Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 44P

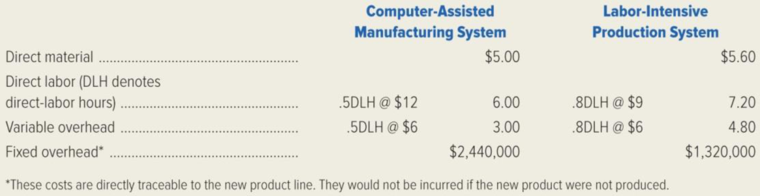

Celestial Products, Inc. has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system or a labor-intensive production system. The manufacturing method will not affect the quality of the product. The estimated

The company’s

Required:

- 1. Calculate the estimated break-even point in annual unit sales of the new product if the company uses the (a) computer-assisted manufacturing system; (b) labor-intensive production system.

- 2. Determine the annual unit sales volume at which the firm would be indifferent between the two manufacturing methods.

- 3. Management must decide which manufacturing method to employ. One factor it should consider is operating leverage. Explain the concept of operating leverage. How is this concept related to Celestial Products’ decision?

- 4. Describe the circumstances under which the firm should employ each of the two manufacturing methods.

- 5. Identify some business factors other than operating leverage that management should consider before selecting the manufacturing method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Administrative expenses was

Please need help with this financial accounting question

b. Prepare the journal entries to record the standard costing information for November.Note: Record any multiple debits or any multiple credits in alphabetical order by account name1)To record aluminum price variance

2)To record copper price variance

3)To record aluminum quantity variance

4)To record copper quantity variance

5)To record labor variances

6)To record variable overhead variances

7)To record fixed overhead variance

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 7 - Prob. 1RQCh. 7 - What is the meaning of the term unit contribution...Ch. 7 - What information is conveyed by a...Ch. 7 - What does the term safety margin mean?Ch. 7 - Prob. 5RQCh. 7 - Delmarva Oyster Company has been able to decrease...Ch. 7 - In a strategy meeting, a manufacturing companys...Ch. 7 - What will happen to a companys break-even point if...Ch. 7 - Prob. 9RQCh. 7 - How can a profit-volume graph be used to predict a...

Ch. 7 - List the most important assumptions of...Ch. 7 - Why do many operating managers prefer a...Ch. 7 - Prob. 13RQCh. 7 - East Company manufactures VCRs using a completely...Ch. 7 - When sales volume increases, which company will...Ch. 7 - What does the term sales mix mean? How is a...Ch. 7 - A car rental agency rents subcompact, compact, and...Ch. 7 - How can a hotels management use cost-volume-profit...Ch. 7 - How could cost-volume-profit analysis be used in...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21RQCh. 7 - Explain briefly how activity-based costing (ABC)...Ch. 7 - Fill in the missing data for each of the following...Ch. 7 - Prob. 24ECh. 7 - Rosario Company, which is located in Buenos Aires,...Ch. 7 - The Houston Armadillos, a minor-league baseball...Ch. 7 - Prob. 27ECh. 7 - Europa Publications, Inc. specializes in reference...Ch. 7 - Tims Bicycle Shop sells 21-speed bicycles. For...Ch. 7 - A contribution income statement for the Nantucket...Ch. 7 - Refer to the income statement given in the...Ch. 7 - Hydro Systems Engineering Associates, Inc....Ch. 7 - Disk City, Inc. is a retailer for digital video...Ch. 7 - CollegePak Company produced and sold 60,000...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Consolidated Industries is studying the addition...Ch. 7 - Serendipity Sound, Inc. manufactures and sells...Ch. 7 - Prob. 41PCh. 7 - The European Division of Worldwide Reference...Ch. 7 - Prob. 43PCh. 7 - Celestial Products, Inc. has decided to introduce...Ch. 7 - Prob. 45PCh. 7 - Jupiter Game Company manufactures pocket...Ch. 7 - Prob. 47PCh. 7 - Condensed monthly income data for Thurber Book...Ch. 7 - Cincinnati Tool Company (CTC) manufactures a line...Ch. 7 - Ohio Limestone Company produces thin limestone...Ch. 7 - Prob. 51PCh. 7 - Colorado Telecom, Inc. manufactures...Ch. 7 - Prob. 53CCh. 7 - Prob. 54CCh. 7 - Niagra Falls Sporting Goods Company, a wholesale...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4 POINTarrow_forwardOn January 1, 2015, Carlisle Enterprises reports net assets of $920,500, although equipment (with a six-year life) having a book value of $510,000 is worth $590,000 and an unrecorded patent is valued at $52,300. Horizon Corporation pays $845,000 on that date for an 85 percent ownership in Carlisle. If the patent is to be written off over a 12-year period, at what amount should it be reported on the consolidated statements on December 31, 2017?arrow_forwardUnder variable costing total period costs arearrow_forward

- Jordan Enterprises has inventory days of 52, accounts receivable days of 25, and accounts payable days of 34. What is its cash conversion cycle? A.) 43 days B.) 58 days C.) 65 days D.) 72 daysarrow_forwardThe ending inventory is?arrow_forwardWhat is the unit product cost under absorption costingarrow_forward

- i want to this question answer general accounting questionarrow_forward??arrow_forwardMercury Inc. had 30,000 units of ending inventory recorded at $9.50 per unit using FIFO method. Current replacement cost is $5.25 per unit. Which amount should be reported as Ending Merchandise Inventory on the balance sheet using lower-of-cost-or-market rule?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License