Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 11P

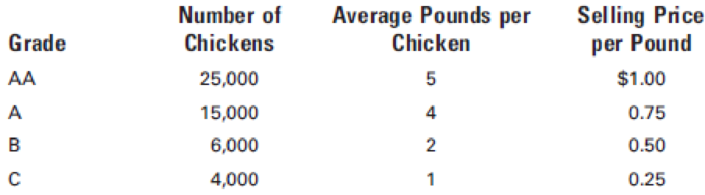

Otto Inc. specializes in chicken farming. Chickens are raised, packaged, and sold mostly to grocery chains. Chickens are accounted for in batches of 50,000. At the end of each growing period, the chickens are separated and sold by grades. Grades AA and A are sold to large grocery chains, and B and C are sold to other buyers. For costing purposes, Otto treats each batch of chicks as a joint product. The cost data for a batch of 50,000 chicks follow:

Total joint costs for the batch were $125,000.

Required:

Compute the cost allocations for each product, using the sales value at split-off method. (Round sales value percentages to five decimal places.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

i want to this question answer General accounting

Can you help me with accounting questions

ans

Chapter 6 Solutions

Principles of Cost Accounting

Ch. 6 - Under what conditions may the unit costs of...Ch. 6 - When is it necessary to use separate equivalent...Ch. 6 - Why is it usually reasonable to assume that labor...Ch. 6 - If materials are not put into process uniformly,...Ch. 6 - In what way do the cost of production summaries in...Ch. 6 - Why might the total number of units completed...Ch. 6 - What is the usual method of handling the cost of...Ch. 6 - If some units are normally lost during the...Ch. 6 - How is the cost of units normally lost reflected...Ch. 6 - Prob. 10Q

Ch. 6 - What adjustment must be made if materials added in...Ch. 6 - What is the difference between the unit costs are...Ch. 6 - What advantage does the FIFO cost method have over...Ch. 6 - How would you define each of the following? a....Ch. 6 - What are three methods of allocating joint costs?

Ch. 6 - Prob. 16QCh. 6 - Prob. 17QCh. 6 - Using the data given for Cases 13 below, and...Ch. 6 - Precision Inc. manufactures wristwatches on an...Ch. 6 - The following data appeared in the accounting...Ch. 6 - Conte Chemical Co. uses the weighted average cost...Ch. 6 - Assuming that all materials are added at the...Ch. 6 - Foamy Inc. manufactures shaving cream and uses the...Ch. 6 - Calculating unit costs; units lost in production...Ch. 6 - Sonoma Products Inc. manufactures a liquid product...Ch. 6 - A company manufactures a liquid product called...Ch. 6 - Using the data given for Cases 1–3 and the FIFO...Ch. 6 - Assume each of the following conditions concerning...Ch. 6 - Adirondack Bat Co. processes rough timber to...Ch. 6 - Computing joint costssales value at split-off and...Ch. 6 - LeMoyne Manufacturing Inc.’s joint cost of...Ch. 6 - Making a journal entryby-product Petrone Metals...Ch. 6 - Espana Co. makes one main product, Uno, and a...Ch. 6 - Manufacturing data for January and February in the...Ch. 6 - Manufacturing data for June and July in the...Ch. 6 - On December 1, Carmel Valley Production Inc. had a...Ch. 6 - Akron Manufacturing Co. manufactures a...Ch. 6 - Green Products Inc. cans peas and uses the...Ch. 6 - Monterrey Products Co. uses the process cost...Ch. 6 - Prob. 7PCh. 6 - Daytona Beverages Inc. uses the FIFO cost method...Ch. 6 - Clearwater Candy Co. had a cost per equivalent...Ch. 6 - Mt. Palomar Manufacturing Co. uses a process cost...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Venezuela Oil Inc. transports crude oil to its...Ch. 6 - Clark Kent Inc. buys crypton for $.80 a gallon. At...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License