Concept explainers

10-52 Materials and Labor Variances

Refer to the information for Deporte Company above.

Required:

Compute the materials and labor variances associated with the changeover activity, labeling each variance as favorable or unfavorable.

Use the following information for Exercises 10-52 and 10-53:

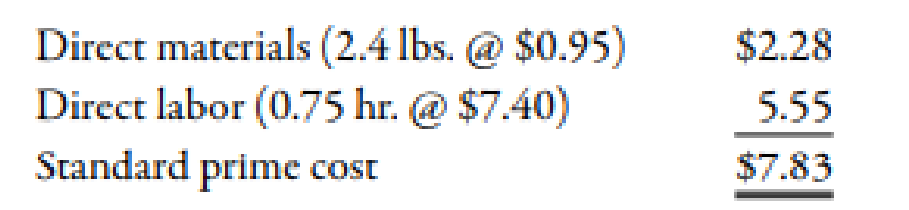

Deporte Company produces single-colored T-shirts. Materials for the shirts are dyed in large vats. After dying the materials for a given color, the vats must be cleaned and prepared for the next batch of materials to be colored. The following standards for changeover for a given batch have been established:

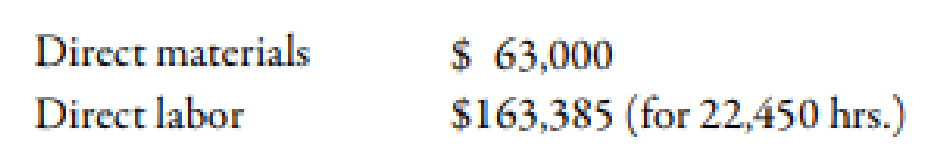

During the year, 79,500 pounds of material were purchased and used for the changeover activity. There were 30,000 batches produced, with the following actual prime costs:

Trending nowThis is a popular solution!

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Solve this Financial Accounting Problem ?arrow_forwardSummit Gear has an accounts receivable balance at the end of 2022 of $412,650. The net credit sales for the year are $892,740. The balance at the end of 2021 was $389,200. What is the accounts receivable turnover rate for 2022?arrow_forwardCorrect answerarrow_forward

- Need Answerarrow_forwardAccurate Answerarrow_forwardArlington Corp.'s stock was purchased six months ago at a price of $38.20 per share. You bought 100 shares at that time. The company pays a quarterly dividend of $0.10 per share. Today, you sold all your shares for $40.75 per share. What is the total amount of your capital gains on this investment?solve thisarrow_forward

- Hii expert please provide answer general Accountingarrow_forwardCompute the Debtor's Turnover Ratio for sterling Enterprise.arrow_forwardYork Enterprises had credit sales of $820,000 during the year. The end-of-year accounts receivable was $75,000, and the beginning accounts receivable was $55,000. Compute the company's Receivables Turnover Ratio.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College