Concept explainers

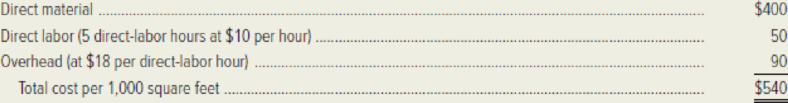

Earth and Artistry, Inc. provides commercial landscaping services. Sasha Cairns, the firm’s owner, wants to develop cost estimates that she can use to prepare bids on jobs. After analyzing the firm’s costs, Cairns has developed the following preliminary cost estimates for each 1,000 square feet of landscaping.

Cairns is quite certain about the estimates for direct material and direct labor. However, she is not as comfortable with the

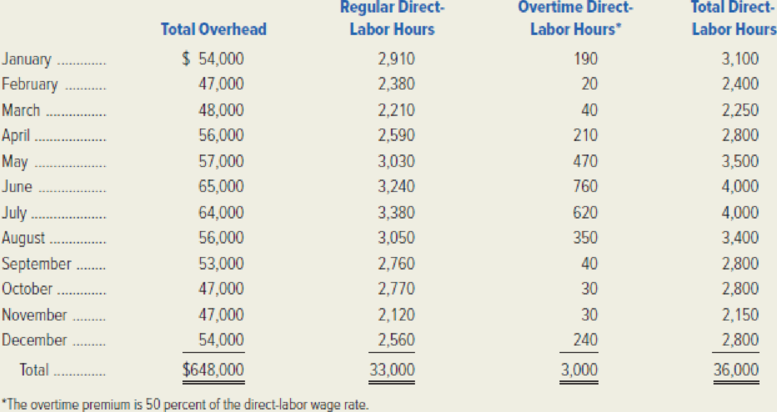

Cairns believes that overhead is affected by total monthly direct-labor hours. Cairns decided to perform a least-squares regression of overhead (OH) on total direct-labor hours (DLH). The following regression formula was obtained.

Required:

- 1. The overhead rate developed from the least-squares regression is different from Cairns’ preliminary estimate of $18 per direct-labor hour. Explain the difference in the two overhead rates.

- 2. Using the overhead formula that was derived from the least-squares regression, determine a total variable-cost estimate for each 1,000 square feet of landscaping.

- 3. Cairns has been asked to submit a bid on a landscaping project for the city government consisting of 60,000 square feet. Cairns estimates that 40 percent of the direct-labor hours required for the project will be on overtime. Calculate the incremental costs that should be included in any bid that Cairns would submit on this project. Use the overhead formula derived from the least-squares regression.

- 4. Should management rely on the overhead formula derived from the least-squares regression as the basis for the variable overhead component of its cost estimate? Explain your answer.

- 5. After attending a seminar on activity-based costing, Cairns decided to further analyze the company’s activities and costs. She discovered that a more accurate portrayal of the firm’s cost behavior could be achieved by dividing overhead into three separate pools, each with its own cost driver. Separate regression equations were estimated for each of the cost pools, with the following results.

OH1 = 10,000 + 4.10DLH,

where DLH denotes direct-labor hours

OH2 = 9,100 + 13.50SFS,

where SFS denotes the number of square feet of turf seeded (in thousands)

OH3 = 8,000 + 6.60PL,

where PL denotes the number of individual plantings (e.g., trees and shrubs)

Assume that 5 direct-labor hours will be needed to landscape each 1,000 square feet, regardless of the specific planting material used.

- a. Suppose the landscaping project for the city will involve seeding all 60,000 square feet of turf and planting 80 trees and shrubs. Calculate the incremental variable overhead cost that Cairns should include in the bid.

- b. Recompute the incremental variable overhead cost for the city’s landscaping project assuming half of the 60,000-square-foot landscaping area will be seeded and there will be 250 individual plantings. The plantings will cover the entire 60,000-square-foot area.

- c. Briefly explain, using concepts from activity-based costing, why the incremental costs differ in requirements (a) and (b).

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity Cost Pool Cleaning carpets Activity for the Year 13,500 hundred square feet 65,000 miles 1,900 jobs Travel to jobs Job support Other (organization-sustaining costs and idle capacity costs) Not applicable The total cost of operating the company for the year is $369,000 which includes the following costs: Wages Cleaning supplies Cleaning equipment depreciation Vehicle expenses Office expenses President's compensation Total cost Activity Measure Square feet cleaned (00s) Miles driven Number of jobs Wages Cleaning…arrow_forwardLabor costs of an auto repair mechanic are seldom based on actual hours worked. Instead, this labor cost is based on an industry average of time estimated to complete a repair job. This means a customer can pay, for example, $120 for two hours of work on a car when the actual time worked was only one hour. Many experienced mechanics can complete repair jobs faster than the industry average. Assume that you are asked to complete such a survey for a repair center. The survey calls for objective input, and many questions require detailed cost data and analysis. The mechanics and owners know you have the survey and encourage you to complete it in a way that increases the average billable hours for repair work. Required Write a one-page memorandum to the mechanics and owners that describes the direct labor analysis you will undertake in completing this survey.arrow_forwardDavidson Engine Repairs provides maintenance and repair services for small engines such as those found in lawn mowers, power saws, and snow throwers. The repair shop costs include the salaries for the mechanics, insurance and depreciation on the repair equipment, materials and parts used for the jobs, and utilities. The repair shop manager would like to develop a model for predicting repair costs and over the past 10 months has carefully recorded the total repair costs incurred, along with the number of maintenance and repair jobs completed each month. The data are shown below: Month January February March 250 246 313 278 217 193 September 163 October 116 April May June July August Jobs Repair Costs $36,610 242 284 $41,395 Y = $37,950 $36,840 $44,340 $40,120 $33,660 $28,990 $25,275 $18,730 Required: 1. Not available in Connect. 2. Using the high-low method, estimate a cost formula for repair costs. Express the formula in the form Y = a + bX. Xarrow_forward

- Whitley Construction Company is in the home remodeling business. Whitley has three teams of highly skilled employees, each of whom has multiple skills involving carpentry, painting, and other home remodeling activities. Each team is led by an experienced employee who coordinates the work done on each job. As the needs of different jobs change, some team members may be shifted to other teams for short periods of time. Whitley uses a job costing system to determine job costs and to serve as a basis for bidding and pricing the jobs. Direct materials and direct labor are easily traced to each job using Whitley's cost tracking software. Overhead consists of the purchase and maintenance of construction equipment, some supervisory labor, the cost of bidding for new customers, and administrative costs. Whitley uses an annual overhead rate based on direct labor hours. Whitley has recently completed work for three clients: Harrison, Barnes, and Tyler. The cost data for each of the three jobs are…arrow_forwardWhitley Construction Company is in the home remodeling business. Whitley has three teams of highly skilled employees, each of whom has multiple skills involving carpentry, painting, and other home remodeling activities. Each team is led by an experienced employee who coordinates the work done on each job. As the needs of different jobs change, some team members may be shifted to other teams for short periods of time. Whitley uses a job costing system to determine job costs and to serve as a basis for bidding and pricing the jobs. Direct materials and direct labor are easily traced to each job using Whitley's cost tracking software. Overhead consists of the purchase and maintenance of construction equipment, some supervisory labor, the cost of bidding for new customers, and administrative costs. Whitley uses an annual overhead rate based on direct labor hours. Whitley has recently completed work for three clients: Harrison, Barnes, and Tyler. The cost data for each of the three jobs are…arrow_forwardWhitley Construction Company is in the home remodeling business. Whitley has three teams of highly skilled employees, each of whom has multiple skills involving carpentry, painting, and other home remodeling activities. Each team is led by an experienced employee who coordinates the work done on each job. As the needs of different jobs change, some team members may be shifted to other teams for short periods of time. Whitley uses a job costing system to determine job costs and to serve as a basis for bidding and pricing the jobs. Direct materials and direct labor are easily traced to each job using Whitley’s cost tracking software. Overhead consists of the purchase and maintenance of construction equipment, some supervisory labor, the cost of bidding for new customers, and administrative costs. Whitley uses an annual overhead rate based on direct labor hours. Whitley has recently completed work for three clients: Harrison, Barnes, and Tyler. The cost data for each of the three jobs are…arrow_forward

- Alan is the owner of a new manufacturing business, producing the vehicle components for Proton Supreme V supplies. Advise him by classifying the following costs into the correct categories; fixed cost, variable costs, production overhead, administration overhead, or distribution overhead. Depreciation of machinery Repairs to machinery Supervisors’ salary Assemblers’ wages Electric power Wages for driver of delivery lorry Raw materials: steels and metals Nuts and bolts Delivery costs Salary to administrative staffarrow_forwardSarina is a cost controller in a manufacturing company that produces ceramic products. The production of the products will go through two processing departments that are the molding and finishing department. The company uses weighted average process costing method in determining the unit cost of its products. She is reviewing the monthly production report of the finishing department that was prepared by her newly hired assistant cost controller. She gets confused with the figures in the report. It is not only the format of the report, but Sarina also concerns on the RM25.71 cost per unit which she felt is higher than their normal unit cost. The production and cost information extracted from report are shown below: Finishing Department Costs: Cost Incurred Work in process inventory, 1 October, RM8,208 450 units; materials 100% complete; conversion Consist of: 60% complete (i) transferred in cost RM4,068 (ii) materials cost…arrow_forwardJean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. She notices that $30,000 of the overhead originated from the equipment used. She decides to incorporate machine-hours into the overhead allocation base to determine the effect on product profitability. Almond Dream requires 2 machine-hours per case, Krispy Krackle requires 7 hours per case, and Creamy Crunch requires 6 hours per case. Additionally, Jean notices that the $15,000 per month spent to rent 10,000 square feet of factory space accounts for almost 22 percent of the overhead. The assignment of square feet is 1,000 to Almond Dream, 4,000 to Krispy Krackle, and 5,000 to Creamy Crunch. Jean decides to incorporate this into the allocation base for the rental costs. Because labor-hours are still an important cost driver for overhead, Jean decides that she should use labor-hours to allocate the remaining $24,500. CBI still plans to produce 1,000…arrow_forward

- Jean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. She notices that $30,000 of the overhead originated from the equipment used. She decides to incorporate machine-hours into the overhead allocation base to determine the effect on product profitability. Almond Dream requires 2 machine-hours per case, Krispy Krackle requires 7 hours per case, and Creamy Crunch requires 6 hours per case. Additionally, Jean notices that the $15,000 per month spent to rent 10,000 square feet of factory space accounts for almost 22 percent of the overhead. The assignment of square feet is 1,000 to Almond Dream, 4,000 to Krispy Krackle, and 5,000 to Creamy Crunch. Jean decides to incorporate this into the allocation base for the rental costs. Because labor-hours are still an important cost driver for overhead, Jean decides that she should use labor-hours to allocate the remaining $24,500. CBI still plans to produce 1,000…arrow_forwardJean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. She notices that $30,000 of the overhead originated from the equipment used. She decides to incorporate machine-hours into the overhead allocation base to determine the effect on product profitability. Almond Dream requires 2 machine-hours per case, Krispy Krackle requires 7 hours per case, and Creamy Crunch requires 6 hours per case. Additionally, Jean notices that the $15,000 per month spent to rent 10,000 square feet of factory space accounts for almost 22 percent of the overhead. The assignment of square feet is 1,000 to Almond Dream, 4,000 to Krispy Krackle, and 5,000 to Creamy Crunch. Jean decides to incorporate this into the allocation base for the rental costs. Because labor-hours are still an important cost driver for overhead, Jean decides that she should use labor-hours to allocate the remaining $24,500. CBI still plans to produce 1,000…arrow_forwardBonita, Inc. produces two types of gas grills: a family model and a deluxe model. Bonita's controller has decided to use a plantwide overhead rate based on direct labor costs. The president of the company recently heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations: Direct labor costs Machine hours Setup hours (a) Family Model $76,800 2,000 200 Total estimated overhead costs are $460,800. Overhead cost allocated to the machining activity cost pool is $276,480 and $184,320 is allocated to the machine setup activity cost pool. Overhead rate Deluxe Model $153,600 2,000 800 Compute the overhead rate using the traditional (plantwide) approach. (Round answer to 2 decimal places, e.g. 15.25.) $arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College