Dana Rand owns a catering company that prepares banquets and parties for both individual and business functions throughout the year. Rand’s business is seasonal, with a heavy schedule during the summer months and the year-end holidays and a light schedule at other times. During peak periods, there are extra costs; however, even during nonpeak periods Rand must work more to cover her expenses.

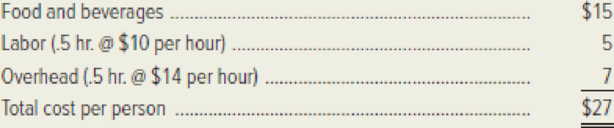

One of the major events Rand’s customers request is a cocktail party. She offers a standard cocktail party and has developed the following cost structure on a per-person basis.

When bidding on cocktail parties, Rand adds a 15 percent markup to this cost structure as a profit margin. Rand is quite certain about her estimates of the prime costs but is not as comfortable with the

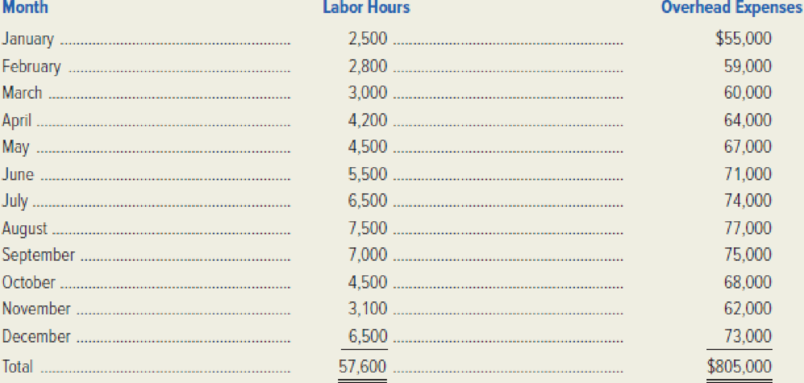

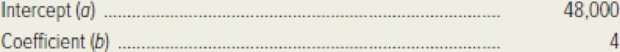

Rand recently attended a meeting of the local chamber of commerce and heard a business consultant discuss regression analysis and its business applications. After the meeting, Rand decided to do a regression analysis of the overhead data she had collected. The following results were obtained.

Required:

- 1. Explain the difference between the overhead rate originally estimated by Dana Rand and the overhead rate developed from the regression method.

- 2. Using data from the regression analysis, develop the following cost estimates per person for a cocktail party.

- a. Variable cost per person

- b. Absorption cost per person

Assume that the level of activity remains within the relevant range.

- 3. Dana Rand has been asked to prepare a bid for a 200-person cocktail party to be given next month. Determine the minimum bid price that Rand should be willing to submit.

- 4. What other factors should Dana Rand consider in developing the bid price for the cocktail party?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Required information [The following information applies to the questions displayed below.} Maria Chavez owns a catering company that serves food and beverages at parties and business functions. Chavez's business is seasonal, with a heavy schedule during the summer months and holidays and a lighter schedule at other times. One of the major events Chavez's customers request is a cocktail party. She offers a standard cocktail party and has estimated the cost per guest as follows: Food and beverages Labor (0.5 hour e $10.00/hr.) Overhead (8.5 hour @ $13.98/hr.) $ 15.00 5.00 6.99 Total cost per guest $ 26.99 The standard cocktail party lasts three hours and Chavez hires one worker for every six guests, so that works out to one- half hour of labor per guest. These workers are hired only as needed and are paid only for the hours they actually work. When bidding on cocktail parties, Chavez adds a 15% markup to yield a price of about $31 per guest. She is confident about her estimates of the…arrow_forwardLon Timur is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Lon, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Lon has gathered the following investment information. 1. 2. 3. 4. 5. Five used vans would cost a total of $75,000 to purchase and would have a 3-year useful life with negligible salvage value. Lon plans to use straight-line depreciation. Ten drivers would have to be employed at a total payroll expense of $48,000. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,000, Maintenance $3,300, Repairs $4,000, Insurance $4,200, and…arrow_forwardLon Timur is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Lon, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Lon has gathered the following investment information. 1. Five used vans would cost a total of $75,551 to purchase and would have a 3-year useful life with negligible salvage value. Lon plans to use straight-line depreciation. 2. Ten drivers would have to be employed at a total payroll expense of $48,300. 3. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,200, Maintenance $3,300, Repairs $3,800, Insurance…arrow_forward

- enosha Winter Services is a small, family-owned snow-removal business. For its services, the company has always charged a flat fee per hundred square metres of snow removal. The current fee is $12.70 per hundred square metres. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on more remote properties that require considerable travel time. The owner’s daughter, home from school for the summer, has suggested investigating this question using ABC. After some discussion, a simple system consisting of four activity cost pools seemed to be adequate. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Snow removal Square metres cleaned (00s) 34,600 hundred square metres Travel to jobs Kilometres driven 18,125 kilometres Job support Number of jobs 250 jobs Other (costs of idle capacity and organization-sustaining costs)…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.10 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 8,000 hundred square feet Travel to jobs Miles driven 131,500 miles Job support Number of jobs 2,100 jobs Other (organization-sustaining costs and idle…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $22.30 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 9,500 hundred square feet Travel to jobs Miles driven 292,000 miles Job support Number of jobs 2,000 jobs Other (organization-sustaining costs and idle…arrow_forward

- Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $22.30 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 9,500 hundred square feet Travel to jobs Miles driven 292,000 miles Job support Number of jobs 2,000 jobs Other (organization-sustaining costs and idle…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $22.40 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, a simple system consisting of four activity cost pools seemed to be adequate. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 10,500 hundred square feet Travel to jobs Miles driven 96,500 miles Job support Number of jobs 1,700 jobs Other (costs of idle…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $22.40 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers—particularly those located on remote ranches that require considerable travel time. The owner’s daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Cleaning carpets Square feet cleaned (00s) 10,500 hundred square feet Travel to jobs Miles driven 93,500 miles Job support Number of jobs 1,700 jobs Other (organization-sustaining costs and idle…arrow_forward

- Sanjana's Sweet Shoppe operates on the boardwalk of a New England coastal town. The store only opens for the summer seaso the business is heavily dependent on the weather and the economy in addition to new competition. Sanjana Sweet, the owner, prepares a budget each year after reading long-term weather forecasts and estimates of summer tourism. The budget is a first ste planning whether she will need any loans and whether she needs to consider adjustments to store staffing. Based on expertise ar experience, she develops the following. Scenario Good Fair Poor Gross Margin per Customer (Price Cost of Poor Fair Good Poor Fair Good Poor Fair Good Sanjana assumes, for simplicity, that the gross margin and the estimated number of customers are independent. Thus, she has nine possible scenarios. In addition to the cost of the products sold, Sanjana estimates staffing costs to be $31,000 plus $2 for every customer in excess of 26,000. The marketing and administrative costs are estimated to be…arrow_forwardFor the past 11 years, Elaine Wright has been an employee of the Star-Bright Electrical Supply store. Elaine is a very diligent employee who rarely calls in sick and staggers her vacation days throughout the year so that no one else gets bogged down with her tasks for more than one day. Star-Bright is a small store that employs only four people other than the owner. The owner and one of the employees help customers with their electrical needs. One of the employees handles all receiving, stocking, and shipping of merchandise.Another employee handles the purchasing, payroll, general ledger, inventory, and AP functions. Elaine handles all of the point-of-sale cash receipts and prepares the daily deposits for the business. Furthermore, Elaine opens the mail and deposits all cash receipts (about 30 percent of the total daily cash receipts). Elaine also keeps the AR records and bills the customers who purchase on credit.Point out any control weaknesses you see in the scenario. List some…arrow_forwardGallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.45 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Cleaning carpets Travel to jobs Job support Other (organization-sustaining costs and idle capacity costs) Activity Measure Square feet cleaned (00s) Miles driven Number of jobs Activity for the Year 10,500 hundred square feet 389,000 miles 2,000…arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT