Loose-leaf for Operations Management (The Mcgraw-hill Series in Operations and Decision Sciences)

12th Edition

ISBN: 9781259580093

Author: William J Stevenson

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5.S, Problem 6P

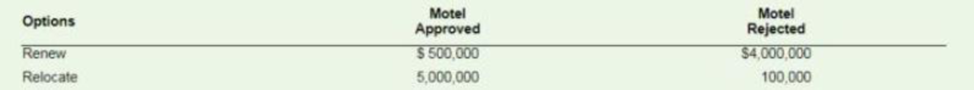

The lease of Theme Park, Inc., is about to expire. Management must decide whether to renew the lease for another 10 years or to relocate near the site of a proposed motel. The town planning board is currently debating the merits of granting approval to the motel. A consultant has estimated the

What course of action would you recommend using?

a. Maximax

b. Maximin

c. Laplace

d. Minimax regret

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Long term capacity plans and how to properly make decisions regarding long-term planning

Long-term capacity plans cover periods longer periods of time. These plans are suitable for large businesses that want to scale their operations with a proven strategy for achieving production targets and meeting customer demands. Long-term capacity plans consider other factors apart from the productive requirements of the company.

How important is it, in your mind, to properly make decisions regarding long-term capacity planning? How does this decision impact the present and future profitability of an organization? Be specific and give examples.

In addition to the Amazon case study you provided, I'm curious if you've encountered other examples of companies successfully applying Little's Law to enhance their supply chain risk management practices. For instance, have you seen organizations use queuing theory to assess the potential ripple effects of disruptions, stress-test their contingency plans, or identify critical control points that require heightened monitoring and agility?

Please provide a reference

Sam's Pet Hotel operates 48 weeks per year, 6 days per week, and uses a continuous review inventory system. It purchases kitty litter for $13.00 per bag

The following information is available about these bags:

> Demand

85 bags/week

>Order cost $60.00/order

> Annual holding cost = 35 percent of cost

> Desired cycle-service level 80 percent

> Lead time = 4 weeks (24 working days)

> Standard deviation of weekly demand = 15 bags

> Current on-hand inventory is 320 bags, with no open orders or backorders.

a. Suppose that the weekly demand forecast of 85 bags is incorrect and actual demand averages only 65 bags per week. How much higher will total

costs be, owing to the distorted EOQ caused by this forecast error?

The costs will be $higher owing to the error in EOQ. (Enter your response rounded to two decimal places.)

Chapter 5 Solutions

Loose-leaf for Operations Management (The Mcgraw-hill Series in Operations and Decision Sciences)

Ch. 5.8 - Explain the meaning of the phrase Hours versus...Ch. 5.8 - Prob. 1.2RQCh. 5.8 - Prob. 1.3RQCh. 5.8 - Prob. 1.4RQCh. 5.8 - Prob. 1.5RQCh. 5.S - Prob. 1DRQCh. 5.S - Prob. 2DRQCh. 5.S - Explain the term bounded rationality.Ch. 5.S - Prob. 4DRQCh. 5.S - Prob. 5DRQ

Ch. 5.S - What information is contained in a payoff table?Ch. 5.S - Prob. 7DRQCh. 5.S - Prob. 8DRQCh. 5.S - Under what circumstances is expected monetary...Ch. 5.S - Explain or define each of these terms: a. Laplace...Ch. 5.S - Prob. 11DRQCh. 5.S - Prob. 12DRQCh. 5.S - Prob. 13DRQCh. 5.S - Prob. 1PCh. 5.S - Refer to problem1. Suppose after a certain amount...Ch. 5.S - Refer to Problems 1 and 2 Construct a graph that...Ch. 5.S - Prob. 4PCh. 5.S - Prob. 5PCh. 5.S - The lease of Theme Park, Inc., is about to expire....Ch. 5.S - Prob. 7PCh. 5.S - Prob. 8PCh. 5.S - Prob. 9PCh. 5.S - A manager must decide how many machines of a...Ch. 5.S - Prob. 11PCh. 5.S - Prob. 12PCh. 5.S - Prob. 13PCh. 5.S - Prob. 14PCh. 5.S - Give this payoff table: a. Determine the range of...Ch. 5.S - Prob. 16PCh. 5.S - Repeat all parts of problem 16, assuming the value...Ch. 5.S - Prob. 18PCh. 5 - Prob. 1DRQCh. 5 - Prob. 2DRQCh. 5 - How do long-term and short-term capacity...Ch. 5 - Give an example of a good and a service that...Ch. 5 - Give some example of building flexibility into...Ch. 5 - Why is it important to adopt a big-picture...Ch. 5 - What is meant by capacity in chunks, and why is...Ch. 5 - Prob. 8DRQCh. 5 - How can a systems approach to capacity planning be...Ch. 5 - Prob. 10DRQCh. 5 - Why is it important to match process capabilities...Ch. 5 - Briefly discuss how uncertainty affects capacity...Ch. 5 - Prob. 13DRQCh. 5 - Prob. 14DRQCh. 5 - Prob. 15DRQCh. 5 - Prob. 16DRQCh. 5 - What is the benefit to a business organization of...Ch. 5 - Prob. 1TSCh. 5 - Prob. 2TSCh. 5 - Prob. 3TSCh. 5 - Prob. 1CTECh. 5 - Prob. 2CTECh. 5 - Identify four potential unethical actions or...Ch. 5 - Any increase in efficiency also increases...Ch. 5 - Prob. 1PCh. 5 - In a job shop, effective capacity is only 50...Ch. 5 - A producer of pottery is considering the addition...Ch. 5 - A small firm intends to increase the capacity of a...Ch. 5 - A producer of felt-tip pens has received a...Ch. 5 - A real estate agent is considering changing her...Ch. 5 - A firm plans to begin production of a new small...Ch. 5 - A manager is trying to decide whether to purchase...Ch. 5 - A company manufactures a product using two machine...Ch. 5 - A company must decide which type of machine to...Ch. 5 - Prob. 11PCh. 5 - A manager must decide how many machines of a...Ch. 5 - Prob. 13PCh. 5 - The following diagram shows a four-step process...Ch. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - A new machine will cost 18,000, butt result it...Ch. 5 - Remodelling an office will cost 25,000 and will...Ch. 5 - Prob. 1CQCh. 5 - Prob. 2CQCh. 5 - Prob. 3CQ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Osprey Sports stocks everything that a musky fisherman could want in the Great North Woods. A particular musky lure has been very popular with local fishermen as well as those who buy lures on the Internet from Osprey Sports. The cost to place orders with the supplier is $3030/order; the demand averages 55 lures per day, with a standard deviation of 11 lure; and the inventory holding cost is $1.001.00/lure/year. The lead time form the supplier is 1010 days, with a standard deviation of 33 days. It is important to maintain a 9898 percent cycle-service level to properly balance service with inventory holding costs. Osprey Sports is open 350 days a year to allow the owners the opportunity to fish for muskies during the prime season. The owners want to use a continuous review inventory system for this item. Refer to the standard normal table LOADING... for z-values. Part 2 a. What order quantity should be used? enter your response here lures. (Enter your response rounded to the…arrow_forward9. Research Methodology Fully explain the Quantitative research methodology that and add in the following sub-sections: . Data Collection • Data Analysisarrow_forwardRuby-Star Incorporated is considering two different vendors for one of its top-selling products which has an average weekly demand of 40 units and is valued at $80 per unit. Inbound shipments from vendor 1 will average 340 units with an average lead time (including ordering delays and transit time) of 2 weeks. Inbound shipments from vendor 2 will average 550 units with an average lead time of 1 week. Ruby-Star operates 52 weeks per year; it carries a 2-week supply of inventory as safety stock and no anticipation inventory. a. The average aggregate inventory value of the product if Ruby-Star used vendor 1 exclusively is $ (Enter your response as a whole number.)arrow_forward

- The Carbondale Hospital is considering the purchase of a new ambulance. The decision will rest partly on the anticipated mileage to be driven next year. The miles driven during the past 5 years are as follows: Year Mileage 1 3,000 2 3 4 4,000 3,450 3,850 5 3,800 a) Using a 2-year moving average, the forecast for year 6 = miles (round your response to the nearest whole number). b) If a 2-year moving average is used to make the forecast, the MAD based on this = miles (round your response to one decimal place). (Hint: You will have only 3 years of matched data.) c) The forecast for year 6 using a weighted 2-year moving average with weights of 0.40 and 0.60 (the weight of 0.60 is for the most recent period) = ☐ miles (round your response to the nearest whole number). miles (round your response to one decimal place). (Hint: You will have only 3 years of The MAD for the forecast developed using a weighted 2-year moving average with weights of 0.40 and 0.60 = matched data.) d) Using…arrow_forwardTask time estimates for the modification of an assembly line at Jim Goodale's Carbondale, Illinois, factory are as follows: B D G Time Activity (in hours) Immediate Predecessor(s) A 5.0 B 7.5 C 5.0 A DEFC 8.0 B, C 4.5 Figure 2 A B, C 7.7 D G 5.0 E, F This exercise contains only part a. a) The correct precedence diagram for the project is shown in 目 F B Figure 3 A E B E ☑ D Farrow_forwardDave Fletcher was able to determine the activity times for constructing his laser scanning machine. Fletcher would like to determine ES, EF, LS, LF, and slack for each activity. The total project completion time and the critical path should also be determined. Here are the activity times: Activity Time (weeks) Immediate Predecessor(s) Activity Time (weeks) Immediate Predecessor(s) A 6 E 3 B B 8 F 6 B C 3 A G 11 C, E D 1 A H 7 D, F Dave's earliest start (ES) and earliest finish (EF) are: Activity ES .EF A 0 6 B 0 8 C 3 9 D 6 E F 8 G 22 H 21 Dave's latest start (LS) and latest finish (LF) are: Activity LS LF H 15 G 11 F 9arrow_forward

- There are multiple ways a company can enter a foreign market. Explore two possibilities such as exporting, foreign direct investment, and collaborations (joint ventures, alliances, licensing, franchising), and evaluate the pros and cons of each method. Which types of products and services would be appropriate for each market entry method?arrow_forward01,3 ☐ Question 3 Scenario 9.3 4 pts The Talbot Company uses electrical assemblies to produce an array of small appliances. One of its high cost/high volume assemblies, the XO-01, has an estimated annual demand of 8,000 units. Talbot estimates the cost to place an order is $50, and the holding cost for each assembly is $20 per year. The company operates 250 days per year. Use the information in Scenario 9.3. What is the annual inventory holding cost if Talbot orders using the EOQ quantity? O less than or equal to $1,500 Ogreater than $4,000 but less than or equal to $6,500 O greater than $6,500 O greater than $1,500 but less than or equal to $4,000 Nextarrow_forwardAnalyze Walmart Inc. operations and conducting a strengths, weaknesses, opportunities, and threats (SWOT) analysis. Pay attention to Walmart Inc. strengths and opportunities to come up with a social cause that meshes well with them. Focusing on areas where Walmart Inc. excels and then finding a social cause that can benefit from Walmart Inc. strengths can also ultimately help Consider how shareholder and stakeholder theories of ethics will impact the selection of a target social cause for Walmart Inc to pursue. What responsibility does Walmart Inc. owe to its stockholders and stakeholders? Will pursuing a social responsibility program detract from the responsibilities to these two groups? Any program that is implement will redirect resources toward the social cause and away from the stockholders and stakeholders. Is it ethical? Walmart Inc SWOT analysis. Justify each item of the analysis. Evaluate the ethical implications of pursuing a social responsibility program in terms of the…arrow_forward

- Detail Instructions Consider the following activities, activity times and precedence relations for a hypothetical Athletic Club Building project. Activity Activity Description Normal Time (weeks) Immediate Predecessors A Form project team 9 B Prepare renovation plans 12 A C Demolish interior space 10 B D Upgrade utility systems 20 A E Select equipment, furniture & 10 B fixtures F Hire Staff 10 A G Renovate building 30 B,C H Purchase equipment, furniture & 26 E fixtures Install equipment, furniture & 4 D.G.H fixtures 3 FI J Train staffarrow_forwardHow do you think smaller companies, with less sophisticated systems compared to giants like Amazon, can apply Little's Law to optimize their operations? Please Provide a referencearrow_forwardWhat are your thoughts on how businesses can account for real-world variability when applying Little's Law, especially in industries where demand is highly unpredictable? Please provide referencearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Marketing

Marketing

ISBN:9780357033791

Author:Pride, William M

Publisher:South Western Educational Publishing

Inventory Management | Concepts, Examples and Solved Problems; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=2n9NLZTIlz8;License: Standard YouTube License, CC-BY