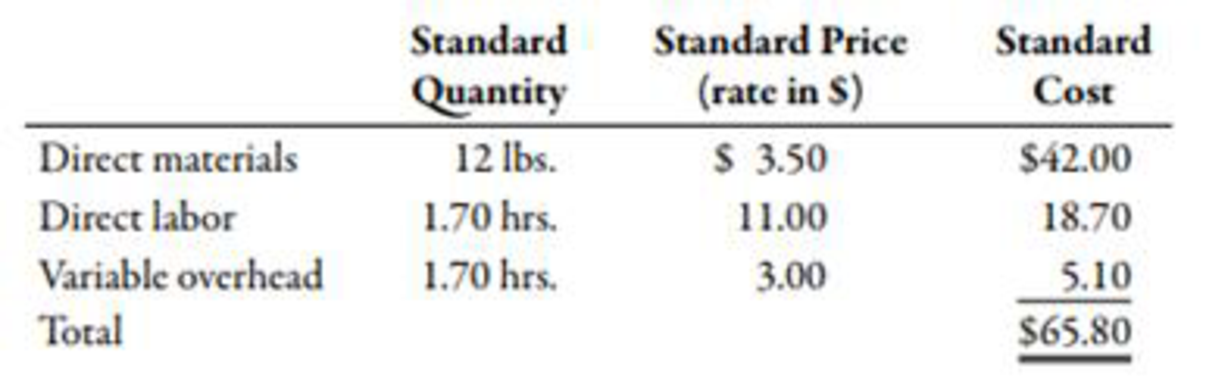

Basuras Waste Disposal Company has a long-term contract with several large cities to collect garbage and trash from residential customers. To facilitate the collection, Basuras places a large plastic container with each household. Because of wear and tear, growth, and other factors, Basuras places about 200,000 new containers each year (about 20% of the total households). Several years ago, Basuras decided to manufacture its own containers as a cost-saving measure. A strategically located plant involved in this type of manufacturing was acquired. To help ensure cost efficiency, a

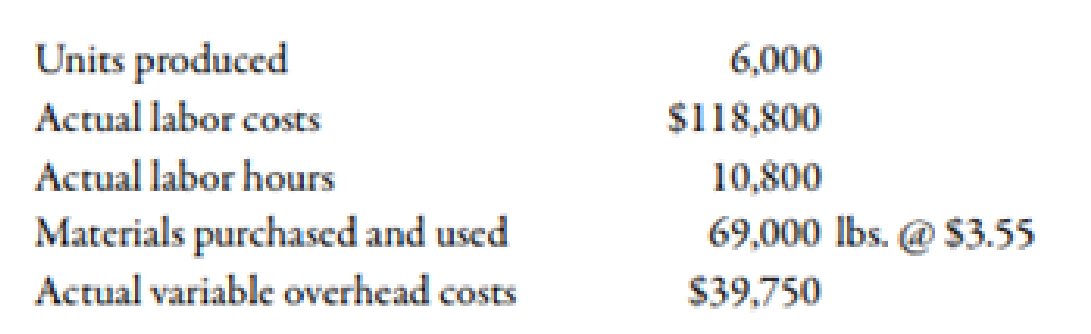

During the first week in January, Basuras had the following actual results:

The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in January. Also, a new manufacturing process was implemented on a trial basis. The new process required a slightly higher level of skilled labor. The higher- quality material has no effect on labor utilization. However, the new manufacturing process was expected to reduce materials usage by 0.25 pound per container.

Required:

- 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assume that the 0.25 pound per container reduction of materials occurred as expected and that the remaining effects are all attributable to the higher-quality material. Would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly.

- 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing process, should it be continued or discontinued? In answering, consider the new process’s materials reduction effect as well. Explain.

- 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new process should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 9,000 and the labor cost was $99,000. Should the new process be adopted? Assume the variances are attributable to the new process. Assuming production of 6,000 units per week, what would be the projected annual savings? (Include the materials reduction effect.)

1.

Calculate the value of material price variance and material usage variance. Identify whether the plant manger could continue to purchase this quality product or purchase the usual quality.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

Use the following formula to calculate material price variance:

Substitute $3.55 for actual price, 69,000 units for actual quantity and $3.50 for standard price in the above formula.

Therefore, the material price variance is $3,450 (U).

Use the following formula to calculate material usage variance with the help of columnar approach:

Substitute $3.50 for standard price, 69,000 units for actual quantity and 72,000 for standard quantity in the above formula.

Therefore, the material usage variance is $10,500 (F).

The new process helps in saving the cost of $5,250

Working Note:

1. Calculation of standard quantity:

2.

Calculate the value of labor rate variance and labor efficiency variance. Identify whether the labor variances are attributable to the new manufacturing process should be continued or discontinued.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $118,800 for actual rate and actual hours, 10,800 hours for actual hours and $11 for standard rate in the above formula.

Therefore, the labor rate variance is $0.

Use the following formula to calculate labor efficiency variance:

Substitute $11.00 for standard rate, 10,800 hours for actual hours and 10,200 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $6,600 (U).

The new process helps in material usage in saving the cost of $5,250 and losses the cost in labor variance of $6,600, which giving a net loss of $1,350

Working Note:

1. Calculation of standard hours:

3.

Calculate the value of labor rate variance and labor efficiency variance. Identify whether the new process be adopted or not.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $99,000 for actual rate and actual hours, 9,000 hours for actual hours and $11 for standard rate in the above formula.

Therefore, the labor rate variance is $0.

Use the following formula to calculate labor efficiency variance:

Substitute $11.00 for standard rate, 9,000 hours for actual hours and 10,200 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $13,200(F).

The new process helps in material usage in saving the cost of $959,400

Working Note:

1. Calculation of standard hours:

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Find operating cash flowarrow_forwardBradley Industries applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $245,000 and 7,000 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $243,500, and actual direct labor-hours were 6,950. The applied manufacturing overhead for the year was closest to __.helparrow_forwardWhat is the net income?arrow_forward

- General Accountingarrow_forwardCan you please solve this financial accounting question?arrow_forwardBogy Enterprises is an all-equity firm with a weighted average cost of capital of 10.25 percent. The current market value of the equity is $32.8 million, and the tax rate is 30 percent. What is EBIT? a. $2,145,066.35 b. $3,425,714.97 c. $5,228,571.18 d. $6,790,110.53 e. $ 48,02,857.14arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning