Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 6, Problem 8P

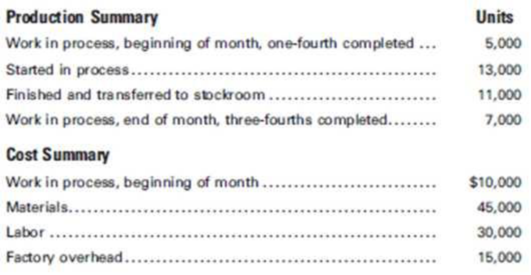

Daytona Beverages Inc. uses the FIFO cost method and adds all materials, labor, and factory

Required:

Prepare a cost of production summary for the month.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the opereting cash flow? General accounting

How much is the direct labor efficiency variance?

To prepare to write your Portfolio Project, create an annotated bibliography by following these steps:

1. Find five credible external sources to support the ideas in your Module 2 Portfolio Milestone draft.

A credible source is defined as:

a scholarly or peer-reviewed journal article – searching for “intercultural communication theory” in the search box at the top of the CSU Global Library page will take you to a variety of sources that you can use; also, choose a specific theory from our textbook or interactive lectures and search for that term, as well. Some examples of theories you can research, along with research to help you get started, are

Hofstede’s Model of Cultural DimensionsLinks to an external site.

Face Negotiation TheoryLinks to an external site.

Communication Accommodation TheoryLinks to an external site.

Anxiety/Uncertainty Management TheoryLinks to an external site.

Integrative Communication Theory of Cross-Cultural AdaptationLinks to an external site.

Sapir-Whorf…

Chapter 6 Solutions

Principles of Cost Accounting

Ch. 6 - Under what conditions may the unit costs of...Ch. 6 - When is it necessary to use separate equivalent...Ch. 6 - Why is it usually reasonable to assume that labor...Ch. 6 - If materials are not put into process uniformly,...Ch. 6 - In what way do the cost of production summaries in...Ch. 6 - Why might the total number of units completed...Ch. 6 - What is the usual method of handling the cost of...Ch. 6 - If some units are normally lost during the...Ch. 6 - How is the cost of units normally lost reflected...Ch. 6 - Prob. 10Q

Ch. 6 - What adjustment must be made if materials added in...Ch. 6 - What is the difference between the unit costs are...Ch. 6 - What advantage does the FIFO cost method have over...Ch. 6 - How would you define each of the following? a....Ch. 6 - What are three methods of allocating joint costs?

Ch. 6 - Prob. 16QCh. 6 - Prob. 17QCh. 6 - Using the data given for Cases 13 below, and...Ch. 6 - Precision Inc. manufactures wristwatches on an...Ch. 6 - The following data appeared in the accounting...Ch. 6 - Conte Chemical Co. uses the weighted average cost...Ch. 6 - Assuming that all materials are added at the...Ch. 6 - Foamy Inc. manufactures shaving cream and uses the...Ch. 6 - Calculating unit costs; units lost in production...Ch. 6 - Sonoma Products Inc. manufactures a liquid product...Ch. 6 - A company manufactures a liquid product called...Ch. 6 - Using the data given for Cases 1–3 and the FIFO...Ch. 6 - Assume each of the following conditions concerning...Ch. 6 - Adirondack Bat Co. processes rough timber to...Ch. 6 - Computing joint costssales value at split-off and...Ch. 6 - LeMoyne Manufacturing Inc.’s joint cost of...Ch. 6 - Making a journal entryby-product Petrone Metals...Ch. 6 - Espana Co. makes one main product, Uno, and a...Ch. 6 - Manufacturing data for January and February in the...Ch. 6 - Manufacturing data for June and July in the...Ch. 6 - On December 1, Carmel Valley Production Inc. had a...Ch. 6 - Akron Manufacturing Co. manufactures a...Ch. 6 - Green Products Inc. cans peas and uses the...Ch. 6 - Monterrey Products Co. uses the process cost...Ch. 6 - Prob. 7PCh. 6 - Daytona Beverages Inc. uses the FIFO cost method...Ch. 6 - Clearwater Candy Co. had a cost per equivalent...Ch. 6 - Mt. Palomar Manufacturing Co. uses a process cost...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Venezuela Oil Inc. transports crude oil to its...Ch. 6 - Clark Kent Inc. buys crypton for $.80 a gallon. At...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Building from the Module 2 Critical Thinking assignment about your company’s water purification product and target country market, research the components needed to build the product. Use the following questions to guide your decisions about production and components, respond to the following topics for this week’s critical thinking assignment. What does the target country produce and export? What does the target country import; what are the imports used for? To what degree does the target country have relevant and cost-effective component manufacturing capabilities? Does the target country have relevant and cost-effective manufacturing/assembly capabilities to create products of acceptable quality? If the target country does not have relevant component and manufacturing skills, where will the water purification components/devices be sourced from given the target country’s trade agreements? How do trade profiles and trade relationships enter into your decision about manufacturing…arrow_forwardThe actual cost of direct labor per hour is $17.20, and the standard cost of direct labor per hour is $16.80. The direct labor hours allowed per finished unit is 0.6 hour. During the current period, 6,200 units of finished goods were produced using 4,000 direct labor hours. How much is the direct labor efficiency variance? a. $4,320 favorable b. $4,320 unfavorable c. $4,800 favorable d. $4,800 unfavorable e. $4,704 unfavorable Answer thisarrow_forwardanswerarrow_forward

- ?arrow_forwardKurup Manufacturing has a standard of 3.4 pounds of materials per unit, at $14.80 per pound. In producing 1,050 units, Kurup used 3,400 pounds of materials at a total cost of $49,200. What is Kurup's total materials variance?arrow_forwardWhat is the amount of equity and net assets of this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY