Allocation of joint costs

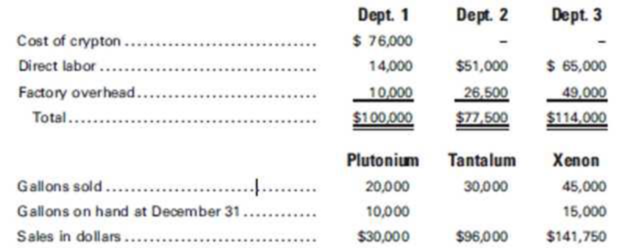

Clark Kent Inc. buys crypton for $.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products plutonium, tantalum, and xenon. Plutonium is sold at the split-off point with no further processing. Tantalum and xenon require further processing before they can be sold. Tantalum is processed in Dept. 2, and xenon is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 31:

No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Kent uses the net realizable value method of allocating joint costs.

Required:

- 1. Calculate the allocation of joint costs.

- 2. Calculate the total cost per unit for each product.

- 3. In examining the product cost reports, Lois Lane, Vice President–Marketing, notes that the per-unit cost of tantalum is greater than the selling price of $2.75 that can be received in the competitive marketplace. Lane wonders whether they should stop selling tantalum. How did Lane determine that the product was being sold at a loss? What per unit cost should be used in determining whether tantalum should be sold?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Management (14th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamentals of Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,