Concept explainers

The management of Golding Company has determined that the cost to investigate a variance produced by its

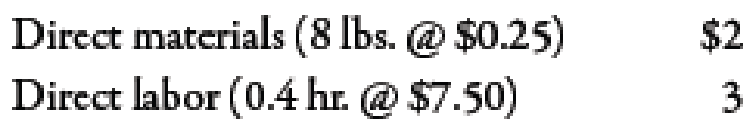

Actual production for the past 3 months follows, with the associated actual usage and costs for materials and labor. There were no beginning or ending raw materials inventories.

Required:

- 1. What upper and lower control limits would you use for materials variances? For labor variances?

- 2. Compute the materials and labor variances for April, May, and June. Identify those that would require investigation by comparing each variance to the amount of the limit computed in Requirement 1. Compute the actual percentage deviation from standard. Round all unit costs to four decimal places. Round variances to the nearest dollar. Round variance rates to three decimal places so that percentages will show to one decimal place.

- 3. CONCEPTUAL CONNECTION Let the horizontal axis be time and the vertical axis be variances measured as a percentage deviation from standard. Draw horizontal lines that identify upper and lower control limits. Plot the labor and material variances for April, May, and June. Prepare a separate graph for each type of variance. Explain how you would use these graphs (called control charts) to assist your

analysis of variances.

1.

Compute the upper and lower limit of materials and labor.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

Use the following formula to calculate the value of upper limit of material for April:

Substitute 0.08 for direct material quantity and $180,750 for price standard in the above formula.

Use the following formula to calculate the value of lower limit of material of price standard for April:

Substitute 0.08 for direct material quantity and $180,750 for price standard in the above formula.

Use the following formula to calculate the value of upper limit of material of quantity standard for April:

Substitute 0.08 for direct material quantity and $180,000 for quantity standard in the above formula.

Use the following formula to calculate the value of lower limit of material of quantity standard for April:

Substitute 0.08 for direct material quantity and $180,000 for quantity standard in the above formula.

Use the following formula to calculate the value of upper limit of labor of price standard for April:

Substitute 0.08 for standard quantity and $270,000 for price standard in the above formula.

Use the following formula to calculate the value of lower limit of labor of price standard for April:

Substitute 0.08 for standard quantity and $270,000 for price standard in the above formula.

Use the following formula to calculate the value of upper limit of labor of efficiency standard for April:

Substitute 0.08 for standard quantity and $270,000 for efficiency standard in the above formula.

Use the following formula to calculate the value of lower limit of labor of efficiency standard for April:

Substitute 0.08 for direct material quantity and $270,000 for quantity standard in the above formula.

Use the following formula to calculate the value of upper limit of material for May:

Substitute 0.08 for direct material quantity and $217,500 for price standard in the above formula.

Use the following formula to calculate the value of lower limit of material of price standard for May:

Substitute 0.08 for direct material quantity and $217,500 for price standard in the above formula.

Use the following formula to calculate the value of upper limit of material of quantity standard for May:

Substitute 0.08 for direct material quantity and $200,000 for quantity standard in the above formula.

Use the following formula to calculate the value of lower limit of material of quantity standard for May:

Substitute 0.08 for direct material quantity and $200,000 for quantity standard in the above formula.

Use the following formula to calculate the value of upper limit of labor of price standard for May:

Substitute 0.08 for standard quantity and $330,000 for price standard in the above formula.

Use the following formula to calculate the value of lower limit of labor of price standard for May:

Substitute 0.08 for standard quantity and $330,000 for price standard in the above formula.

Use the following formula to calculate the value of upper limit of labor of efficiency standard for May:

Substitute 0.08 for standard quantity and $300,000 for efficiency standard in the above formula.

Use the following formula to calculate the value of lower limit of labor of efficiency standard for May:

Substitute 0.08 for direct material quantity and $300,000 for quantity standard in the above formula.

Use the following formula to calculate the value of upper limit of material for June:

Substitute 0.08 for direct material quantity and $221,250, for price standard in the above formula.

Use the following formula to calculate the value of lower limit of material of price standard for June:

Substitute 0.08 for direct material quantity and $221,250 for price standard in the above formula.

Use the following formula to calculate the value of upper limit of material of quantity standard for June:

Substitute 0.08 for direct material quantity and $220,000 for quantity standard in the above formula.

Use the following formula to calculate the value of lower limit of material of quantity standard for June:

Substitute 0.08 for direct material quantity and $220,000 for quantity standard in the above formula.

Use the following formula to calculate the value of upper limit of labor of price standard for June:

Substitute 0.08 for standard quantity and $345,000 for price standard in the above formula.

Use the following formula to calculate the value of lower limit of labor of price standard for June:

Substitute 0.08 for standard quantity and $345,000 for price standard in the above formula.

Use the following formula to calculate the value of upper limit of labor of efficiency standard for June:

Substitute 0.08 for standard quantity and $330,000 for efficiency standard in the above formula.

Use the following formula to calculate the value of lower limit of labor of efficiency standard for June:

Substitute 0.08 for direct material quantity and $330,000 for quantity standard in the above formula.

Working Note:

1. Calculation of price standard for material:

2. Calculation of quantity standard for material:

3. Calculation of price standard for labor:

4. Calculation of efficiency standard for labor:

Note: Other calculations are done in a same manner as mentioned above.

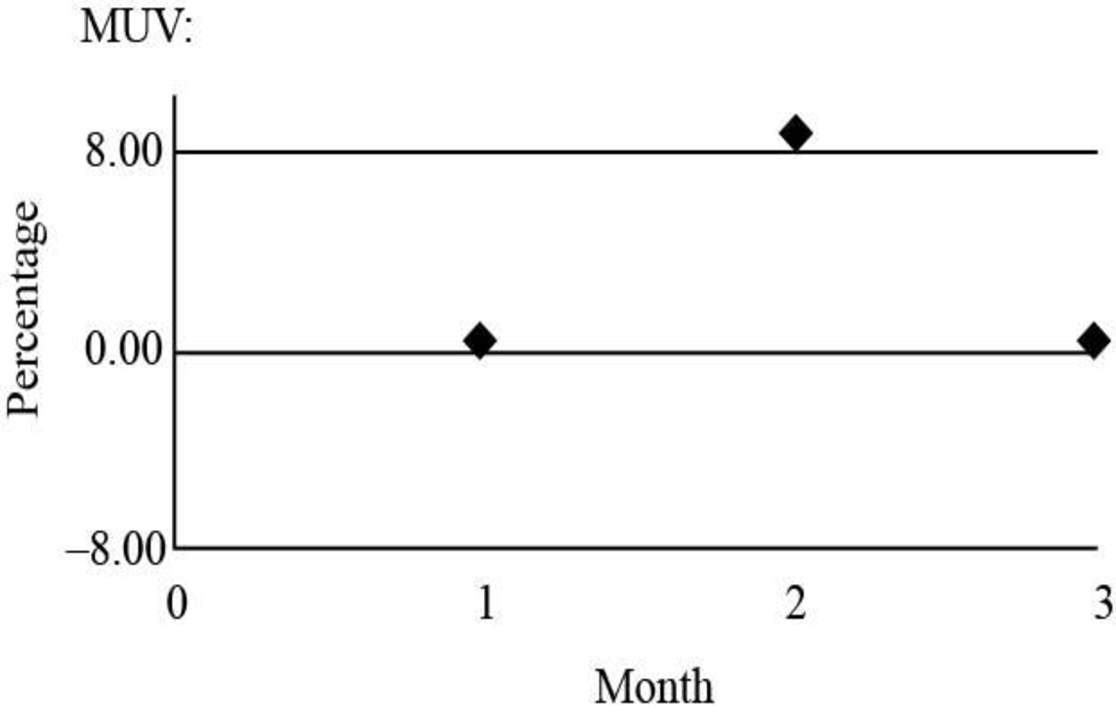

2.

Calculate the materials and labor variances for the month of April, May and June.

Explanation of Solution

| Month |

Variances ($) | Limit |

Deviation (%) |

| April | |||

| Material price variance | 8,242(U) | 14,460 | 4.6 |

| Material usage variance | 750(U) | 14,400 | 0.4 |

| Labor rate variance | 0 | 21,600 | 0.0 |

| Labor efficiency variance | 0 | 21,600 | 0.0 |

| May | |||

| Material price variance | 522(U) | 17,400 | 0.2 |

| Material usage variance | 17,500(U) | 16,000 | 8.8 |

| Labor rate variance | 7,000(F) | 26,400 | (2.1) |

| Labor efficiency variance | 30,000(U) | 24,000 | 10.0 |

| June | |||

| Material price variance | 8,762(U) | 17,700 | 4.0 |

| Material usage variance | 1,250(U) | 17,600 | 0.6 |

| Labor rate variance | 15,001(U) | 27,600 | 4.3 |

| Labor efficiency variance | 15,000(U) | 26,400 | 4.5 |

Table (1)

3.

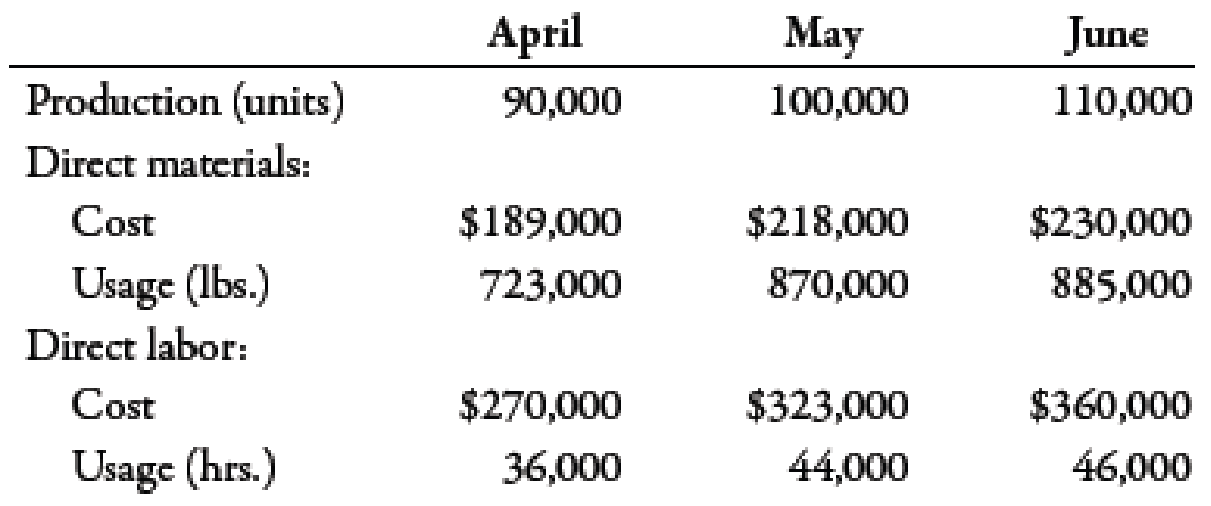

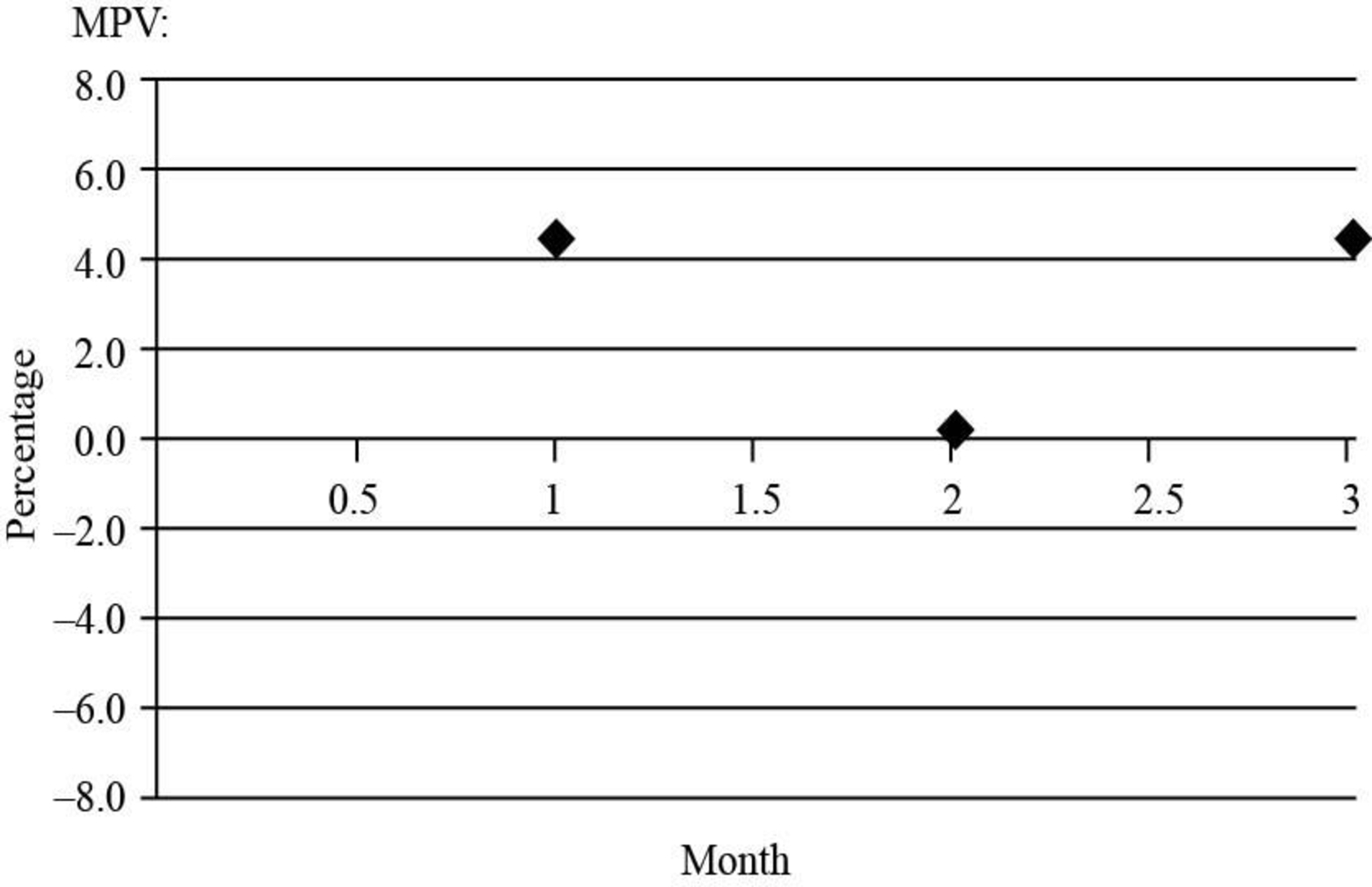

Construct the graph for upper and lower limits for month of April, May and June.

Explanation of Solution

Graph of month of Material price variance:

Fig (1)

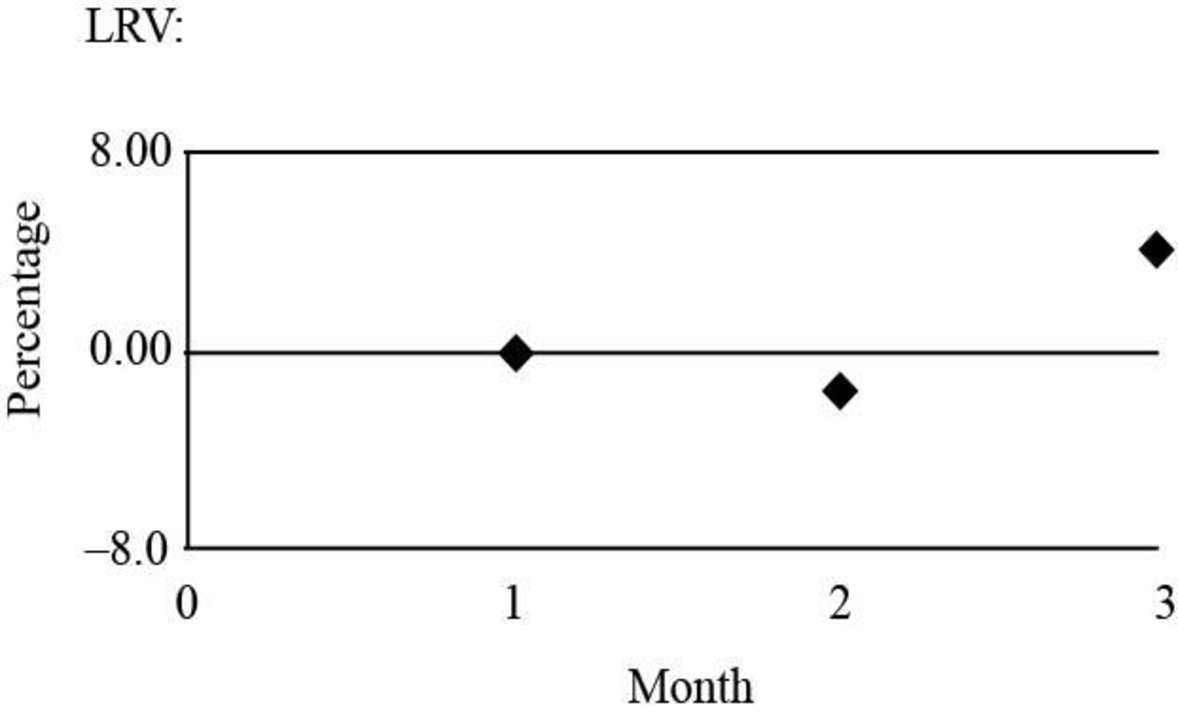

Graph of month of material usage variance:

Fig (2)

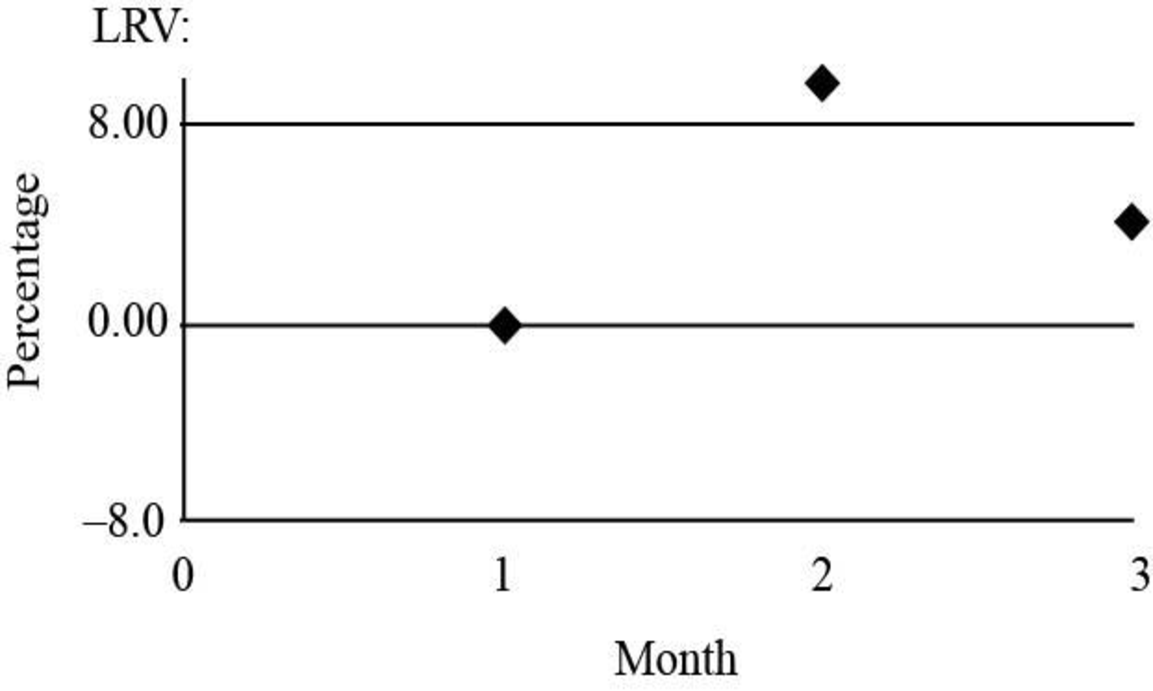

Graph of month of labor rate variance:

Fig (3)

Graph of month of labor efficiency variance

Fig (4)

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Financial Accountarrow_forwardSubject:- General Account Data for a firm's first year of operation is given below. The firm uses direct costing: Units produced (no work in process) 6,000 Units sold 5,000 units in ending inventory of finished goods 1,000 Sales price for each unit $75 Variable manufacturing costs for each unit manufactured $30 Variable selling and admin. expenses for each unit sold $16 Fixed manufacturing costs for the year $90,000 Fixed selling and admin. expenses for the year $65,000 The costs of the goods sold for the year is: a) $270,000 b) $225,000 c) $150,000 d) $45,000arrow_forwardQuestion: Cost Account Many companies have switched from absorption costing to variable costing for internal reporting: A) so the denominator level is more accurate B) to reduce the undesirable incentive to build up inventories C) to comply with external reporting requirements D) to increase bonuses for managersarrow_forward

- Subject = General Accountarrow_forwardRoth Inc. has a deferred tax liability of $68,000 at the beginning of 2013. At the end of 2013, it reports accounts receivable on the books at $90,000 and the tax basis at zero (its only temporary difference). If the enacted tax rate is 34% for all periods, and income taxes payable for the period is $230,000, determine the amount of total income tax expense to report for 2013.(Subject:- General Account)arrow_forwardCalculate the selling price solution this questionarrow_forward

- Roth Inc. has a deferred tax liability of $68,000 at the beginning of 2013. At the end of 2013, it reports accounts receivable on the books at $90,000 and the tax basis at zero (its only temporary difference). If the enacted tax rate is 34% for all periods, and income taxes payable for the period is $230,000, determine the amount of total income tax expense to report for 2013.arrow_forwardOxford Corporation began operations in 2012 and reported a pretax financial income of $225,000 for the year. Oxford's tax depreciation exceeded its book depreciation by $40,000. Oxford's tax rate for 2012 and years thereafter is 30%. In its December 31, 2012, balance sheet, what amount of deferred tax liability should be reported?arrow_forwardSub. Accountarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,