Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 38BEB

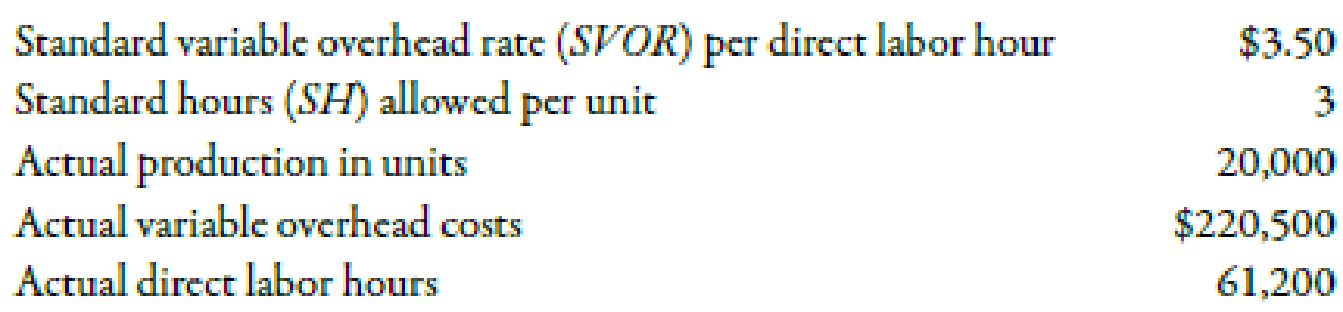

Mulliner Company showed the following information for the year:

Required:

- 1. Calculate the standard direct labor hours for actual production.

- 2. Calculate the applied variable

overhead . - 3. Calculate the total variable overhead variance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question related to financial accounting: During the current year, Carl Equipment Stores had net sales of $540 million, a cost of goods sold of $367 million, average accounts receivable of $64 million, and an average inventory of $53 million. Assuming a 365-day year, the average number of days required for Carl Equipment to sell its inventory is? Help me

Help this question general accounting

Subject. General accounting

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 10 - Discuss the dirrerence between budgets and...Ch. 10 - Describe the relationship that unit standards have...Ch. 10 - Why is historical experience often a poor basis...Ch. 10 - Prob. 4DQCh. 10 - Explain why standard costing systems adopted.Ch. 10 - How does standard costing improve the control...Ch. 10 - Discuss the differences among actual costing,...Ch. 10 - Prob. 8DQCh. 10 - The budget variance for variable production costs...Ch. 10 - When should a standard cost variance be...

Ch. 10 - What are control limits, and how are they set?Ch. 10 - Explain why the materials price variance is often...Ch. 10 - The materials usage variance is always the...Ch. 10 - The labor rate variance is never controllable. Do...Ch. 10 - Prob. 15DQCh. 10 - What is kaizen costing? On which part of the value...Ch. 10 - What is target costing? Describe how costs are...Ch. 10 - Prob. 18DQCh. 10 - The variable overhead efficiency variance has...Ch. 10 - Describe the difference between the variable...Ch. 10 - What is the cause of an unfavorable volume...Ch. 10 - Does the volume variance convey any meaningful...Ch. 10 - Which do you think is more important for control...Ch. 10 - Prob. 1MCQCh. 10 - A currently attainable standard is one that a....Ch. 10 - An ideal standard is one that a. uses only...Ch. 10 - The underlying details for the standard cost per...Ch. 10 - The standard quantity of materials allowed is...Ch. 10 - The standard direct labor hours allowed is...Ch. 10 - Investigating variances from standard is a. always...Ch. 10 - Prob. 8MCQCh. 10 - The materials price variance is usually computed...Ch. 10 - Responsibility for the materials usage variance is...Ch. 10 - Responsibility for the labor rate variance...Ch. 10 - Responsibility for the labor efficiency variance...Ch. 10 - (Appendix 10A) Which of the following items...Ch. 10 - (Appendix 10A) Which of the following is true...Ch. 10 - The total variable overhead variance is the...Ch. 10 - A variable overhead spending variance can occur...Ch. 10 - The total variable overhead variance can be...Ch. 10 - The total fixed overhead variance is a. the...Ch. 10 - The total fixed overhead variance can be expressed...Ch. 10 - An unfavorable volume variance can occur because...Ch. 10 - Prob. 21BEACh. 10 - Control Limits During the last 6 weeks, the actual...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Rath Company showed the following information for...Ch. 10 - Variable Overhead Spending and Efficiency...Ch. 10 - Performance Report for Variable Variances Humo...Ch. 10 - Total Fixed Overhead Variance Bradshaw Company...Ch. 10 - Fixed Overhead Spending and Volume Variances,...Ch. 10 - Prob. 32BEBCh. 10 - Control Limits During the last 6 weeks, the actual...Ch. 10 - Prob. 34BEBCh. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Use the following information to complete Brief...Ch. 10 - Mulliner Company showed the following information...Ch. 10 - Variable Overhead Spending and Efficiency...Ch. 10 - Performance Report for Variable Variances Potter...Ch. 10 - Bulger Company provided the following data:...Ch. 10 - Fixed Overhead Spending and Volume Variances,...Ch. 10 - Standard Quantities of Labor and Materials...Ch. 10 - Sommers Company uses the following rule to...Ch. 10 - Use the following information for Exercises 10-45...Ch. 10 - Refer to the information for Cinturon Corporation...Ch. 10 - Refer to the information for Cinturon Corporation...Ch. 10 - Materials Variances Manzana Company produces apple...Ch. 10 - Labor Variances Verde Company produces wheels for...Ch. 10 - At the beginning of the year, Craig Company had...Ch. 10 - Jackie Iverson was furious. She was about ready to...Ch. 10 - 10-52 Materials and Labor Variances Refer to the...Ch. 10 - Refer to the information for Deporte Company...Ch. 10 - Esteban Products produces instructional aids,...Ch. 10 - Escuchar Products, a producer of DVD players, has...Ch. 10 - Use the following information for Exercises 10-56...Ch. 10 - Refer to the information for Rostand Inc. above....Ch. 10 - At the beginning of the year, Lopez Company had...Ch. 10 - Zepol Company is planning to produce 600,000 power...Ch. 10 - Last year, Gladner Company had planned to produce...Ch. 10 - Anker Company had the data below for its most...Ch. 10 - Cabanarama Inc. designs and manufactures...Ch. 10 - Basuras Waste Disposal Company has a long-term...Ch. 10 - Tom Belford and Tony Sorrentino own a small...Ch. 10 - Mantenga Company provides routine maintenance...Ch. 10 - Buenolorl Company produces a well-known cologne....Ch. 10 - The management of Golding Company has determined...Ch. 10 - Phono Company manufactures a plastic toy cell...Ch. 10 - Botella Company produces plastic bottles. The unit...Ch. 10 - The Lubbock plant of Morrils Small Motor Division...Ch. 10 - Moleno Company produces a single product and uses...Ch. 10 - The Lubbock plant of Morrils Small Motor Division...Ch. 10 - Extrim Company produces monitors. Extrims plant in...Ch. 10 - Lynwood Company produces surge protectors. To help...Ch. 10 - Shumaker Company manufactures a line of high-top...Ch. 10 - Paul Golding and his wife, Nancy, established...Ch. 10 - Prob. 79CCh. 10 - Prob. 1MTCCh. 10 - The Two Cost Systems Sacred Heart Hospital (SHH)...Ch. 10 - Prob. 3MTCCh. 10 - Prob. 4MTCCh. 10 - The Two Cost Systems Sacred Heart Hospital (SHH)...Ch. 10 - Prob. 6MTCCh. 10 - Prob. 7MTCCh. 10 - Prob. 8MTCCh. 10 - Prob. 9MTCCh. 10 - Sacred Heart Hospital (SHH) faces skyrocketing...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A fixture company manufactures products brass products in a small manufacturing facility that has 40 employees. Each employee provides 36 hours of labor per week. Determine the direct labor rate variance using the information given in the table. Standard wage per hour Standard labor time per unit Standard number of lbs. of brass $ 14.4 20 minutes 1.3 lbs. Standard price per lb. of brass Actual price per lb. of brass Actual lbs. of brass used during the weel Number of units produced during the week Actual wage per hour Actual hours for the week $ 10.75 $ 11 12,051 lbs. 9,000 $ 14.83 1,440 hoursarrow_forwardQuestion related to financial accounting: During the current year, Carl Equipment Stores had net sales of $540 million, a cost of goods sold of $367 million, average accounts receivable of $64 million, and an average inventory of $53 million. Assuming a 365-day year, the average number of days required for Carl Equipment to sell its inventory is? Current answerarrow_forwardGeneral accountingarrow_forward

- The current ratio of a company is 8:1 and its acid-test ratio is 1:1. If the inventories and prepaid items amount to $633,000, what is the amount of current liabilitiesarrow_forwardExpert of general account answer this questionsarrow_forwardPrince albert scanning plc had a solve this question general Accountingarrow_forward

- provide correct solution in this general account queryarrow_forwardGive me this questionarrow_forwardNatasha Industries has a product with a selling price per unit of $136, the unit variable cost is $46, and the total monthly fixed costs are $300,000. How much is Natasha's contribution margin ratio? Provide Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY