Concept explainers

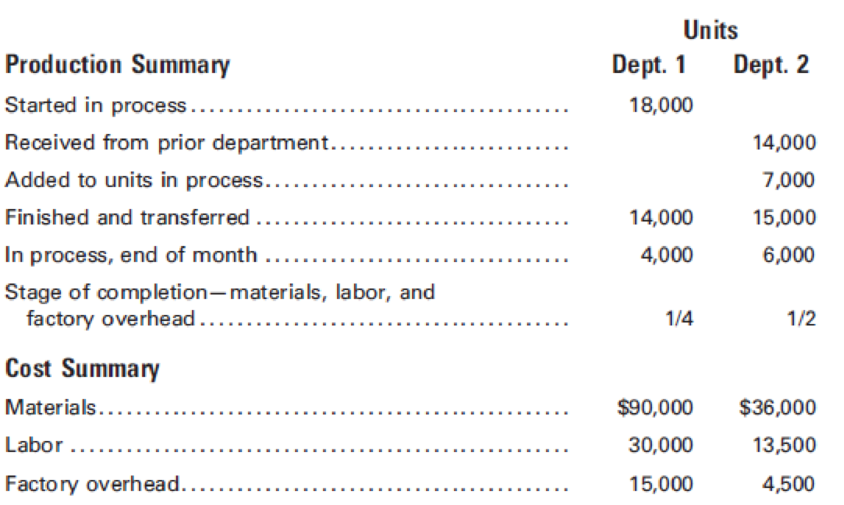

A company manufactures a liquid product called Crystal. The basic ingredients are put into process in Department 1. In Department 2, other materials are added that increase the number of units being processed by 50%. The factory has only two departments.

Calculate the following for each department: (a) unit cost for the month for materials, labor, and factory

1.

Compute unit cost for materials, labor and factory overhead, cost of the units transferred and cost of the ending work in process-department 1.

Explanation of Solution

Compute equivalent unit of production.

| Particulars | Units |

| Units finished and transferred out | 14,000 |

| Ending work in process | 1,000 |

| Total | 15,000 |

Table (1)

a. Compute unit cost.

| Particulars | Amount ($) |

| Materials | 6 |

| Labor | 2 |

| Factory overhead | 1 |

| Total | 9 |

Table (2)

Working Notes:

Calculate the cost of work in process, end of month-material.

Calculate the cost of work in process, end of month-labor.

Calculate the cost of work in process, end of month-factory overhead.

b. Compute cost of units finished and transferred.

c. Compute total work in process, end of month.

| Particulars | Amount ($) |

| Materials | 6,000 |

| Labor | 2,000 |

| Factory overhead | 1,000 |

| Total | 9,000 |

Table (3)

Working Notes:

Calculate the cost of work in process-material.

Calculate the cost of work in process-labor.

Calculate the cost of work in process-factory overhead.

2.

Compute unit cost for materials, labor and factory overhead, cost of the units transferred and cost of the ending work in process-department 2.

Explanation of Solution

Compute equivalent unit of production- department 2.

| Particulars | Units |

| Units finished and transferred out | 15,000 |

| Ending work in process | 3,000 |

| Total | 18,000 |

Table (4)

a. Compute unit cost-department 2.

| Particulars | Amount ($) |

| Materials | 2 |

| Labor | 0.75 |

| Factory overhead | 0.25 |

| Total | 3 |

Table (5)

Working Notes:

Calculate the cost of work in process, end of month-material.

Calculate the cost of work in process, end of month-labor.

Calculate the cost of work in process, end of month-factory overhead.

b. Compute cost of units finished and transferred- department 2.

| Particulars | Amount ($) |

| Cost in department 1 | 90,000 |

| Cost in department 2 | 45,000 |

| Total | 135,000 |

Table (6)

Working Notes:

Calculate the cost in department 1.

(1) Calculate the adjusted unit cost.

(2) Calculate the new quantity.

| Particulars | Amount ($) |

| Units from department | 14,000 |

| Units added | 7,000 |

| New quantity | 21,000 |

Table (7)

Calculate the cost in department 2.

c. Compute work in process, end of month- department 2.

| Particulars | Amount ($) | Amount ($) |

| Cost in department 1 | 36,000 | |

| Cost in department 2 | ||

| Materials | 6,000 | |

| Labor | 2,000 | |

| Factory overhead | 1,000 | 9,000 |

| Total | 45,000 |

Table (8)

Working Notes:

Calculate the cost of work in process-material.

Calculate the cost of work in process-labor.

Calculate the cost of work in process-factory overhead.

Want to see more full solutions like this?

Chapter 6 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

PRIN.OF CORPORATE FINANCE

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense? Need helparrow_forwardClassify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense?arrow_forwardJournalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,