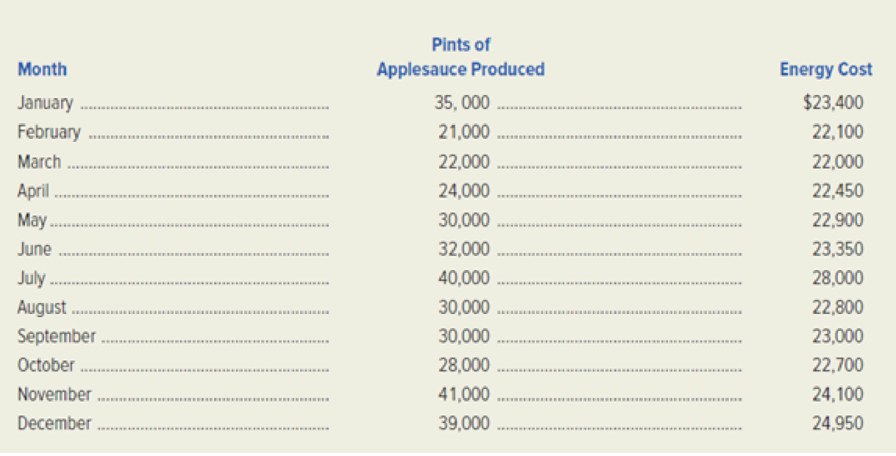

Jonathan Macintosh is a highly successful Pennsylvania orchardman who has formed his own company to produce and package applesauce. Apples can be stored for several months in cold storage, so applesauce production is relatively uniform throughout the year. The recently hired controller for the firm is about to apply the high-low method in estimating the company’s energy cost behavior. The following costs were incurred during the past 12 months:

Requited:

- 1. Use the high-low method to estimate the company’s energy cost behavior and express it in equation form.

- 2. Predict the energy cost for a month in which 26.000 pints of applesauce are produced.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Horton Manufacturing Incorporated produces blinds and other window treatments for residential homes and offices. The owner is concerned about the maintenance costs for the production machinery because maintenance costs for the previous fiscal year were higher than he expected. The owner has asked you to assist in estimating future maintenance costs to better predict the firm's profitability. Together, you have determined that the best cost driver for maintenance costs is machine hours. The data from the previous fiscal year for maintenance costs and machine hours follow: Month Maintenance Costs Machine Hours $ 2,695 2,740 2,790 2,890 2,925 3,025 2,935 1 2 3 4 56789012 10 11 2,975 2,850 2,640 2,660 2,960 Maintenance cost 1,620 1,730 1,745 1,795 1,790 1,890 1,810 1,845 1,835 1,480 1,690 1,495 Required: 1. Use the high-low method to estimate the fixed and variable portions for maintenance costs. (In your calculations, round "slope (uni variable cost)" to 4 decimal places. Enter the "slope…arrow_forwardHorton Manufacturing Incorporated produces blinds and other window treatments for residential homes and offices. The owner is concerned about the maintenance costs for the production machinery because maintenance costs for the previous fiscal year were higher than he expected. The owner has asked you to assist in estimating future maintenance costs to better predict the firm's profitability. Together, you have determined that the best cost driver for maintenance costs is machine hours. The data from the previous fiscal year for maintenance costs and machine hours follow: Month 1 3 4 6 7 8 9 10 11 12 Maintenance Costs Machine Hours $ 2,665 2,710 2,760 2,860 2,895 3,045 2,905 2,945 2,820 2,610 2,630 2,930 Maintenance cost 1,566 1,670 1,685 1,735 1,855 1,890 1,865 1,885 1,775 1,450 1,630 1,465 Required: 1. Use the high-low method to estimate the fixed and variable portions for maintenance costs. (In your calculations, round "slope (unit variable cost)" to 4 decimal places. Enter the…arrow_forwardNonearrow_forward

- Calculate the relevant cost per unit.arrow_forwardPERBANAS, Inc. installs heating systems in new homes built in the southern tier counties of New York state. Jobs are priced using the time and materials method. The president of PERBANAS, Fenturini, is pricing a job involving the heating systems for six houses to be built by a local developer. He has made the following estimates. Material cost $ 30,000 Labor hours 200 The following predictions pertain to the company’s operations for the next year. Labor rate, including fringe benefits $ 8.00 per hour Annual labor hours 6,000 hours Annual overhead costs: Material handling and storage $ 12,500 Other overhead costs $ 54,000 Annual cost of materials used $ 125,000 Perbanas adds a markup of $ 2 per hour on its time charges, but there is no markup on material costs. Required: 1. Calculate the company's time charges and the material charges percentage. 2. Compute the price for the job 3. What would be the price of the job if Perbanas also added a markup of 5 % on all material charges…arrow_forwardJean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory; in other words, a cleaning is started and completed on the same day. Required: 1. Prepare a statement of services produced in good form. 2. What if HHH planned to purchase 30,000 of direct materials? Assume there would be no change in beginning and ending inventories of materials. Explain which line items on the statement of services produced would be affected and how (increase or decrease).arrow_forward

- Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. HHH expects to sell 15,000 cleanings at a price of 45 each next year. Total selling expense is projected at 22,000, and total administrative expense is projected at 53,000. Required: 1. Prepare an income statement in good form. 2. What if Jean and Tom increased the price to 50 per cleaning and no other information was affected? Explain which line items in the income statement would be affected and how.arrow_forwardJean and Tom Perritz own and manage Happy Home Helpers. Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. Required: 1. Prepare a statement of cost of services sold in good form. 2. How does this cost of services sold statement differ from the cost of goods sold statement for a manufacturing firm?arrow_forwardTriple X Company manufactures and sells refrigerators. It makes some of the parts for the refrigerators and purchases others. The engineering department believes it might be possible to cut costs by manufacturing one of the parts currently being purchased for $8.25 each. The firm uses 100,000 of these parts each year. The accounting department compiles the followinglist of costs based on engineering estimates:Fixed costs will increase by $50,000.Labor costs will increase by $125,000.Factory overhead, currently running $500,000 per year, may be expected to increase 12 percent. Raw materials used to make the part will cost $600,000.Given the preceding estimates, should Triple X make the part or continue to buy it?arrow_forward

- Guthrie Generators manufactures a solenoid that it uses in several of its products. Management is considering whether to continue manufacturing the solenoids or to buy them from an outside source. The following information is available: 1. The company needs 20,000 solenoids per year. The solenoids can be purchased from an outside supplier at a cost of $15 per unit. 2. The unit cost of manufacturing the solenoids is $20, computed as follows: Direct materials Direct labor Factory overhead: Variable Fixed Total manufacturing costs Cost per unit ($400,000 ÷ 20,000 units) 3. If the company decides not to manufacture the solenoids, it will eliminate all of the raw materials and direct labor costs but only 75 percent of the variable factory overhead costs. 4. If the solenolds are purchased from the outside source, machinery used in the production of solenoids will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale of this machinery would also eliminate $5,000…arrow_forwardSouthern Tier Heating, Inc. installs heating systems in new homes built in the southern tier counties of New York state. Jobs are priced using the time and materials method. The president of Southern Tier Heating, EIwing, is pricing a job involving the heating systems for six houses to be built by a local developer. He has made the following estimates. Material cost $ 60,000 Labor hours 400 The following predictions pertain to the company’s operations for the next year. Labor rate, including fringe benefits $ 16.00 per hour Annual labor hours 12,000 hours Annual overhead costs: Material handling and storage $ 25,000 Other overhead costs $ 108,000 Annual cost of materials used $ 250,000 Perbanas adds a markup of $ 4 per hour on its time charges, but there is no markup on material costs. Required: 1. Calculate the company's time charges and the material charges percentage. 2. Compute the price for the job 3. What would be the price of the job if Perbanas also added a markup of 10 % on…arrow_forwardChandler Packaged Treats (CPT) sells a specialty pet food to pet stores. CPT management prides itself on its scientific management methods. Applying those methods, the controller estimates the following monthly costs based on 10,000 units (produced and sold): Direct material Direct labor Manufacturing overhead Selling, general, and administrative Total Required: a. Compute CPT's unit selling price that will yield a profit of $200,000, given sales of 10,000 units. b. What dollar sales does CPT need to achieve to generate a 15 percent profit on sales, assuming variable costs per unit are 55 percent of the selling price per unit and fixed costs are $188,100. c. Management believes that a selling price of $100.00 per unit is reasonable given current market conditions. How many units must CPT sell to generate the revenues (dollar sales) determined in requirement (b)? Total Annual Costs (10,000 units) $ 128,000 60,000 132,000 100,000 $ 420,000 Complete this question by entering your answers…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning