Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 48P

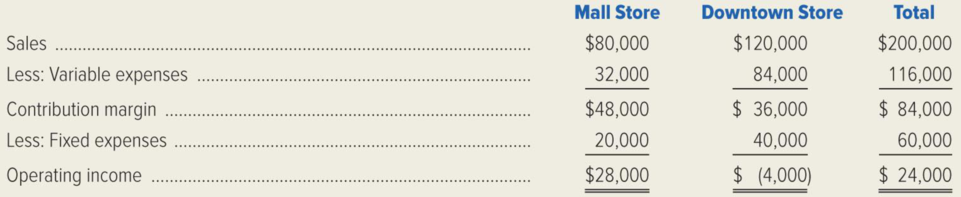

Condensed monthly income data for Thurber Book Stores are presented in the following table for November 20x1. (Ignore income taxes.)

Additional Information:

- Management estimates that closing the downtown store would result in a 10 percent decrease in mall store sales, while closing the mall store would not affect downtown store sales.

- One-fourth of each store’s fixed expenses would continue through December 31, 20x2, if either store were closed.

- The operating results for November 20x1 are representative of all months.

Required:

- 1. Calculate the increase or decrease in Thurber’s monthly operating income during 20x2 if the downtown store is closed.

- 2. The management of Thurber Book Stores is considering a promotional campaign at the down town store that would not affect the mall store. Annual promotional expenses at the downtown store would be increased by $60,000 in order to increase downtown store sales by 10 percent. What would be the effect of this promotional campaign on the company’s monthly operating income during 20x2?

- 3. One-half of the downtown store’s dollar sales are from items sold at their variable cost to attract customers to the store. Thurber’s management is considering the deletion of these item’s, a move that would reduce the downtown store’s direct fixed expenses by 15 percent and result in the loss of 20 percent of the remaining downtown store’s sales volume. This change would not affect the mall store. What would be the effect on Thurber’s monthly operating income if the items sold at their variable cost are eliminated?

- 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: the downtown store’s sales amounted to $126,000 and its variable expenses were $86,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kindly help me with accounting questions

Duo Corporation is evaluating a project with the following cash flows:

Year

0

1

2

3

Cash Flow

-$ 30,000

12,200

14,900

16,800

4

5

13,900

-10,400

The company uses an interest rate of 8 percent on all of its projects.

a. Calculate the MIRR of the project using the discounting approach.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

b. Calculate the MIRR of the project using the reinvestment approach.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

c. Calculate the MIRR of the project using the combination approach.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Discounting approach MIRR

b. Reinvestment approach MIRR

c. Combination approach MIRR

%

%

%

Hello tutor please provide this question solution general accounting

Chapter 7 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 7 - Prob. 1RQCh. 7 - What is the meaning of the term unit contribution...Ch. 7 - What information is conveyed by a...Ch. 7 - What does the term safety margin mean?Ch. 7 - Prob. 5RQCh. 7 - Delmarva Oyster Company has been able to decrease...Ch. 7 - In a strategy meeting, a manufacturing companys...Ch. 7 - What will happen to a companys break-even point if...Ch. 7 - Prob. 9RQCh. 7 - How can a profit-volume graph be used to predict a...

Ch. 7 - List the most important assumptions of...Ch. 7 - Why do many operating managers prefer a...Ch. 7 - Prob. 13RQCh. 7 - East Company manufactures VCRs using a completely...Ch. 7 - When sales volume increases, which company will...Ch. 7 - What does the term sales mix mean? How is a...Ch. 7 - A car rental agency rents subcompact, compact, and...Ch. 7 - How can a hotels management use cost-volume-profit...Ch. 7 - How could cost-volume-profit analysis be used in...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21RQCh. 7 - Explain briefly how activity-based costing (ABC)...Ch. 7 - Fill in the missing data for each of the following...Ch. 7 - Prob. 24ECh. 7 - Rosario Company, which is located in Buenos Aires,...Ch. 7 - The Houston Armadillos, a minor-league baseball...Ch. 7 - Prob. 27ECh. 7 - Europa Publications, Inc. specializes in reference...Ch. 7 - Tims Bicycle Shop sells 21-speed bicycles. For...Ch. 7 - A contribution income statement for the Nantucket...Ch. 7 - Refer to the income statement given in the...Ch. 7 - Hydro Systems Engineering Associates, Inc....Ch. 7 - Disk City, Inc. is a retailer for digital video...Ch. 7 - CollegePak Company produced and sold 60,000...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Consolidated Industries is studying the addition...Ch. 7 - Serendipity Sound, Inc. manufactures and sells...Ch. 7 - Prob. 41PCh. 7 - The European Division of Worldwide Reference...Ch. 7 - Prob. 43PCh. 7 - Celestial Products, Inc. has decided to introduce...Ch. 7 - Prob. 45PCh. 7 - Jupiter Game Company manufactures pocket...Ch. 7 - Prob. 47PCh. 7 - Condensed monthly income data for Thurber Book...Ch. 7 - Cincinnati Tool Company (CTC) manufactures a line...Ch. 7 - Ohio Limestone Company produces thin limestone...Ch. 7 - Prob. 51PCh. 7 - Colorado Telecom, Inc. manufactures...Ch. 7 - Prob. 53CCh. 7 - Prob. 54CCh. 7 - Niagra Falls Sporting Goods Company, a wholesale...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this question solution general accountingarrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forwardLight emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forward

- Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…arrow_forwardFinancial accountingarrow_forwardDont use ai solution general Accounting questionarrow_forward

- Need correct answer general Accountingarrow_forwardYear 0123 Cash Flow -$ 19,000 11,300 10,200 6,700 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability indexarrow_forwardSol This question answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License