Concept explainers

The G&E Company is preparing a bid to build the new 47,000-seat Shoreline baseball stadium. The construction must start on July 3, 2017, and be completed in time for the start of the 2020 season. A penalty clause of $250,000 per day of delay beyond April 3 is written into the contract.

Percival Young, the president of the company, expressed optimism at obtaining the contract and revealed that the company could net as much as $3 million on the project. He also said if they were successful, the prospects of future projects are bright since there is a projected renaissance in building classic ball parks with modem luxury boxes.

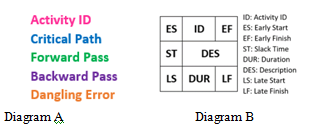

Given the information provided in Table 63, construct a network schedule for the stadium project and answer the following questions:

What is the critical path for the project?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

PROJECT MANAGEMENT (LOOSELEAF)-W/ACCESS

- What are the stages of team development and their information?arrow_forwardPlease original work Name of fiction technology company: TESC technology Corp Background information: You are the chairman of the board for a large technology company. You are seeking a new CEO to replace your recently departed company founder. You are seeking an innovative leader for your organization. What do you think are the most important characteristics for the leader to have? Explain why each is important. How will you determine if an individual has those characteristics? Discuss how executives can ensure a successful fit. Please cite in text references and add weblinksarrow_forwardPlease original work Background information: Building a Knowledge Based Culture To operate efficiently in today’s technology driven environment, business leaders have realized the importance of building knowledge-based cultures and practices into the very fiber of their organizations. How do you design a knowledge-based culture using the training and development processes? What type of innovation is this in a successful high-tech firm? In a stable firm with little external change? Explain. Please cite in text references and add weblinkarrow_forward

- Consider the case of Nutrorim that you read in Module 1 from a culture, structure, and strategy perspective. Answer the following questions. Be sure to support your reasoning with evidence from the case and course concepts. What impact has the democratic culture had on the company’s ability to make good, effective, decisions? How do you think this culture evolved?arrow_forwardPlease original work CEO of a Consulting Management firm Background information: You are in charge of creating a balanced scorecard and the strategy map for an organization of your choice. discuss how you would approach the CEO of your current or a previous organization in order to gather executive input on creating a strategy map. Provide five key questions would you ask and provide the reason for asking each. What concerns would you have about this executive interview? Why? Please cite in text references and add weblinksarrow_forwardWhat is the net operating income for yeararrow_forward

- the importance of aligning the scope delivery with the scope definition and maintaining a formal change control process. Clearly documenting and evaluating the impact of every potential change helps ensure that any updates remain realistic and properly authorized. In your experience, what strategies or tools have you found most helpful for communicating these changes to the broader team so that everyone stays informed and on the same page?arrow_forwardWhat is a good survey design on leadership in management that gather primary data that reveals the Values, Assumptions, Beliefs, and Expectations (VABEs) that relies on the key ten (10) questions that begin "the purpose of thequestion is ?"arrow_forwardDocument for Analysis Please read the following poorly-written email, then create an outline for a more effective email, and post it to this Discussion. Here are some questions to ask yourself while you create an outline: What is the real purpose of this message? Could you make it more "direct"? Which words and phrases are overly complicated, clichéd, too informal, or overly formal? Could you replace them with more simple, familiar words or phrases? Which sentences or words are overly negative? Could they be positively phrased? Are there "I/we" (writer-focused) sentences that could use a "you" (audience-focused) attitude? This email is to Inglesina, an Italian maker of very high-quality and stylish home accessories and decor items. Fabulous Home Accents is writing to Inglesina because they want to sell Inglesina products on their website. However, Inglesina is very selective about who sells their product. Here's the email; it needs work! "Our e-tailing company, Fabulous Home Accents,…arrow_forward

- Once you know your decision-making style, read the case and answer the following questions. Be sure to use case examples and your understanding of Rowe's Decision Making Styles to support your arguments.arrow_forwardword directive to address these conflicts. In Healthcare Claims We are having problems with paying claims the same day the situation that our department is facing.What are clear and reasonable expectations and goals to achieve cohesion, cooperation, and communication between the 4 generations of workers in healthcare claims What strategy can I take to to overcome these conflicts and improve workplace performance.How can I Explain how success will be measured based on your strategy and goals.Considering using tables, matrices, or other visuals.How can I Evaluate what leadershipraits you need to incorporate to lead your diverse departmentarrow_forwardword directive to address these conflicts. In Healthcare Claims We are having problems with paying claims the same day the situation that our department is facing.What are clear and reasonable expectations and goals to achieve cohesion, cooperation, and communication between the 4 generations of workers in healthcare claims What strategy can I take to to overcome these conflicts and improve workplace performance.How can I Explain how success will be measured based on your strategy and goals.Considering using tables, matrices, or other visuals.How can I Evaluate what leadership traits you need to incorporate to lead your diverse departmentarrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,