Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 42P

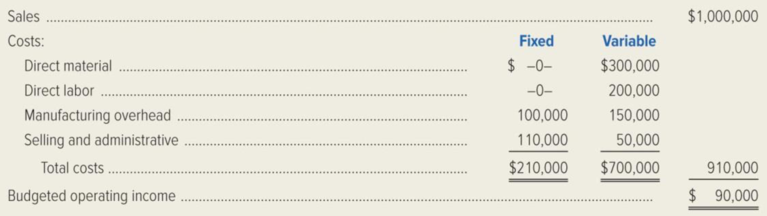

The European Division of Worldwide Reference Corporation produces a pocket dictionary containing popular phrases in six European languages. Annual budget data for the coming year follow. Projected sales are 100,000 books.

Required:

- 1. Calculate the break-even point in units and in sales dollars.

- 2. If the European Division is subject to an income-tax rate of 40 percent, compute the number of units the company would have to sell to earn an after-tax profit of $90,000.

- 3. If fixed costs increased $31,500 with no other cost or revenue factor changing, compute the firm’s break-even sales in units.

- 4. Prepare a profit-volume graph for the European Division.

- 5. Due to an unstable political situation in the country in which the European Division is located, management believes the country may split into two independent nations. If this happens, the tax rate could rise to 50 percent. Assuming all other data as in the original problem, how many pocket dictionaries must be sold to earn $90,000 after taxes?

- 6. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements (1), (2), (3), and (5) above. Show how the solution will change if the following information changes: sales amounted to $1,100,000 and fixed manufacturing

overhead was $110,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Tokyo Division of Toy King manufactures “Togo Toy” and sells them in the Japanese market for P6,000 each. The following data are from the Tokyo Division’s 2018 budget:

Variable Cost P3,800 per unit

Fixed Overhead P6,080,000

Total Assets P12,500,000

Toy King has instructed the Tokyo Division to budget a rate of return on total assets (before taxes) of 20%.

The Tokyo Division is considering adjustments in the budget to reach the desired 20% rate of return on total assets:

a. How many units must be sold to obtain the desired return if no other part of the budget is changed?

b. Suppose sales cannot be increased beyond 3,400 units. How much must total assets be reduced to obtain the desired return? Assume that for every P1,000 decrease in total assets, fixed costs decrease by P100.

Disk City, Inc. is a retailer for digital video disks. The projected net income for the current year is $1,760,000 based on a sales volume of 260,000 video disks. Disk City has been selling the disks for $19 each. The variable costs consist of the $8 unit purchase price of the disks and a handling cost of $2 per disk. Disk City’s annual fixed costs are $580,000.

Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.)

Q. What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $19? (Do not round intermediate calculations. Round your final answer to the nearest whole number.)

Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of $18,000,000. There is a

6% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following:

Salaries

$ 960,000

Utilities

365,000

Office space

230,000

Advertising

1,200,000

Required:

Prepare a selling and administrative expenses budget for Fazel Company for the coming year.

Fazel Company

Selling and Administrative Expenses Budget

For the Coming Year

Variable selling expenses

Fixed expenses:

Salaries

Utilities

Office space

Advertising

Total fixed expenses

Total selling and administrative expenses

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 7 - Prob. 1RQCh. 7 - What is the meaning of the term unit contribution...Ch. 7 - What information is conveyed by a...Ch. 7 - What does the term safety margin mean?Ch. 7 - Prob. 5RQCh. 7 - Delmarva Oyster Company has been able to decrease...Ch. 7 - In a strategy meeting, a manufacturing companys...Ch. 7 - What will happen to a companys break-even point if...Ch. 7 - Prob. 9RQCh. 7 - How can a profit-volume graph be used to predict a...

Ch. 7 - List the most important assumptions of...Ch. 7 - Why do many operating managers prefer a...Ch. 7 - Prob. 13RQCh. 7 - East Company manufactures VCRs using a completely...Ch. 7 - When sales volume increases, which company will...Ch. 7 - What does the term sales mix mean? How is a...Ch. 7 - A car rental agency rents subcompact, compact, and...Ch. 7 - How can a hotels management use cost-volume-profit...Ch. 7 - How could cost-volume-profit analysis be used in...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21RQCh. 7 - Explain briefly how activity-based costing (ABC)...Ch. 7 - Fill in the missing data for each of the following...Ch. 7 - Prob. 24ECh. 7 - Rosario Company, which is located in Buenos Aires,...Ch. 7 - The Houston Armadillos, a minor-league baseball...Ch. 7 - Prob. 27ECh. 7 - Europa Publications, Inc. specializes in reference...Ch. 7 - Tims Bicycle Shop sells 21-speed bicycles. For...Ch. 7 - A contribution income statement for the Nantucket...Ch. 7 - Refer to the income statement given in the...Ch. 7 - Hydro Systems Engineering Associates, Inc....Ch. 7 - Disk City, Inc. is a retailer for digital video...Ch. 7 - CollegePak Company produced and sold 60,000...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Consolidated Industries is studying the addition...Ch. 7 - Serendipity Sound, Inc. manufactures and sells...Ch. 7 - Prob. 41PCh. 7 - The European Division of Worldwide Reference...Ch. 7 - Prob. 43PCh. 7 - Celestial Products, Inc. has decided to introduce...Ch. 7 - Prob. 45PCh. 7 - Jupiter Game Company manufactures pocket...Ch. 7 - Prob. 47PCh. 7 - Condensed monthly income data for Thurber Book...Ch. 7 - Cincinnati Tool Company (CTC) manufactures a line...Ch. 7 - Ohio Limestone Company produces thin limestone...Ch. 7 - Prob. 51PCh. 7 - Colorado Telecom, Inc. manufactures...Ch. 7 - Prob. 53CCh. 7 - Prob. 54CCh. 7 - Niagra Falls Sporting Goods Company, a wholesale...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- "Disk City, Inc., is a retailer for digital video disks. The projected net income for the current year is $200,000 based on a sales volume of 200,000 video disks. Disk City has been selling the disks for $16 each. The variable costs consist of the $10 unit purchase price of the disks and a handling cost of $2 per disk. Disk City’s annual fixed costs are $600,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.). "Required: 1.Calculate Disk City’s break-even point for the current year in number of video disks. 2.What will be the company’s net income for the current year if there is a 10 percent increase in projected unit sales volume? 3.What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $16? 4.In order to cover a 30 percent increase in…arrow_forwardThe Tokyo Division of Toy King manufactures “Togo Toy” and sells them in the Japanese market for P6,000 each. The following data are from the Tokyo Division’s 2018 budget: Variable Cost P3,800 per unit Fixed Overhead P6,080,000 Total Assets P12,500,000 Toy King has instructed the Tokyo Division to budget a rate of return on total assets (before taxes) of 20%. Assume that only 2,400 units can be sold in the Japanese market. However, another 1,400 units can be sold to the American Marketing Division of Toy King. The Tokyo manager has offered to sell the 1,400 units for P5,500 each. The American Marketing Division manager has countered with an offer to pay P5,000 per unit, claiming that she can subcontract production to an American producer at a cost equivalent to P5,000. The Tokyo manager knows that if his production falls to 2,400 units he could eliminate some assets, reducing total assets to P10…arrow_forwardA firm estimates that it will sell 100,000 units of its sole product in the coming period. It projects the sales price at P40 per unit, the CM ratio at 70 percent, and profit at P500,000. What is the firm budgeting for fixed costs in the coming period?arrow_forward

- Brown expects Spirit to generate, on average, 3,600 freight miles each month next year. How much in operating costs should Brown budget for next year?arrow_forwardThe Shibuya Division of Mihoyo manufactures "Genshin Impact" and sells them in the Japanese market for P6,000 each. The following data are from the Shibuya Division's 2018 budget: Variable cost- P3,800 per unit Fixed overhead-P6,080,000 Total assets-P12,500,000 Mihoyo has instructed the Shibuya Division to budget a rate of return on total assets (before taxes) of 20%. 1. Suppose the Shibuya Division expects to sell 3,400 units during 2018: a. What rate of return will be earned on total assets? b. What would be the expected capital turnover? c. What would be the operating income percentage of sales? 2. The Shibuya Division is considering adjustments in the budget to reach the desired 20% rate of return on total assets: a. How many units must be sold to obtain the desired return if no other part of the budget is changed? b. Suppose sales cannot be increased beyond 3,400 units. How much must total assets be reduced to obtain the desired return? Assume that for every P1,000…arrow_forwardDisk City, Inc., is a retailer for digital video disks. The projected net income for the current year is $200,000 based on a sales volume of 200,000 video disks. Disk City has been selling the disks for $16 each. The variable costs consist of the $10 unit purchase price of the disks and a handling cost of $2 per disk. Disk City's annual fixed costs are S600,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.) Required: 1. Calculate Disk City's break-even point for the current year in number of video disks.arrow_forward

- The firm uses the absorption costing approach to cost-plus pricing to set prices for its products. Based on budgeted sales of 50,000 units next year, the unit product cost of a particular product is ₱75.00. The company's selling, general, and administrative expenses for this product are budgeted to be ₱1,800,000 in total for the year. The company has invested ₱800,000 in this product and expects a return on investment of 12%. Tax rate is 25%. The selling price for this product based on the absorption costing approach described in the text would be closest to: a. ₱ 39.28 b. ₱ 51.41 c. ₱ 93.75 d. ₱ 84.00 e. ₱ 102.75 f. ₱ 113.56arrow_forwardService volume for the coming budget year will be 10,000 units per week of service type 1 and 20,000 per week of service type 2. You plan to charge $200 for type 1 and $100 for type 2 services. Experience tells you that you will collect 75% of what you bill. Based on this information, how much gross and net revenue will you expect in the coming budget year?arrow_forwardFilmore Enterprises reports the year-end information from December 31, 2023 as follows: Sales (90,000 units) $1,170,000 Cost of goods sold $409,500 Gross margin $760,500 Operating expenses $620,100 Operating income $140,400 Filmore Enterprises is developing the next twelve- month budget. In January 2024, the company would like to increase selling prices by 3%. As a result, it is expected there will be a decrease in sales volume of 7%. All other operating expenses are expected to remain constant. Assume that COGS is a variable cost and that operating expenses are a fixed cost. Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. What is the budgeted operating income for the year? Budgeted Sales $Answer Budgeted cost of goods sold $Answer Budgeted gross margin $Answer Operating expenses $Answer Budgeted operating income $Answerarrow_forward

- The firm’s tentative budget for next year includes: Sales- ₱400,000; Variable Expenses-₱250,000; Fixed Manufacturing Overhead- ₱80,000; Selling and Administrative Expenses-₱150,000. With a tax rate of 25%, the forecasted net income is ₱52,500. Mr. Bong, the marketing manager proposed an aggressive advertisement costing additional ₱25,000 that he predicts will result in a 25% unit sales increase. Assuming that Bong’s proposal will be incorporated into the budget, what should be the increase in the budgeted net income for next year? a. ₱12,000 b. ₱25,000 c. ₱103,125 d. ₱56,250 e. ₱37,500arrow_forwardBear, Inc. estimates its sales at 200,000 units in the first quarter and that sales will increase by 20,000 units each quarter over the year. Bear calculates a 25% ending inventory of finished goods based on next month's sales. Each unit sells for $35. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale. Production in units for the third quarter should be budgeted atarrow_forwardParker & Associates, LLC has budgeted the following amounts for its next fiscal year: Total fixed expenses $974,000 Selling price per unit $53 Variable expenses per unit $28 If fixed expenses increase by 10%, the selling price per unit would need to increase by what percentage in order to maintain the original break-even sales in units (round to the nearest tenth of a percent)? Round percentage to one decimal place (ex: 0.03456 = 3.5%). Answer = ______%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY