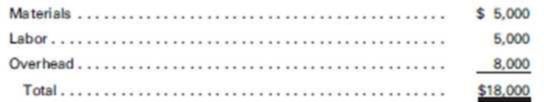

Precision Inc. manufactures wristwatches on an assembly line. The work in process inventory as of March 1 consisted of 1,000 watches that were complete as to materials and 75% complete as to labor and

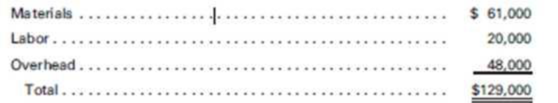

During the month, 10,000 units were started and 9,500 units were completed. The 1,500 units of ending inventory were complete as to materials and 25% complete as to labor and overhead.

The costs for March were as follows:

Calculate:

- a. Equivalent units for material, labor, and overhead, using the weighted average cost method

- b. Unit costs for materials, labor, and overhead

- c. Cost of the units completed and transferred

- d. Detailed cost of the ending inventory

- e. Total of all costs accounted for

Trending nowThis is a popular solution!

Chapter 6 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Principles of Microeconomics (MindTap Course List)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- Please explain the correct approach for solving this general accounting question.arrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forwardCan you help me solve this financial accounting question using the correct financial procedures?arrow_forward

- Can you help me solve this accounting question using valid financial accounting techniques?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning