Concept explainers

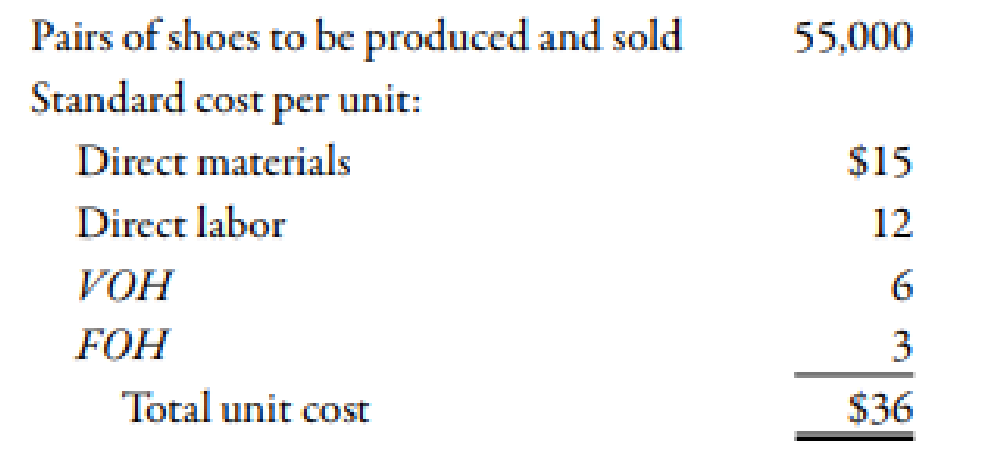

Shumaker Company manufactures a line of high-top basketball shoes. At the beginning of the year, the following plans for production and costs were revealed:

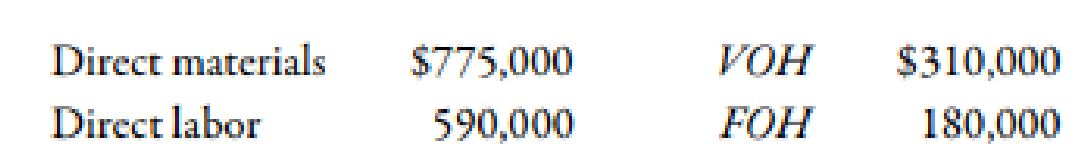

During the year, a total of 50,000 units were produced and sold. The following actual costs were incurred:

There were no beginning or ending inventories of raw materials. In producing the 50,000 units 63,000 hours were worked, 5% more hours than the standard allowed for the actual output.

Required:

- 1. Using a flexible budget, prepare a performance report comparing expected costs for the actual production with actual costs.

- 2. Determine the following: (a) Fixed overhead spending and volume variances and (b) Variable overhead spending and efficiency variances.

1.

Construct the performance report by comparing the expected costs for the actual production with actual costs with the help of flexible budget.

Explanation of Solution

Flexible Budgets:

Flexible budgets are prepared for various levels of activities or outputs. This enables the entity to know the result for the selected level of activity.

Performance report of the variances:

| Budgeted variance | |||

| Overhead cost item |

Actual cost (A) ($) |

Actual Costs (B) ($) |

Spending variance ($) |

| Direct material | 775,000 | 750,0001 | 25,000 (U) |

| Direct labor | 590,000 | 600,0002 | 10,000 (F) |

| Variable overhead | 310,000 | 300,0003 | 10,000 (U) |

| Fixed overhead | 180,000 | 165,0004 | 15,000 (U) |

| Total | 1,855,000 | 1,815,000 | 40,000 (U) |

Table (1)

Working Note:

1. Calculation of actual cost of direct material:

2. Calculation of actual cost of direct labor:

3. Calculation of actual cost of variable overhead:

4. Calculation of actual cost of fixed overhead:

2.

Calculate the value of fixed overhead spending and volume variance. Also, calculate the value of variable overhead spending and efficiency variance.

Explanation of Solution

(a).

Use the following formula to calculate fixed overhead spending variance:

Substitute $180,000 for actual fixed overhead and $165,000 for budgeted fixed overhead in the above formula.

Therefore, the fixed overhead spending variance is $15,000 (U).

Use the following formula to calculate volume variance:

Substitute $165,000 for budgeted fixed overhead, $2.50 for fixed overhead rate and $60,000 for standard hours in the above formula.

Therefore, the volume variance is $15,000 (U).

(b).

Use the following formula to calculate variable overhead spending variance:

Substitute $310,000 for actual overhead, $5.00 for standard variable overhead and 63,000 hours for actual hours in the above formula.

Therefore, the variable overhead spending variance is $5,000 (F).

Use the following formula to calculate variable efficiency variance:

Substitute 63,000 hours for actual hours, 60,000 hours for standard hours and $5.00 for applied variable overhead in the above formula.

Therefore, the efficiency variance is $15,000 (U).

Working Note:

1. Calculation of standard hours:

2. Calculation of fixed overhead rate:

First, hours allowed computed so as calculating the fixed overhead rate:

3. Calculation of variable overhead rate

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- What is the company's gross profitarrow_forwardQuestion 2Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalarrow_forwardGet correct answer general accounting questionsarrow_forward

- Please solve this questions general accountingarrow_forwardCurrent Attempt in Progress During 2025, Crane Corporation had the following amounts, all before calculating tax effects: income before income taxes $550,000, loss on operation of discontinued music division $66,000, gain on disposal of discontinued music division $44,000, and unrealized loss on available-for-sale securities $165,000. The income tax rate is 20%. Prepare a partial income statement, beginning with income before income taxes for the year ended December 31, 2025. CRANE CORPORATION Income Statement (Partial) $ GA $ $ Prepare a statement of comprehensive income for the year ended December 31, 2025. CRANE CORPORATION Statement of Comprehensive Income $ $arrow_forwardMake an Excel spreadsheet to compute gross wages due each employee under federal wage-hour law. See notes below. Ryan is normally paid $1,000 for a 40-hour workweek. One week, he works 46 hours. Latisha is normally paid $1,200 for a 40-hour workweek. One Monday she is out sick but receives 8 hours sick pay. She then works 40 hours Tuesday–Friday. Al is normally paid $500 for a 40-hour workweek. One week, he works 45 hours. Lee is normally paid $1,500 for a 40-hour workweek. To make up for leaving early one Friday, he works 44 hours this week.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub