is GH¢100. The company wants to determine how many of each type of panel to produce in order to maximize profit. i) Solve this LPP by using graphical analysis ii) What will be the slack at the optimal solution point? Show calculation.arrow_forwardqusestion 6. An electrical engineering company is designing two types of solar panel systems: Standard Panels (S) and High-Efficiency Panels (H). The company has certain constraints regarding the hours of labor and material available for production each week. Each Standard Panel requires 4 hours of labor and 2 units of material and each High-Efficiency Panel requires 3 hours of labor and 5 units of material. The company has a maximum of 60 hours of labor and 40 units of material available per week. The profit from each Standard Panel is GH¢80, and the profit from each High-Efficiency Panel is GH¢100. The company wants to determine how many of each type of panel to produce in order to maximize profit. i. Formulate a linear programming model of the problem for the company. ii Convert the linear programming model formulated in (a) to a standard form.arrow_forwardG ווח >>> Mind Tap Cengage Learning 1- CENGAGE MINDTAP Chapter 09 Excel Activity: Exponential Smoothing Question 1 3.33/10 e Submit 自 A ng.cengage.com C Excel Online Student Work G A retail store records customer demand during each sales period. 1. What is the f... Q Search this course ? ✓ Co Excel Online Tutorial Excel Online Activity: Exponential Smoothing A-Z A retail store records customer demand during each sales period. The data has been collected in the Microsoft Excel Online file below. Use the Microsoft Excel Online file below to develop the single exponential smoothing forecast and answer the following questions. Office Video X Open spreadsheet Questions 1. What is the forecast for the 13th period based on the single exponential smoothing? Round your answer to two decimal places. 25.10 2. What is the MSE for the single exponential smoothing forecast? Round your answer to two decimal places. 21.88 Activity Frame ? 3. Choose the correct graph for the single exponential…arrow_forward

- Not use ai pleasearrow_forwardItems removed from the work area (5S) were taken to a storage area called ___________. Choose from: SORT, STORD, KNUJ, STUFF, FUDG SORT STORD KNUJ STUFF FUDGarrow_forwardCould you please help explain How was the poor strategic decisions lead to economic downturns of Circuit City Company? What are the sequences of key events and problems that contribute to its collapse. Could you please explain each one them and give the examples If Circuit City would apply Lean Six Sigma. would it helped prevent businesses from collapsed?? How Qualitative and quantitative Research Methodology in Case Study Research would affect Circuit City?arrow_forward

- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,  Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning