Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 40P

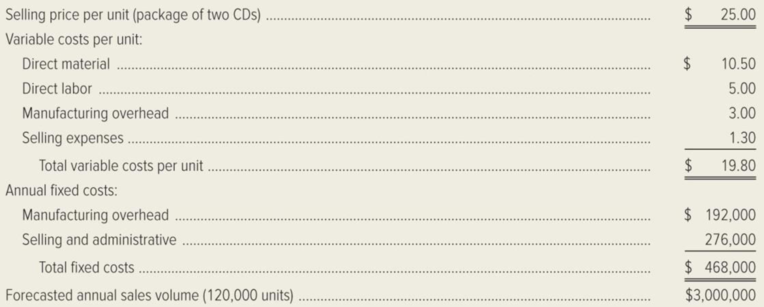

Serendipity Sound, Inc. manufactures and sells compact discs. Price and cost data are as follows:

In the following requirements, ignore income taxes.

Required:

- 1. What is Serendipity Sound’s break-even point in units?

- 2. What is the company’s break-even point in sales dollars?

- 3. How many units would Serendipity Sound have to sell in order to earn $260,000?

- 4. What is the firm’s margin of safety?

- 5. Management estimates that direct-labor costs will increase by 8 percent next year. How many units will the company have to sell next year to reach its break-even point?

- 6. If the company’s direct-labor costs do increase by 8 percent, what selling price per unit of product must it charge to maintain the same contribution-margin ratio?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Study the information given below and answer each of the following questions independently:Calculate the total Marginal Income and Net Profit/Loss if all the tables are sold. Use the marginal income ratio to calculate the break-even value.Calculate the new total Marginal Income and Net Profit/Loss, if an increase in advertising expenseby R100 000 is expected to increase sales by 400 units.How many units must be sold if the company wishes to earn a net profit of R298 920.Based on the expected sales volume of 2 400 units, determine the sales price per unit (expressedin rands and cents) that will enable the company to break even.

Miles Co. can further process Product B to produce Product C. Product B is currently selling for P60 per pound and costs P42 per pound to produce. Product C would sell for P82 per pound and would require an additional cost of P13 per pound to produce. What is the differential revenue of producing and selling Product C? (Per pound)

Cobb Co. can further process Product X to produce Product Y. Product X is currently selling for $30 per pound and costs $28 per pound to produce. Product Y would sell for $60 per pound and would require an additional cost of $24 per pound to produce. What is the net differential income from producing Product Y?

(a)$6 per pound (b)a$8 per pound (c)$2 per pound (d)$30 per pound A

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 7 - Prob. 1RQCh. 7 - What is the meaning of the term unit contribution...Ch. 7 - What information is conveyed by a...Ch. 7 - What does the term safety margin mean?Ch. 7 - Prob. 5RQCh. 7 - Delmarva Oyster Company has been able to decrease...Ch. 7 - In a strategy meeting, a manufacturing companys...Ch. 7 - What will happen to a companys break-even point if...Ch. 7 - Prob. 9RQCh. 7 - How can a profit-volume graph be used to predict a...

Ch. 7 - List the most important assumptions of...Ch. 7 - Why do many operating managers prefer a...Ch. 7 - Prob. 13RQCh. 7 - East Company manufactures VCRs using a completely...Ch. 7 - When sales volume increases, which company will...Ch. 7 - What does the term sales mix mean? How is a...Ch. 7 - A car rental agency rents subcompact, compact, and...Ch. 7 - How can a hotels management use cost-volume-profit...Ch. 7 - How could cost-volume-profit analysis be used in...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21RQCh. 7 - Explain briefly how activity-based costing (ABC)...Ch. 7 - Fill in the missing data for each of the following...Ch. 7 - Prob. 24ECh. 7 - Rosario Company, which is located in Buenos Aires,...Ch. 7 - The Houston Armadillos, a minor-league baseball...Ch. 7 - Prob. 27ECh. 7 - Europa Publications, Inc. specializes in reference...Ch. 7 - Tims Bicycle Shop sells 21-speed bicycles. For...Ch. 7 - A contribution income statement for the Nantucket...Ch. 7 - Refer to the income statement given in the...Ch. 7 - Hydro Systems Engineering Associates, Inc....Ch. 7 - Disk City, Inc. is a retailer for digital video...Ch. 7 - CollegePak Company produced and sold 60,000...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Consolidated Industries is studying the addition...Ch. 7 - Serendipity Sound, Inc. manufactures and sells...Ch. 7 - Prob. 41PCh. 7 - The European Division of Worldwide Reference...Ch. 7 - Prob. 43PCh. 7 - Celestial Products, Inc. has decided to introduce...Ch. 7 - Prob. 45PCh. 7 - Jupiter Game Company manufactures pocket...Ch. 7 - Prob. 47PCh. 7 - Condensed monthly income data for Thurber Book...Ch. 7 - Cincinnati Tool Company (CTC) manufactures a line...Ch. 7 - Ohio Limestone Company produces thin limestone...Ch. 7 - Prob. 51PCh. 7 - Colorado Telecom, Inc. manufactures...Ch. 7 - Prob. 53CCh. 7 - Prob. 54CCh. 7 - Niagra Falls Sporting Goods Company, a wholesale...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A product is currently reported on the balance sheet at a cost of $29. The selling price of the product is currently $30 and disposal costs are $3. If the company had to buy the product today, it would pay $28. The product has a normal profit margin on sales of 30%. What amount should the product be valued at under each of the following methods? Lower of Cost or Market (LCM) Lower of Cost of Net Realizable Value (LCNRV)arrow_forwardPlease answer in text form , without image)arrow_forwardStudy the information given below and answer each of the following questions independently: 3.1 Calculate the total Marginal Income and Net Profit/Loss if all the tables are sold. 3.2 Use the marginal income ratio to calculate the break-even value. 3.3 Calculate the new total Marginal Income and Net Profit/Loss, if an increase in advertising expenseby R100 000 is expected to increase sales by 400 units.3.4 How many units must be sold if the company wishes to earn a net profit of R298 920. 3.5 Based on the expected sales volume of 2 400 units, determine the sales price per unit (expressedin rands and cents) that will enable the company to break even.arrow_forward

- 1. What is the relevant cost to make the part? State answer in total dollars NOT per unit and as a positive number. 2. Should Ran Corporation make the part? 3. What should Ran ignore? Why? 4. What would be the impact on total Net Income if Ran corporation accepted the supplier's offer? Show a negative for a loss, positive for a gain.arrow_forwardStudy the information given below and answer each of the following questions independently: Calculate the total Marginal Income and Net Profit/Loss if all the tables are sold. 3.1 Use the marginal income ratio to calculate the break-even value. Calculate the new total Marginal Income and Net Profit/Loss, if an increase in advertising expense by R100 000 is expected to increase sales by 400 units. 3.2 3.3 3.4 3.5 How many units must be sold if the company wishes to earn a net profit of R298 920. Based on the expected sales volume of 2 400 units, determine the sales price per unit (expressed in rands and cents) that will enable the company to break even. INFORMATION Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: 1. 2. 3. 4. 5. Total production and sales Selling price per table Variable manufacturing costs per table: Direct material Direct labour Overheads Fixed manufacturing overheads Other costs: Fixed…arrow_forwardNik is a company that manufactures running shoes. It has a fixed cost of $300,000.00. Additionally, it costs $30 to produce each pair. They are sold at $80 a pair. A.Write the cost function, C, of producing x running shoes. B.Write the revenue function, R, from the sale of x running shoes. C.Suppose Nik produces too many running shoes- more than they can sell in the stores. How would this impact profits? Is there anything the managers can do to cut their losses? D.Suppose that we can sell all of the units that we produce. How many running shoes would Nik have to produce/sell in order for the company to make a profit? E.Determine the break-even point. Describe what this means. Graph the lines with at least three points each.arrow_forward

- Shalom Company manufactures Peace Products and sells it at P500 per unit. Variable manufacturing costs to manufacture is P200 per unit, while it incurs P150 per unit to sell. The fixed costs to manufacture and sell are P150,000 and P120,000, respectively. (1) How many units should Shalom Company sell to break-even? (2) If the company targets to earn profit of P300,000, how many units should Company sell?arrow_forwardThe smith company management would like to know the total sales units that are required for the company to earn a profit of $ 150000. The following data are available. The unit selling price of $50, variable cost per unit $25. Total fixed cost of $ 500000. Find Profit in order for the Manufacturer to break even. How many units must be sold in order for the Manufacturer to break even?arrow_forwardA small company manufactures a certain item and sells it online. The company has a business model where the cost, C in dollars, to make x items is given by the equation C = 20/3 x + 50. The revenue R , in dollars , made by selling x items is given by the equation R = 10x. How many items must the company sell in order for the cost to equal their revenue?arrow_forward

- a. Davao had a potential foreign customer that has offered to buy 1,500 tons at 450 per ton. Assume that all of Davao's costs would bet at the same levels and rates as last year. What net incomr after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? b. Without prejudice to your answers to peevious questions, and assume that Davao plans to market its product in a new territory. Davao estimated that an advertising and promotion program costing 61,500 annually would need to be undertaken for the next two or three years. In addition l, a 25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao's current after-tax income of 94,500.arrow_forwardRylan corporation received an offer from an exporter for 25,000 units of product at $16 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available Domestic sales price: $22 Unit manufacturing costs: Variable: 11 Fixed: 6 A. What is the amount of income or loss from acceptance of the offer? B. What is the differential cost from acceptance of the offer?arrow_forwardAssume that a merchandiser purchases a product from a supplier for $3.00 per unit and then sells it to customers for $5.00 per unit. Ordinarily, the company sell 30,000 units per year; however, it is considering lowering its price to $4.50 per unit. At the lower price, the company expects to sell 49,250 units per year. What total contribution margin will the company earn if it sells 49,250 units at a price of $4.50 per unit? Multiple Choice $69,400 $73,875 $64,025 $83,725arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License