Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 31E

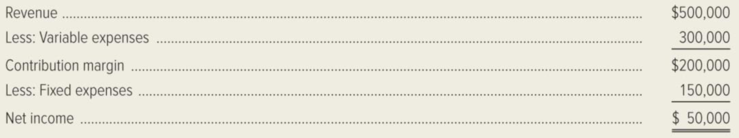

A contribution income statement for the Nantucket Inn is shown below. (Ignore income taxes.)

Required:

- 1. Show the hotel’s cost structure by indicating the percentage of the hotel’s revenue represented by each item on the income statement.

- 2. Suppose the hotel’s revenue declines by 15 percent. Use the contribution-margin percentage to calculate the resulting decrease in net income.

- 3. What is the hotel’s operating leverage factor when revenue is $500,000?

- 4. Use the operating leverage factor to calculate the increase in net income resulting from a 20 percent increase in sales revenue.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the hotel’s operating leverage factor when revenue is $500,000?

Use the operating leverage factor to calculate the increase in net income resulting from a 20 percent increase in sales revenue.

A contribution income statement for the Nantucket Inn is shown below. (Ignore income taxes.)

Revenue

$

2,250,000

Less: Variable expenses

1,200,000

Contribution margin

$

1,050,000

Less: Fixed expenses

675,000

Net income

$

375,000

Required:1. Prepare a contribution income statement if the hotel’s volume of activity increases by 25 percent, and fixed expenses increase by 50 percent.2. Prepare a contribution income statement if the ratio of variable expenses to revenue doubles. There is no change in the hotel’s volume of activity. Fixed expenses decline by $250,000.

Requirement 1. If

SnowDreams

cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level?

Complete the following table to calculate

SnowDreams'

projected income.

Revenue at market price

Less: Total costs

Operating income

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 7 - Prob. 1RQCh. 7 - What is the meaning of the term unit contribution...Ch. 7 - What information is conveyed by a...Ch. 7 - What does the term safety margin mean?Ch. 7 - Prob. 5RQCh. 7 - Delmarva Oyster Company has been able to decrease...Ch. 7 - In a strategy meeting, a manufacturing companys...Ch. 7 - What will happen to a companys break-even point if...Ch. 7 - Prob. 9RQCh. 7 - How can a profit-volume graph be used to predict a...

Ch. 7 - List the most important assumptions of...Ch. 7 - Why do many operating managers prefer a...Ch. 7 - Prob. 13RQCh. 7 - East Company manufactures VCRs using a completely...Ch. 7 - When sales volume increases, which company will...Ch. 7 - What does the term sales mix mean? How is a...Ch. 7 - A car rental agency rents subcompact, compact, and...Ch. 7 - How can a hotels management use cost-volume-profit...Ch. 7 - How could cost-volume-profit analysis be used in...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21RQCh. 7 - Explain briefly how activity-based costing (ABC)...Ch. 7 - Fill in the missing data for each of the following...Ch. 7 - Prob. 24ECh. 7 - Rosario Company, which is located in Buenos Aires,...Ch. 7 - The Houston Armadillos, a minor-league baseball...Ch. 7 - Prob. 27ECh. 7 - Europa Publications, Inc. specializes in reference...Ch. 7 - Tims Bicycle Shop sells 21-speed bicycles. For...Ch. 7 - A contribution income statement for the Nantucket...Ch. 7 - Refer to the income statement given in the...Ch. 7 - Hydro Systems Engineering Associates, Inc....Ch. 7 - Disk City, Inc. is a retailer for digital video...Ch. 7 - CollegePak Company produced and sold 60,000...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Consolidated Industries is studying the addition...Ch. 7 - Serendipity Sound, Inc. manufactures and sells...Ch. 7 - Prob. 41PCh. 7 - The European Division of Worldwide Reference...Ch. 7 - Prob. 43PCh. 7 - Celestial Products, Inc. has decided to introduce...Ch. 7 - Prob. 45PCh. 7 - Jupiter Game Company manufactures pocket...Ch. 7 - Prob. 47PCh. 7 - Condensed monthly income data for Thurber Book...Ch. 7 - Cincinnati Tool Company (CTC) manufactures a line...Ch. 7 - Ohio Limestone Company produces thin limestone...Ch. 7 - Prob. 51PCh. 7 - Colorado Telecom, Inc. manufactures...Ch. 7 - Prob. 53CCh. 7 - Prob. 54CCh. 7 - Niagra Falls Sporting Goods Company, a wholesale...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As the operator of XYZ Fitness gym, you calculate your demand equation to be x = -0 .0 6 p + 8 4 where x is the number of members in the club and p is the annual membership fee you charge per member. Your annual operating costs are a fixed cost of $20,000 per year plus a variable cost of $20 per member. Find the annual revenue function, in terms of p. Find the annual cost function, in terms of p Find a simplified expression for the annual profit function, in terms of p At what price should you set the annual membership fee to obtain the maximum revenue? What is the maximum possible revenue?arrow_forwardMarina Manufacturing is considering buying new equipment for its factory. The new equipment will reduce variable labor costs but increase depreciation expense. Contribution margin is expected to increase from $250,000 to $300,000. Net income is expected to remain the same at $100,000 Compute the degree of operating leverage before and after the purchase of the new equipment and interpret your results. (Round answers to 2 decimal places, eg. 15.25) Degree of operating leverage Before After eTextbook and Mediaarrow_forward• Calculate the revenue needed to earn a target operating income of $102,000. • If fixed costs increase by $19,000, what decrease in variable cost per person must be achieved to maintain the breakeven point calculated in requirement 1? • The general manager at Lifețime Escapes proposes to increase the price of the package tour to $8,200 to decrease the breakeven point in units. Using information in the original problem, calculate the new breakeven point in units. What factors should the general manager consider before deciding to increase the price of the package tour?arrow_forward

- Suppose Morrison Corp.’s breakeven point is revenues of $1,100,000. Fixed costs are $660,000. Q1. Compute the contribution margin percentage. Q2. Compute the selling price if variable costs are $16 per unit. Q3. Suppose 75,000 units are sold. Compute the margin of safety in units and dollars. Q4. What does this tell you about the risk of Morrison making a loss? What are the most likely reasons for this risk to increase?arrow_forward2. If other resorts in the area charge $65 per day, what price should Winter Sports charge? Complete the following table to calculate the price Winter Sports should charge. (Round your answer to the nearest cent.) Fixed costs $ 33,750,000 7,500,000 Plus: Total costs Total variable costs Desired profit $ 41,250,000 15,000,000 $ 56,250,000 750,000 75.00 Plus: Target revenue Divided by: Number of skiers / snowboarders Price per lift ticket If other resorts in the area charge $65 per day, what price should Winter Sports charge? The price is be able to charge competing ski resorts in the area. Given Winter Sports reputation, they should a day without affecting their volume.arrow_forwardSuppose ABC Corp’s break-even point is revenues of $1,100,000. Fixed costs are $660,000 a. Calculate the contribution margin percentage. b. Calculate the selling price if variable costs are $16 per unit. c. Suppose 75 000 units are sold. Calculate the profit earned. d. Will the company be profitable if able to sell 30,000 units? Explain. c. What should the company do to increase its profit above break-even point?arrow_forward

- What is the procedure to answer these questions, please? Last year a local restaurant realized sales of $300,000 with fixed costs of $110,000 and total variable costs of $70,000. 1. What was the restaurants contribution rate (as a decimal) last year? 2. If the restaurant has the same contribution rate this year, what net income can be expected this year from a revenue of $180,000? 3. If the restaurant has the same fixed and variable costs this year, what sales this year will result in a profit of $29,000? 4. Suppose that the fixed costs this year rise to $130,000 and the variable costs remain the same. What is break-even revenue?arrow_forwardCan you please give me correct answer?arrow_forwardCarla Vista Company is considering two alternatives. Alternative A will have sales of $154,800 and costs of $100,100. Alternative B will have sales of $181,400 and costs of $131,800. Compare alternative A with alternative B showing incremental revenues, costs, and net income. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Revenues Costs Net income $ Alternative A is better than Alternative A Alternative B eTextbook and Media $ Alternative B $ Net Income Increase (Decrease)arrow_forward

- Solve the following independent cases and label your supporting computations properly. A) The company's projected profit for the coming year is as follows: Total P 200,000' 120,000 80,000 64,000 16,000 Per Unit P 20 Sales Less: Variable Costs 12 P 8 Contribution Margin P Less: Fixed Costs Net Income 1. Compute the additional profit that the company would earn if sales were P25,000 more than expected. B) KTA sells a special type of health food at a price of P16 per pound. Last year, it purchases this food from its supplier at a cost of P12 per pound. The supplier informed KTA that its cost increases and that this product will now be priced at P14 a pound. Over the years, KTA established a steady market and intends to pass the cost increase along to its customers and also add a P1 per unit to the price for additional profit. Fixed cost for the year are not expected to change and will remain at P34,000. Income tax rate is 32%. The net income after tax last year was P24,000. 2. If KTA can…arrow_forwardSandhill Company is considering two alternatives. Alternative A will have sales of $157,300 and costs of $100,800. Alternative B will have sales of $181.500 and costs of $139,600. Compare alternative A with alternative B showing incremental revenues, costs, and net income. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g.-15,000 or parenthesis, e.g. (15,000)) Revenues Costs Net income $ Alternative A is better than $ Alternative B Net Income Increase (Decrease)arrow_forwardRequired: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $590 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 760 canoes for $590 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $590 each. 5. Suppose Sandy Bank wants to earn $76,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $590 each. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table. Note: Round your "Cost per Unit" answers to 2 decimal places. Number of Canoes Produced and Sold Total costs Variable Costs Fixed Costs Total Costs Cost per Unit Required 3 Required 4 Variable Cost per Unit Fixed Cost per Unit Total Cost per Unit $ $ $ 500 Required 5 780 0 0.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License