Concept explainers

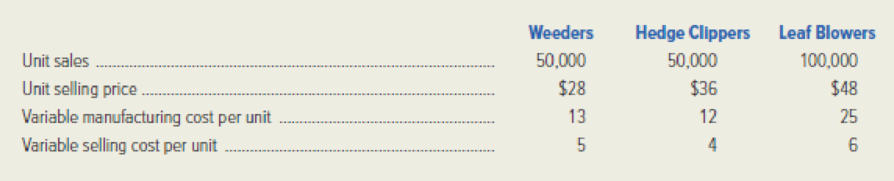

Cincinnati Tool Company (CTC) manufactures a line of electric garden tools that are sold in general hardware stores. The company’s controller, Will Fulton, has just received the sales

For 20x2, CTC’s fixed manufacturing

Required:

- 1. Determine CTC’s budgeted net income for 20x2.

- 2. Assuming the sales mix remains as budgeted, determine how many units of each product CTC must sell in order to break even in 20x2.

- 3. After preparing the original estimates, management determined that its variable

manufacturing cost of leaf blowers would increase by 20 percent, and the variable selling cost of hedge clippers could be expected to increase by $1.00 per unit. However, management has decided not to change the selling price of either product. In addition, management has learned that its leaf blower has been perceived as the best value on the market, and it can expect to sell three times as many leaf blowers as each of its other products. Under these circumstances, determine how many units of each product CTC would have to sell in order to break even in 20x2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Need help with this accounting questionarrow_forwardWhat is the number of shares outstanding for this accounting question?arrow_forwardQuestion 2Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalarrow_forward

- What is the total cost of job number w2398 on these financial accounting question?arrow_forwardHow much is the direct materials price variance for this accounting question?arrow_forwardMiguel Manufacturing Company uses a predetermined manufacturing overhead rate based on direct labor hours. At the beginning of 2023, they estimated total manufacturing overhead costs at $2,352,000, and they estimated total direct labor hours at 7,000. The administration and selling overheads are to be absorbed in each job cost at 15% of prime cost. Distribution cost should be added to each job according to quotes from outside carriage companies. The company wishes to quote for job # 222. Job stats are as follows: Direct materials cost Direct labour cost $173,250 $240,000 500 hours Direct labour hours Special Design Cost Distribution quote from haulage company Units of product produced $8,750 $21,700 400 cartons a) Compute Miguel's Manufacturing Company predetermined manufacturing overhead rate for 2023. b) How much manufacturing overhead was allocated to Job #222? c) Calculate the total cost & quotation price of Job #222, given that a margin of 25% is applied. d) How much was the…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning