Concept explainers

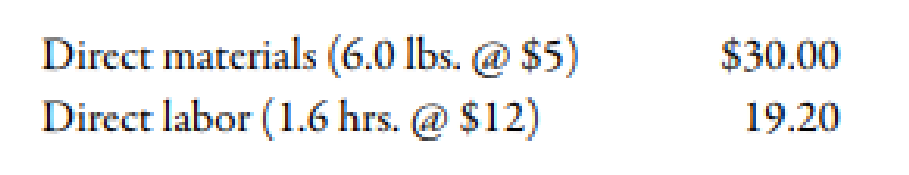

The Lubbock plant of Morril’s Small Motor Division produces a major subassembly for a 6.0 horsepower motor for lawnmowers. The plant uses a

During the year, the Lubbock plant had the following actual production activity:

- a. Production of subassemblies totaled 50,000 units.

- b. A total of 260,000 pounds of raw materials was purchased at $4.70 per pound.

- c. There were 60,000 pounds of raw materials in beginning inventory (carried at $5 per lb.) There was no ending inventory.

- d. The company used 82,000 direct labor hours at a total cost of $1,066,000.

The Lubbock plant’s practical activity is 60,000 units per year. Standard

Required:

- 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Of the two materials variances, which is viewed as the more controllable? To whom would you assign responsibility for the usage variance in this case? Explain.

- 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Who is usually responsible for the labor efficiency variance? What are some possible causes for this variance?

- 3. CONCEPTUAL CONNECTION Assume that the purchasing agent for the small motors plant purchased a lower-quality raw material from a new supplier. Would you recommend that the plant continue to use this cheaper raw material? If so, what standards would likely need revision to reflect this decision? Assume that the end products quality is not significantly affected.

- 4. Prepare all possible

journal entries.

1.

Calculate the value of material price variance and material usage variance. Identify which of the material variance is most controllable. Also, identify to whom the responsibility of usage variance is given and give reason.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

Use the following formula to calculate material price variance:

Substitute $4.70 for actual price, $5.00 for standard price and 260,000 for actual quantity in the above formula.

Therefore, the material price variance is $78,000(F).

Use the following formula to calculate material usage variance:

Substitute 320,000 units for actual quantity, 300,000 units for standard quantity and $5 for standard price in the above formula.

Therefore, the material usage variance is $100,000(U).

According to the above calculations, material usage variance is more controllable because prices of the material depend upon the market situation which is not controllable. The responsibility of this variance should be assigned to the purchase department. The reason for the extra usage is poor quality material purchased as they are priced lower.

Working Note:

1. Calculation of standard quantity:

2.

Calculate the value of labor rate variance and labor efficiency variance. Identify the person who is responsible for the labor efficiency variance. Also, explain the causes of this variance.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $13 for actual rate, $12 for standard rate, 82,000 hours for actual hours in the above formula.

Therefore, the labor rate variance is $82,000(U).

Use the following formula to calculate labor efficiency variance:

Substitute 82,000 hours for actual hours, 80,000 hours for standard hours and $12 for standard rate in the above formula.

Therefore, the labor efficiency variance is $24,000(U).

The production department is responsible for the labor efficiency variance. In the given case, use of poor quality material could have affected efficiency. Other possible causes of the variance could be lack of demand as demand of the product is less as compared to the expected demand, poor supervision , lack of proper training and lack of experience.

Working Note:

1. Calculation of standard hours:

3.

Identify whether an individual would recommend using the cheaper raw material. If, yes then provide standards that should be used in the decision making.

Explanation of Solution

The variances which are affected by the poor quality material is given below:

| Serial Number | Variances |

Amount ($) |

| 1. | Material price variance | 78,000(F) |

| 2. | Material usage variance | 100,000(U) |

| 3. | Labor efficiency variance | 24,000(U) |

| Total | 46,000(U) |

Table (1)

If the outcome of the variances is very large due to the poor quality product, then company should not use this cheaper material.

4.

Pass necessary journal entries.

Explanation of Solution

Journal entry for purchase of raw material:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Material | 1,300,000 | |||

| Material price variance | 78,000 | |||

| Accounts payable | 1,222,000 | |||

| (To record purchase of raw material) |

Table (2)

- Material is an asset and it is increased by $1,300,000. Therefore, debit the material account with $1,300,000.

- The balance of material price variance is favorable and the favorable balance is always credited. Therefore, credit the material price variance with $78,000.

- Accounts payable is a liability and it is increased by $1,222,000. Therefore, credit the accounts payable account with $1,222,000.

Journal entry for issuance of raw material:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Work in progress | 1,500,000 | |||

| Material usage variance | 100,000 | |||

| Materials | 1,600,000 | |||

| (To record issuance of raw material) |

Table (3)

- Work in progress is an asset and it is increased by $1,500,000. Therefore, debit the work in progress account with $1,500,000.

- The balance of material usage variance is unfavorable and the unfavorable balance is always debited. Therefore, debit the material usage variance with $100,000.

- Material is an asset and it is decreased by $1,600,000. Therefore, credit the material account with $1,600,000.

Journal entry for addition of labor to work in progress:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Work in progress | 960,000 | |||

| Labor rate variance | 82,000 | |||

| Labor efficiency variance | 24,000 | |||

| Accrued payroll | 1,066,000 | |||

| (To record labor rate and efficiency variance) |

Table (4)

- Work in progress is an asset and it is increased by $960,000. Therefore, debit the work in progress account with $960,000.

- The balance of labor rate variance is unfavorable and the unfavorable balance is always debited. Therefore, debit the labor rate variance with $82,000.

- The balance of labor efficiency variance is unfavorable and the unfavorable balance is always debited. Therefore, debit the labor efficiency variance with $24,000.

- Accrued payroll is a liability and it is increased by $1,066,000. Therefore, credit the accrued payroll account with $1,066,000.

Journal entry for the closing of variances to cost of goods sold:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Cost of goods sold | 206,000 | |||

| Material usage variance | 100,000 | |||

| Labor rate variance | 82,000 | |||

| Labor efficiency variance | 24,000 | |||

| (To record closing of variances) |

Table (5)

- The balance of cost of goods sold account is increased by $206,000. Therefore, debit the cost of goods sold account with $206,000.

- The balance of material usage variance is transferred to cost of goods sold. Therefore, credit the material usage variance account with $100,000.

- The balance of labor rate variance is transferred to cost of goods sold. Therefore, credit the labor rate variance account with $82,000.

- The balance of labor efficiency variance is transferred to cost of goods sold. Therefore, credit the labor efficiency variance account with $24,000.

Journal entry for the closing of variances to cost of goods sold:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Material price variance | 78,000 | |||

| Cost of goods sold | 78,000 | |||

| (To record closing of variances) |

Table (6)

- The balance of material price variance is transferred to cost of goods sold. Therefore, debit the material price variance account with $78,000.

- The balance of cost of goods sold account is decreased by $78,000. Therefore, credit the cost of goods sold account with $78,000.

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Hi expert please help me this questionarrow_forwardFinancial Accountingarrow_forwardAt an activity level of 8,500 machine hours in a month, Gayle Corporation's total variable production engineering cost is $765,500 and its total fixed production engineering cost is $210,000. Assume that this level of activity is within the relevant range. Required: What would be the total production engineering cost per unit, both fixed and variable, at an activity level of 8,600 machine hours in a month? Helparrow_forward

- provide correct answer is bestarrow_forwardWhat is net sales revenue?arrow_forwardRichmond Corporation's 2021 balance sheet reported net fixed assets of $15,725,600 and accumulated depreciation of ($4,875,200). Richmond Corporation's 2022 balance sheet reported net fixed assets of $20,910,300 and accumulated depreciation of ($6,430,700). What was the change in gross fixed assets for Richmond Corporation between 2021 and 2022? answerarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,