Concept explainers

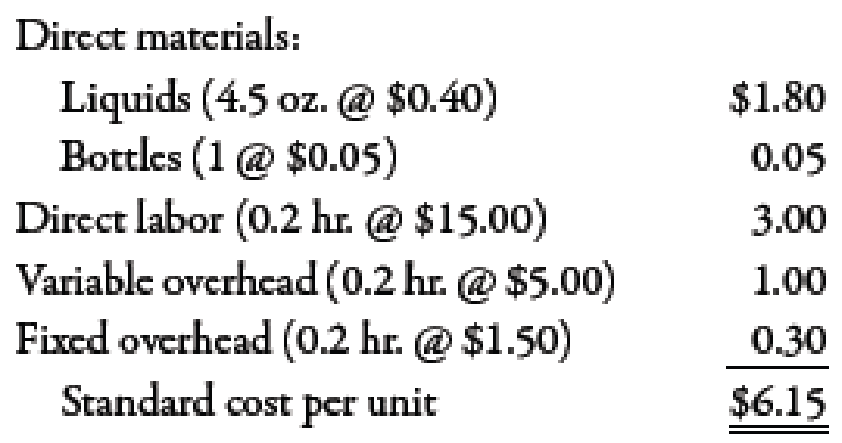

Buenolorl Company produces a well-known cologne. The

Management has decided to investigate only those variances that exceed the lesser of 10% of the standard cost for each category or $20,000.

During the past quarter, 250,000 four-ounce bottles of cologne were produced. Descriptions of actual activity for the quarter follow:

- a. A total of 1.35 million ounces of liquids was purchased, mixed, and processed. Evaporation was higher than expected. (No inventories of liquids are maintained.) The price paid per ounce averaged $0.42.

- b. Exactly 250,000 bottles were used. The price paid for each bottle was $0.048.

- c. Direct labor hours totaled 48,250, with a total cost of $733,000.

Normal production volume for Buenolorl is 250,000 bottles per quarter. The standard

Required:

- 1. Calculate the upper and lower control limits for materials and labor.

- 2. Compute the total materials variance, and break it into price and usage variances. Would these variances be investigated?

- 3. Compute the total labor variance, and break it into rate and efficiency variances. Would these variances be investigated?

1.

Compute the upper and lower limit of materials and labor.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

Use the following formula to calculate the value of upper limit of liquid standard:

Substitute $450,000 for liquid standard in the above formula.

“OR”

Use the following formula to calculate the value of upper limit of liquid standard:

Substitute $450,000 for liquid standard and $20,000 for standard cost in the above formula.

The upper limit of liquid standard is lower of the above calculated value. Therefore, the upper limit of liquid standard is $470,000.

Use the following formula to calculate the value of lower limit of liquid standard:

Substitute $450,000 for liquid standard in the above formula.

“OR”

Use the following formula to calculate the value of lower limit of liquid standard:

Substitute $450,000 for liquid standard and $20,000 for standard cost in the above formula.

The lower limit of labor is higher of the above calculated value. Therefore, the lower limit of liquid standard is $430,000.

Use the following formula to calculate the value of upper limit of bottle standard:

Substitute $12,500 for liquid standard in the above formula.

“OR”

Use the following formula to calculate the value of upper limit of bottle standard:

Substitute $12,500 for liquid standard and $20,000 for standard cost in the above formula.

The upper limit of bottle standard is lower of the above calculated value. Therefore, the upper limit of bottle standard is $13,750.

Use the following formula to calculate the value of lower limit of bottle standard:

Substitute $12,500 for liquid standard in the above formula.

“OR”

Use the following formula to calculate the value of lower limit of bottle standard:

Substitute $12,500 for liquid standard and $20,000 for standard cost in the above formula.

The lower limit of bottle standard is higher of the above calculated value. Therefore, the lower limit of bottle standard is ($7,500).

Use the following formula to calculate the value of upper limit of direct labor standard:

Substitute $750,000 for liquid standard in the above formula.

“OR”

Use the following formula to calculate the value of upper limit of direct labor standard:

Substitute $750,000 for liquid standard and $20,000 for standard cost in the above formula.

The upper limit of direct labor standard is lower of the above calculated value. Therefore, the upper limit of direct labor standard is $770,000.

Use the following formula to calculate the value of lower limit of direct labor standard:

Substitute $750,000 for liquid standard in the above formula.

“OR”

Use the following formula to calculate the value of lower limit of direct labor standard:

Substitute $750,000 for liquid standard and $20,000 for standard cost in the above formula.

The lower limit of direct labor standard is higher of the above calculated value. Therefore, the lower limit of direct labor standard is $730,000.

Working Note:

1.

Calculation of liquid standard for liquid material:

2.

Calculation of liquid standard for bottle standard:

3.

Calculation of liquid standard for direct labor standard:

2.

Compute the total material variance and divide this variance into price variance and usage variance. Also, identify whether this variance should be investigated or not.

Explanation of Solution

Use the following formula to calculate material price variance of liquid:

Substitute $0.42 for actual price, 1,350,000 units for actual quantity and $0.40 for standard price in the above formula.

Therefore, the material price variance is $27,000 (U).

Use the following formula to calculate material usage variance of bottle:

Substitute $0.40 for standard price, 1,350,000 units for actual quantity and 1,125,000 for standard quantity in the above formula.

Therefore, the material usage variance is $90,000 (U).

The liquid variance should be investigated because the liquid variance is increases from the $20,000.

Use the following formula to calculate material price variance of liquid:

Substitute $0.048 for actual price, 250,000 units for actual quantity and $0.05 for standard price in the above formula.

Therefore, the material price variance is $500 (F).

Use the following formula to calculate material usage variance of bottle:

Substitute $0.05 for standard price, 250,000 units for actual quantity and 250,000 for standard quantity in the above formula.

Therefore, the material usage variance is $0.

The bottle standard should not be investigated because the variance of bottle standard is within the accepted limits.

3.

Compute the total material variance and divide this variance into price variance and usage variance. Also, identify whether this variance should be investigated or not.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $15.19 for actual rate, $15.00 for standard rate, 48,250 hours for actual hours in the above formula.

Therefore, the labor rate variance is $9,168 (U).

Use the following formula to calculate labor efficiency variance:

Substitute $15.00 for standard rate, 48,250 hours for actual hours and 50,000 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $26,250 (F).

The labor efficiency variance should be investigated because it increases from the amount of $20,000.

Working Note:

1.

Calculation of actual rate:

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Quick answer of this accounting questionsarrow_forwardFinancial Accounting: At an output level of 53,000 units, you calculate that the degree of operating leverage is 1.75. If output rises to 82,420 units, what will the percentage change in operating cash flow be?arrow_forwardDo fast answer of this accounting questionsarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning