Problem 2.1TI: For the Park City basketball team, scores for the last 30 games were as follows (smallest to... Problem 2.2TI: The following data show the distances (in miles) from the homes of off-campus statistics students to... Problem 2.3TI: The table shows the number of sins and losses the Atlanta Hawks have had in 42 seasons. Create a... Problem 2.4TI: In a survey, 40 people were asked how many times per year they had their car in the shop for... Problem 2.5TI: The population in Park City is made up of children, working-age adults, and retirees. Table 2.10... Problem 2.6TI: Park city is broken down into six voting districts. The table shows the percent of the total... Problem 2.7TI: The following data are the shoe sizes of 50 male students. The sizes ate continuous data since shoe... Problem 2.8TI: The following data are the number of sports played by 50 student athletes. The number of sports is... Problem 2.9TI: The following data represent the number of employees at various restaurants in New You City. Using... Problem 2.10TI: Construct a frequency polygon of U.S. Presidents’ ages at inauguration shown in Table 2.15. Problem 2.12TI: The following table is a portion of a data set from wwwworldbank.org. Use the table to construct a... Problem 2.13TI: For the following 11 salaries, calculate the IQR and determine if any salaries are outliers. The... Problem 2.14TI: Find the interquartile range for the following two data sets and compare them. Test Scores for Class... Problem 2.15TI: Forty bus drivers were asked how many hours they spend each day running their routes (rounded to the... Problem 2.16TI: Refer to the Table 223. Find the third quartile. What is another name for the third quartile? Problem 2.17TI: Listed are 29 ages for Academy Award sinning best actors in order from smallest to largest. 18; 21;... Problem 2.18TI: Listed are 30 ages for Academy Award winning best actors in order from smallest to largest. 18; 21;... Problem 2.19TI: For the 100-meter dash, the third quartile for times for finishing the race was 113 seconds.... Problem 2.20TI: On a 60 point written assignment, the 80th percentile for the number of points earned was 49.... Problem 2.21TI: During a season, the 40th percentile for points scored per player in a game is eight. Interpret the... Problem 2.23TI: The following data are the number of pages In 40 books on a shelf. Construct a box plot using a... Problem 2.24TI: The folloising data set show’s the heights in inches for the boys in a class of 40 students. 66; 66;... Problem 2.25TI: Follow the steps you used to graph a box-and-whisker plot for the data values shown. 0 5; 5; 15; 30;... Problem 2.26TI: The following data show the number of months patients typically wait on a transplant list before... Problem 2.27TI: In a sample of 60 households, one house is worth $2,500,000. Half of the rest are worth $280,000,... Problem 2.28TI: The number of books checked out from the library from 25 students are as follows: 0; 0; 0; 1; 2; 3;... Problem 2.29TI: Five credit scores are 680, 680, 700, 720, 720. The data set is bimodal because the scores 680 and... Problem 2.30TI: Mails conducted a study on the effect that playing video games has on memory recall. As part of her... Problem 2.31TI: Discuss the mean, median, and mode for each of the following problems. Is there a pattern between... Problem 2.32TI: On a baseball team, the ages of each of the players are as follows: 21; 21; 22; 23; 24; 24; 25; 25;... Problem 2.33TI: The following data show the different types of pet food stores in the area carry. 6; 6; 6; 6; 7; 7;... Problem 2.34TI: Find the standard deviation for the data from the previous example. First, press the STAT key and... Problem 2.35TI: Two swimmers, Angie and Beth, from different teams, wanted to find out who has the fastest time for... Problem 1P: For each of the following data sets, create a stem plot and identify any outliers. The miles per... Problem 2P: For each of the following data sets, create a stem plot and identify any outliers. 2. The height in... Problem 3P: For each of the following data sets, create a stem plot and identify any outliers. The data are the... Problem 4P: For each of the following data sets, create a stem plot and identify any outliers. The data are... Problem 5P: For each of the following data sets, create a stem plot and identify any outliers. 5. In a survey,... Problem 6P: For each of the following data sets, create a stem plot and identify any outliers. 6. In a survey,... Problem 7P: For each of the following data sets, create a stem plot and identify any outliers. 7. Several... Problem 8P: The students in Ms. Ramirez’s math class have birthdays in each of the four seasons. Table 2.40... Problem 9P: Using the data from Mrs. Ramirez’s math class supplied in Exercise 2.8, construct a bar graph... Problem 10P: David County has six high schools. Each school sent students to participate In a county-side science... Problem 11P: Use the data from the David County science competition supplied in Exercise 2.10. Construict a bar... Problem 12P: Sixty-five randomly selected car salespersons were asked the number of cars they generally sell in... Problem 13P: What does the frequency column in Table 2.42 sum to? Why? Problem 14P: What does the relative frequency column in Table 2.42 sum to? Why? Problem 15P: What is the difference between relative frequency and frequency for each data value in Table 2.42? Problem 16P: What is the difference between cumulative relative frequency and relative frequency for each data... Problem 17P: To construct the histogram for the data in Table 2.42. determine appropriate minimum and maximum x... Problem 18P:

Problem 19P: Construct a frequency polygon from the frequency distribution for the 50 highest ranked countries... Problem 20P: Use the two frequency tables to compare the life expectancy of men and women from 20 randomly... Problem 21P: Construct a times series graph for (a) the number of male births, (b) the number of female births,... Problem 22P: The following data sets List full time police per 100,000 citizens along with homicides per 100,000... Problem 23P: Listed are 29 ages for Academy Award winning best actors in order from smallest to largest. 18; 21;... Problem 24P: Listed are 32 ages for Academy Award winning best actors in order from smallest to largest. 18; 18;... Problem 25P: Jesse was ranked 37th in his graduating class of 180 students. At hat percentile is Jesse’s ranking? Problem 26P: a. For runners in a race, a low time means a faster run. The winners in a race have the shortest... Problem 27P: a. For runners in a race, a higher speed means a faster run. Is it more desirable to have a speed... Problem 28P: On an exam, would it be more desirable to earn a grade with a high or low percentile? Explain. Problem 29P: Mina is waiting in line at the Department of Motor Vehicles (DMV). Her wait time of 32 minutes is... Problem 30P: In a survey collecting data about the salaries earned by recent college graduates, Li found that het... Problem 31P: In a study collecting data about the repair costs of damage to automobiles in a certain type of... Problem 32P: The University of California has two criteria used to set admission standards for freshman to be... Problem 33P: Suppose that you are buying a house. You and your realtor have determined that the most expensive... Problem 34P: First quartile = _______ Problem 35P: Second quartile = median = 50th percentile = Problem 36P: Third quartile = _______ Problem 37P: Interquartile range (IQR) = _____ — _____ Problem 38P: Inteiquartile range (IQR = _____ — _____ = _____ _____ Problem 39P: percentile = _______ Problem 40P: Use the following information to answer the next two exercises. Sixty-five randomly selected car... Problem 41P: Use the following information to answer the next two exercises. Sixty-five randomly selected car... Problem 42P: Find the mean for the following frequency tables. Problem 43P: Use the following information to answer the next three exercises: The following data show the... Problem 44P: Use the following information to answer the next three exercises: The following data show the... Problem 45P: Use the following information to answer the next three exercises: The following data show the... Problem 46P: Use the following information to answer the next three exercises: Sixty-five randomly selected car... Problem 47P: Use the following information to answer the next three exercises: Sixty-five randomly selected car... Problem 48P: Use the following information to answer the next three exercises: Sixty-five randomly selected car... Problem 49P: Use the following information to answer the next three exercises State whether the data are... Problem 50P: Use the following information to answer the next three exercises State whether the data are... Problem 51P: Use the following information to answer the next three exercises State whether the data are... Problem 52P: When the data are skewed left, what is the typical relationship between the mean and median? Problem 53P: When the data are symmetrical, what is the typical relationship between the mean and median? Problem 54P: What word describes a distribution that has two modes? Problem 55P: Describe the shape of this distribution. Figure 2.32 Problem 56P: Describe the relationship between the mode and the median of this disthbution. Figure 2.33 Problem 57P: Describe the relationship between the mean and the median of this distribution. Figure 2.34 Problem 58P: Describe the shape of this distribution. Figure 2.35 Problem 59P: Describe the relationship between the mode and the median of this distribution. Figure 2.36 Problem 60P: Are the mean and the median the exact same in this distribution? Why or why not? Figure 2.37 Problem 61P: Describe the shape of this distribution. Figure 2.38 Problem 62P: Describe the relationship between the mode and the median of this distribution. Figure 2.39 Problem 63P: Describe the relationship between the mean and the median of this distribution. Figure 2.40 Problem 64P: The mean and median for the data are the same. 3; 4; 5; 5; 6; 6; 6; 6; 7; 7; 7; 7; 7; 7; 7 Is the... Problem 65P: Which is the greatest, the mean, the mode, or the median of the data set? 11; 11; 12; 12; 12; 12;... Problem 66P: Which is the least, the mean, the mode, and the median of the data set? 56; 56; 56; 58; 59; 60; 62;... Problem 67P: Of the three measures, which tends to reflect skewing the most, the mean, the mode, or the median?... Problem 68P: In a perfectly symmetrical distribution, when would the mode be different from the mean and median? Problem 69P: Use the following information to answer the next rsv exeirises: The following data are the distances... Problem 70P: Use the following information to answer the next two exercises: The following data are the distances... Problem 71P: Two baseball players, Fredo and Karl, on different teams wanted to find out who had the higher... Problem 72P: Use Table 2.57 to find the value that is three standard deviations: a. above the mean b. below the... Problem 73P: Find the standard deviation for the following frequency tables using the formula. Check the... Problem 74H: Student grades on a chemistry exam were: 77, 78, 76, 81, 86, 51, 79, 82, 84, 99 a. Constrict a... Problem 75H: Table 2.61 contains the 2010 obesity rates in U.S. states and Washington, DC. a. Use a random number... Problem 76H: Suppose that three book publishers were interested in the number of fiction paperbacks adult... Problem 77H: Often, cruise ships conduct all on-board transactions, with the exception of gambling, on a cashless... Problem 78H: Twenty-five randomly selected students were asked the number of movies they watched the previous... Problem 79H: The percentage of people who own at most three t-shirts costing more than 519 each is approximately:... Problem 80H: If the data were collected by asking the first 111 people who entered the store, then the type of... Problem 81H: Following are the 2010 obesity rates by U.S. states and Washington. DC. Construct a bar graph of... Problem 82H: The median age for U.S. blacks currently is 30.9 years; for U.S. whites it is 42.3 years. a. Based... Problem 83H: Six hundred adult Americans were asked by telephone poll, "What do you think constitutes a... Problem 84H: Given the following box plot: Figure 2.41 a. which quarter has the smallest spread of data? What is... Problem 85H: The following box plot shows the U.S. population for 1990, the latest available year. Figure 2.42 a.... Problem 86H: In a survey of 2O-year-olds in China, Germany, and the United States, people re asked the number of... Problem 87H: Given the following box plot, answer the questions. Figure 2.44 a. Think of an example (in words)... Problem 88H: Given the following box plots, answer t* questions. Figure 2.45 a. In complete sentences, explain... Problem 89H: A survey was conducted of 130 purchases of new BMW 3 series cars, 130 purchasers of new BNIVV 5... Problem 90H: Twenty-five randomly selected students were asked the number of movies they watched the previous... Problem 91H: The most obese countries in the world have obesity rates that range from 11.4% to 74.6°o. This data... Problem 92H: Table 2.72 gives the percent of children under five considered to be underweight. What is the best... Problem 93H: The median age of the U.S. population in 1980 was 30.0 years. In 1991, the median age was 33.1... Problem 94H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 95H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 96H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 97H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 98H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 99H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 100H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 101H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 102H: Use the following information to answer the neat nine exercises: The population parameters below... Problem 103H: Three students were applying to the same graduate school. They came from schools with different... Problem 104H: A music school has budgeted to purchase three musical instruments. They plan to purchase a piano... Problem 105H: An elementary school class ran one mile with a mean of II minutes and a standard deviation of three... Problem 106H: The most obese countries in the world have obesity rates that range from 11.4% to 4.6°%. This data... Problem 107H: Table 2.76 gives the percent of children under five considered to be underweight. What is the best... Problem 108BITH: Santa, Clara Country, Ca, has approximately 27,873 Japanese-Amercians. Their ages are follows: a.... Problem 109BITH: Javier and Ercilia are supervisors at a shopping mall. Each was given the task of estimating the... Problem 110BITH: What is the IQR? a. 8 b. 11 C. 15 d. 35 Problem 111BITH: What is the mode? a. 19 b. 19.5 c. 1and 20 d. 22.65 Problem 112BITH: Is this a sample or the entire population? a. sample b. entire population c. neither Problem 113BITH: Twenty-five randomly selected students were asked the number of movies they watched the previous... Problem 114BITH: Forty randomly selected students were asked the number of pairs of sneakers they owned. Let X = the... Problem 115BITH: Following are the published weights (in pounds) of all of the team members of the San Francisco... Problem 116BITH: One hundred teachers attended a seminar on mathematical problem solving. The attitudes of a... Problem 117BITH: Refer to Figure 2.50 determine which of the following are tnze and which are false. Explain your... Problem 118BITH: In a recent issue of the IFFF Spectrum, 84 engineering conferences were announced. Four conferences... Problem 119BITH: A survey of enrollment at 35 community colleges across the United States yielded the following... Problem 120BITH: Use the following information to answer the next two exercises. X = the number of days per week that... Problem 121BITH: Use the following information to answer the not two exercises. X = the number of days per week that... Problem 122BITH: Suppose that a publisher conducted a survey asking adult consumers the number of fiction paperback... format_list_bulleted

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

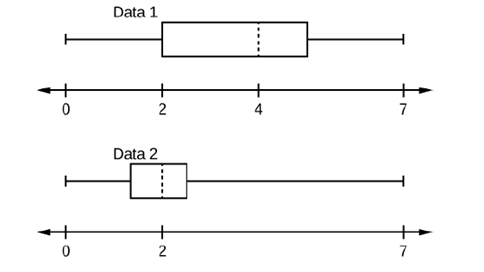

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt