The Two Cost Systems

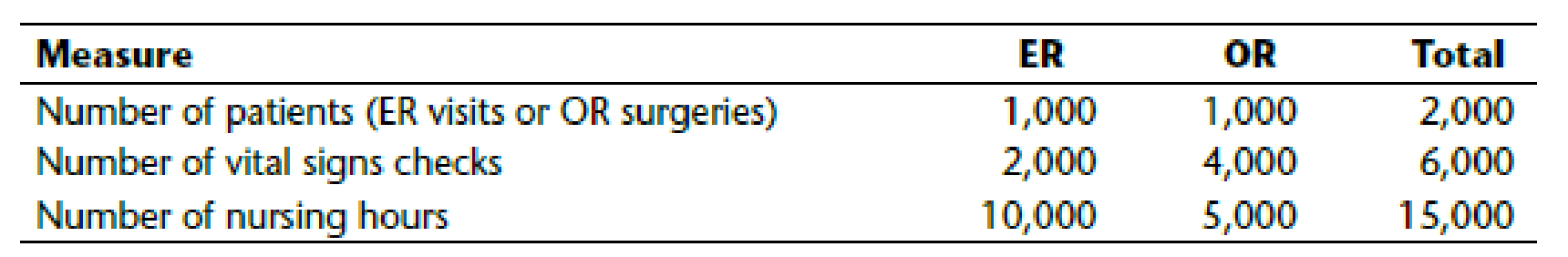

Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service lines—the Emergency Room (ER) and the Operating Room (OR). SHH’s current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal $300,000. The table below shows expected patient volume for both lines.

After discussion with several experienced nurses, Jack Bauer (SHH’s accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients’ vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients’ vital signs. This system is referred to as the “vital-signs costing system.” The earlier table also shows data for vital signs checks for lines.

Calculate the amount of nursing costs that the vital-signs costing system assigns to the ER and to the OR.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Sol This question answerarrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What is the impact on Abercrombie & Fitch's financial statements from the write-down of its logo-adorned merchandise…arrow_forwardTherefore the final answerarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning