Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 35P

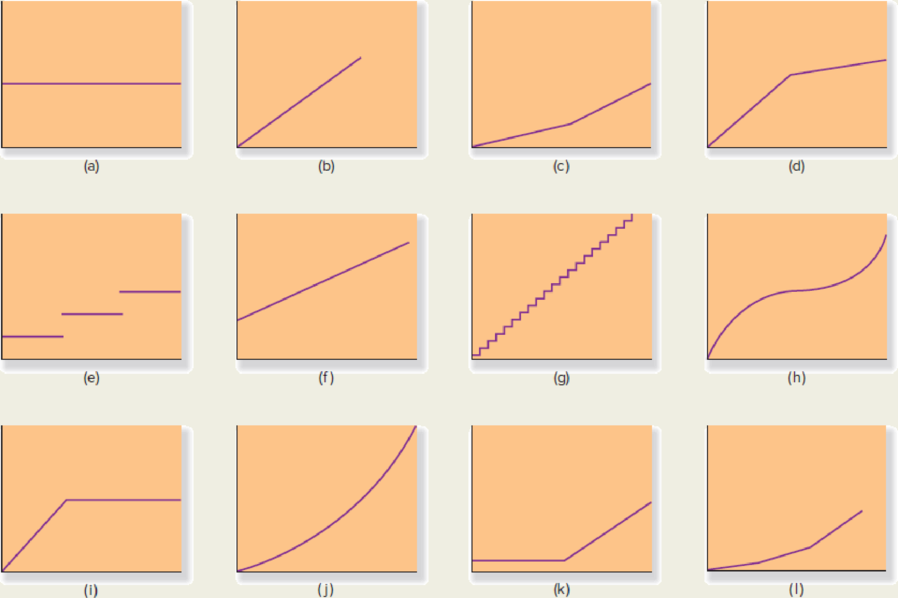

For each of the cost items described below, choose the graph (see below) that best represents it.

- 1. The salary costs of the shift supervisors at a truck depot. Each shift is eight hours. The depot operates with one, two, or three shifts at various times of the year.

- 2. The salaries of the security personnel at a factory. The security guards are on duty around the clock.

- 3. The wages of table-service personnel in a restaurant. The employees are part-time workers, who can be called upon for as little as two hours at a time.

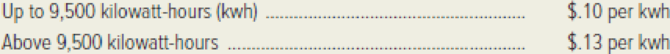

- 4. The cost of electricity during peak-demand periods is based on the following schedule.

The price schedule is designed to discourage overuse of electricity during periods of peak demand.

- 5. The cost of sheet metal used to manufacture automobiles.

- 6. The cost of utilities at a university. For low student enrollments, utility costs increase with enrollment, but at a decreasing rate. For large student enrollments, utility costs increase at an increasing rate.

- 7. The cost of online back-up storage at a rate of $2.50 per gigabyte, up to 50 gigabytes, beyond which storage is unlimited, at no additional cost.

- 8. The cost of the nursing staff in a hospital. The staff always has a minimum of nine nurses on duty. Additional nurses are used depending on the number of patients in the hospital. The hospital administrator estimates that this additional nursing staff costs approximately $195 per patient per day.

- 9. The cost of chartering a private airplane. The cost is $390 per hour for the first three hours of a flight. Then the charge drops to $280 per hour.

- 10. Under a licensing agreement with a South American import/export company, your firm has begun shipping machine tools to several countries. The terms of the agreement call for an annual licensing fee of $100,000 to be paid to the South American import company if total exports are under $5,000,000. For sales in excess of $5,000,000, an additional licensing fee of 10 percent of sales is due.

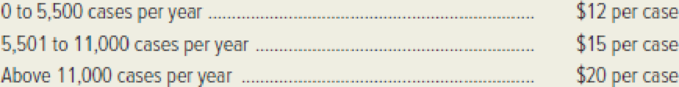

- 11. Your winery exports wine to several Pacific Rim countries. In one nation, you must pay a tariff for every case of wine brought into the country. The tariff schedule is the following:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

answer

What is the unit cost of production per ball bearing?

? Financial accounting

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 6 - Describe the importance of cost behavior patterns...Ch. 6 - Define the following terms, and explain the...Ch. 6 - Suggest an appropriate activity base (or cost...Ch. 6 - Draw a simple graph of each of the following types...Ch. 6 - Explain the impact of an increase in the level of...Ch. 6 - Explain why a manufacturers cost of supervising...Ch. 6 - Explain the impact of an increase in the level of...Ch. 6 - Prob. 8RQCh. 6 - Indicate which of the following descriptions is...Ch. 6 - Prob. 10RQ

Ch. 6 - What is meant by a learning curve? Explain its...Ch. 6 - Suggest an appropriate independent variable to use...Ch. 6 - What is an outlier? List some possible causes of...Ch. 6 - Explain the cost estimation problem caused by...Ch. 6 - Describe the visual-fit method of cost estimation....Ch. 6 - What is the chief drawback of the high-low method...Ch. 6 - Explain the meaning of the term least squares in...Ch. 6 - Prob. 18RQCh. 6 - Prob. 19RQCh. 6 - List several possible cost drivers that could be...Ch. 6 - Prob. 21RQCh. 6 - Prob. 22ECh. 6 - The behavior of the annual maintenance and repair...Ch. 6 - WMEJ is an independent television station run by a...Ch. 6 - Jonathan Macintosh is a highly successful...Ch. 6 - Jonathan Macintosh is a highly successful...Ch. 6 - The Iowa City Veterinary Laboratory performs a...Ch. 6 - Chillicothe Meat Company produces one of the best...Ch. 6 - Rio Bus Tours has incurred the following bus...Ch. 6 - Prob. 31ECh. 6 - Prob. 32ECh. 6 - Prob. 33ECh. 6 - Gator Beach Marts, a chain of convenience grocery...Ch. 6 - For each of the cost items described below, choose...Ch. 6 - The following selected data were taken from the...Ch. 6 - Antioch Extraction, which mines ore in Montana,...Ch. 6 - Nations Capital Fitness, Inc. operates a chain of...Ch. 6 - The Allegheny School of Music has hired you as a...Ch. 6 - Prob. 40PCh. 6 - (Note: Instructors who wish to cover all three...Ch. 6 - Refer to the original data in the preceding...Ch. 6 - Shortly after being hired as an analyst with...Ch. 6 - The controller of Chittenango Chain Company...Ch. 6 - Dana Rand owns a catering company that prepares...Ch. 6 - Madison County Airport handles several daily...Ch. 6 - Earth and Artistry, Inc. provides commercial...Ch. 6 - Prob. 48CCh. 6 - Refer to the data and accompanying information in...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

10-10 What challenges do managers face in managing global teams? How should those challenges be handled?

Fundamentals of Management (10th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY