Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 12E

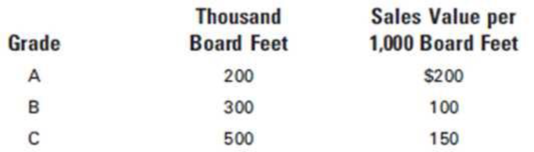

Adirondack Bat Co. processes rough timber to obtain three grades of lumber, A, B, and C that are then made into baseball bats. The company allocates joint costs to the joint products on the basis of the sales value at the split-off point. During the month of May, Adirondack incurred total joint production costs of $300,000 in producing the following:

- 1. Make the

journal entry to transfer the finished lumber to separate work in process inventory accounts for each product. - 2. What would be the allocation of the joint costs if the company were to use the physical measure method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this general accounting problem using the correct accounting principles.

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Please provide the correct answer to this general accounting problem using valid calculations.

Chapter 6 Solutions

Principles of Cost Accounting

Ch. 6 - Under what conditions may the unit costs of...Ch. 6 - When is it necessary to use separate equivalent...Ch. 6 - Why is it usually reasonable to assume that labor...Ch. 6 - If materials are not put into process uniformly,...Ch. 6 - In what way do the cost of production summaries in...Ch. 6 - Why might the total number of units completed...Ch. 6 - What is the usual method of handling the cost of...Ch. 6 - If some units are normally lost during the...Ch. 6 - How is the cost of units normally lost reflected...Ch. 6 - Prob. 10Q

Ch. 6 - What adjustment must be made if materials added in...Ch. 6 - What is the difference between the unit costs are...Ch. 6 - What advantage does the FIFO cost method have over...Ch. 6 - How would you define each of the following? a....Ch. 6 - What are three methods of allocating joint costs?

Ch. 6 - Prob. 16QCh. 6 - Prob. 17QCh. 6 - Using the data given for Cases 13 below, and...Ch. 6 - Precision Inc. manufactures wristwatches on an...Ch. 6 - The following data appeared in the accounting...Ch. 6 - Conte Chemical Co. uses the weighted average cost...Ch. 6 - Assuming that all materials are added at the...Ch. 6 - Foamy Inc. manufactures shaving cream and uses the...Ch. 6 - Calculating unit costs; units lost in production...Ch. 6 - Sonoma Products Inc. manufactures a liquid product...Ch. 6 - A company manufactures a liquid product called...Ch. 6 - Using the data given for Cases 1–3 and the FIFO...Ch. 6 - Assume each of the following conditions concerning...Ch. 6 - Adirondack Bat Co. processes rough timber to...Ch. 6 - Computing joint costssales value at split-off and...Ch. 6 - LeMoyne Manufacturing Inc.’s joint cost of...Ch. 6 - Making a journal entryby-product Petrone Metals...Ch. 6 - Espana Co. makes one main product, Uno, and a...Ch. 6 - Manufacturing data for January and February in the...Ch. 6 - Manufacturing data for June and July in the...Ch. 6 - On December 1, Carmel Valley Production Inc. had a...Ch. 6 - Akron Manufacturing Co. manufactures a...Ch. 6 - Green Products Inc. cans peas and uses the...Ch. 6 - Monterrey Products Co. uses the process cost...Ch. 6 - Prob. 7PCh. 6 - Daytona Beverages Inc. uses the FIFO cost method...Ch. 6 - Clearwater Candy Co. had a cost per equivalent...Ch. 6 - Mt. Palomar Manufacturing Co. uses a process cost...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Venezuela Oil Inc. transports crude oil to its...Ch. 6 - Clark Kent Inc. buys crypton for $.80 a gallon. At...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem using appropriate accountarrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License