Concept explainers

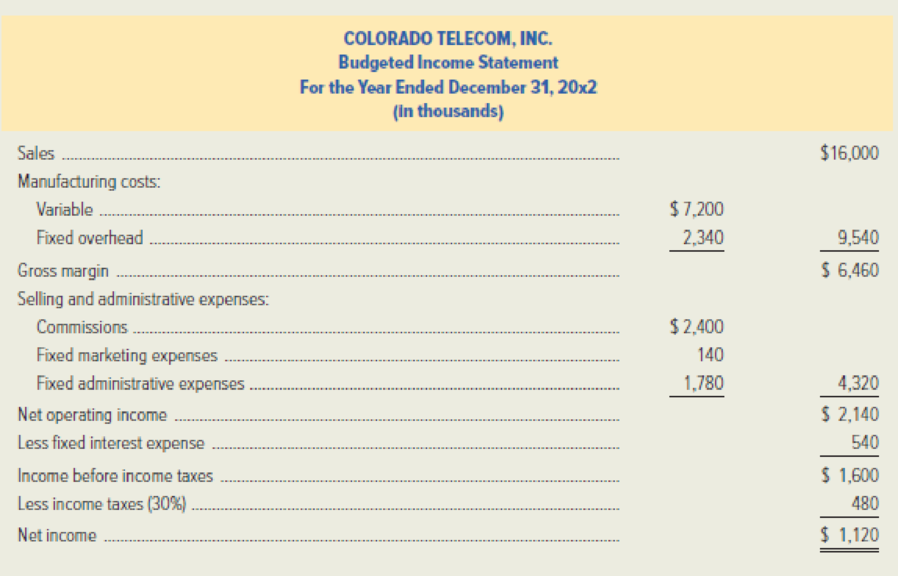

Colorado Telecom, Inc. manufactures telecommunications equipment. The company has always been production oriented and sells its products through agents. Agents are paid a commission of 15 percent of the selling price. Colorado Telecom’s

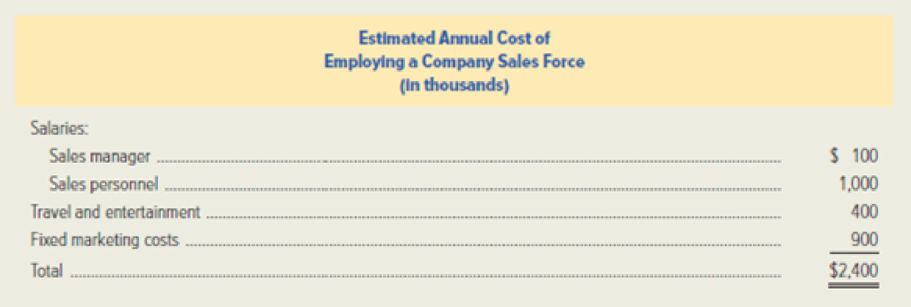

After the profit plan was completed for the coming year. Colorado Telecom’s sales agents demanded that the commissions be increased to 22½ percent of the selling price. This demand was the latest in a series of actions that Liliana Richmond, the company’s president, believed had gone too far. She asked Molly Rosewood, the most sales-oriented officer in her production-oriented company, to estimate the cost to the company of employing its own sales force. Rosewood’s estimate of the additional annual cost of employing its own sales force, exclusive of commissions, follows. Sales personnel would receive a commission of 10 percent of the selling price in addition to their salary.

Required:

- 1. Calculate Colorado Telecom’s estimated break-even point in sales dollars for 20x2.

- a. If the events that are represented in the budgeted income statement fake place.

- b. If the company employs its own sales force.

- 2. If Colorado Telecom continues to sell through agents and pays the increased commission of 22½ percent of the selling price, determine the estimated volume in sales dollars for 20x2 that would be required to generate the same net income as projected in the budgeted income statement.

- 3. Determine the estimated volume in sales dollars that would result in equal net income for 20x2 regardless of whether the company continues to sell through agents and pays a commission of 22½ percent of the selling price or employs its own sales force.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of $16,100,000 and cost of goods sold of $8,855,000. Advertising is a key part of Coral Seas' business strategy, and total marketing expense for the year is budgeted at $2,898,000. Total administrative expenses are expected to be $644,000. Coral Seas has no interest expense. Income taxes are paid at the rate of 40 percent of operating income. Required: Question Content Area 1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year. Coral Seas Jewelry CompanyBudgeted Income StatementFor the Coming Year $- Select - - Select - Gross margin $fill in the blank ade044f46060001_5 Less: $- Select - - Select - - Select - Operating income $fill in the blank ade044f46060001_11 - Select - $- Select - Question Content Area 2. What if Coral Seas had interest payments of $483,000…arrow_forwardCoral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of $16,300,000 and cost of goods sold of $8,965,000. Advertising is a key part of Coral Seas' business strategy, and total marketing expense for the year is budgeted at $2,934,000. Total administrative expenses are expected to be $652,000. Coral Seas has no interest expense. Income taxes are paid at the rate of 40 percent of operating income. Required: Question Content Area 1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year. Coral Seas Jewelry CompanyBudgeted Income StatementFor the Coming Year $Sales Less: Cost of goods sold Gross margin $fill in the blank e744f5f1dfcfffc_5 Less: $- Select - - Select - - Select - Operating income $fill in the blank e744f5f1dfcfffc_11 - Select - $- Select - Question Content Area 2. What if Coral Seas had interest payments of…arrow_forwardJace and Associates provides professional consulting services to a variety of clientele in an effort to help them improve the operating effectiveness and profitability of their businesses. At the start of the year, budgeted MOH costs were $250,000; budgeted direct labor hours, its allocation base, were 100,000. The company is considering doing work for a new client that is estimated to take around 45 hours. How much should Jace bid on this job if the company incurs a direct labor rate of $30/hour and charges a 60% mark-up above job costs? (Round answer to 2 decimal places, e.g. 5,275.25.) Bid price $arrow_forward

- Novo, Inc., wants to develop an activity flexible budget for the activity of moving materials.Novo uses eight forklifts to move materials from receiving to stores. The forklifts are also usedto move materials from stores to the production area. The forklifts are obtained through an operating lease that costs $18,000 per year per forklift. Novo employs 25 forklift operators whoreceive an average salary of $50,000 per year, including benefits. Each move requires the use of a crate. The crates are used to store the parts and are emptied only when used in production.Crates are disposed of after one cycle (two moves), where a cycle is defined as a move from receiving to stores to production. Each crate costs $1.80. Fuel for a forklift costs $3.60 per gallon. A gallon of gas is used every 20 moves. Forklifts can make three moves per hour and are available for 280 days per year, 24 hours per day (the remaining time is downtime for various reasons). Each operator works 40 hours per week and 50…arrow_forwardMagnussen, Inc., uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 45,000 units next year, the unit product cost of a particular product is $15.60. The company's selling, general, and administrative expenses for this product are budgeted to be $1,035,000 in total for the year. The company has invested $280,000 in this product and expects a return on investment of 11%. The selling price for this product based on the absorption costing approach described in the text would be closest to: A) $39.28 B) $17.32 C) $97.20 D) $38.60 Please write the steps to solve the questions !arrow_forwardLegal Corporation offers a wide range of legal services to its customers. Each of the firm's attorneys can negotiate billing rates with their clients. Legal Corporation set a budget at the start of the year to better manage its operations. Total billed hours, amount billed per hour, and variable expense per hour were all included in the budget. Unfortunately, the firm failed to meet its budgeted goals for last year. The results are shown below. Actual Budget Total hours billed 5,800 6,100 Amount billed/hour $375 $425 The hourly variable expense was estimated at $60, but the total variable expense was $295,000. The reasons for the firm's failure to fulfill its budgeted targets are a source of contention among the attorneys. Calculate the variance in variable expenses. Make your computations visible.arrow_forward

- Pittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies completely on independent sales agents to market its products. These agents are paid a sales commission of 15% for all items sold. Barbara Cheney, Pittman’s controller, has just prepared the company’s budgeted income statement for next year as follows: Pittman Company Budgeted Income Statement For the Year Ended December 31 Sales $ 21,500,000 Manufacturing expenses: Variable $ 9,675,000 Fixed overhead 3,010,000 12,685,000 Gross margin 8,815,000 Selling and administrative expenses: Commissions to agents 3,225,000 Fixed marketing expenses 150,500*Footnote asterisk Fixed administrative expenses 2,020,000 5,395,500 Net operating income 3,419,500 Fixed interest expenses 752,500 Income before income taxes 2,667,000 Income taxes (30%) 800,100 Net income $ 1,866,900 *Footnote…arrow_forwardPittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies on independent sales agents to market its products. These agents are paid a sales commission of 15% for all items sold. Barbara Cheney, Pittman's controller, just prepared the company's budgeted income statement for next year as follows: Pittman Company Budgeted Income Statement For the Year Ended December 31 Sales Manufacturing expenses: Variable $ 19,000,000 $ 8,550,000 2,660,000 11,210,000 Fixed overhead Gross margin Selling and administrative expenses: Commissions to agents 7,790,000 2,850,000 Fixed marketing expenses 133,000* Fixed administrative expenses 1,920,000 4,903,000 Net operating income Fixed interest expenses Income before income taxes Income taxes (30%) 2,887,000 665,000 2,222,000 666,600 $ 1,555,400 Net income *Primarily depreciation on storage facilities. As Barbara handed the statement to Karl Vecci, Pittman's president,…arrow_forwardWilson Blossom is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: (a1) Direct materials $55.00 Direct labor 19.00 Manufacturing overhead 16.00 Selling and administrative 14.00 Total unit cost $104.00 The company's budget includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (a2) Your answer is partially correct. Your answer is correct. Calculate variable overhead per unit and variable selling and…arrow_forward

- Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiner’s master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer’s share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company’s union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 6,400 glare filters in inventory on December 31 of the current year, and has a policy of carrying 25 percent of the following month’s projected sales in inventory. Information on the first four months of the coming year is as follows: January February March April Estimated unit sales 37,400 35,200 40,200 38,200 Sales price per unit $82 $82 $77 $77 Direct labor hours per unit 2.70 2.70 2.30 2.30 Direct labor hourly rate $19 $19 $20…arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiner’s master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer’s share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company’s union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 25 percent of the following month’s projected sales in inventory. Information on the first four months of the coming year is as follows: January February March April Estimated unit sales 37,000 34,600 39,600 40,400 Sales price per unit $80 $80 $76 $76 Direct labor hours per unit 2.70 2.70 2.40 2.40 Direct labor hourly rate $17 $17 $18…arrow_forwardWilson Sandhill is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: Direct materials $45.00 Direct labor 18.00 Manufacturing overhead 18.00 Selling and administrative 14.00 Total unit cost $95.00 The company's budget includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (a2) Your answer is partially correct. Monty, Finland's second largest homebuilder, has approached Wilson with an offer to buy…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning