Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 23E

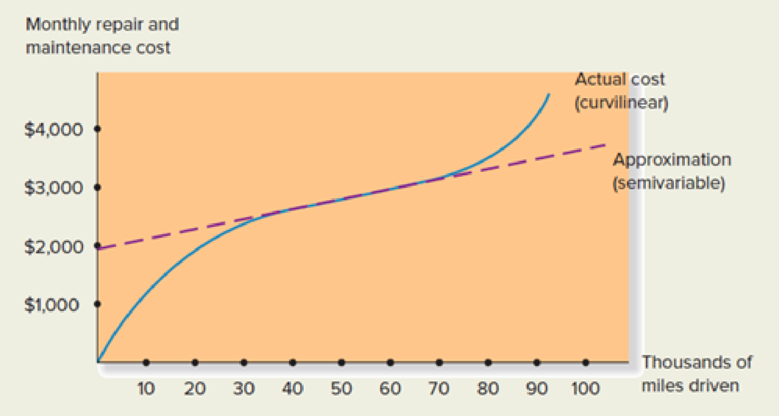

The behavior of the annual maintenance and repair cost in the Bus Transportation Department of the Summerset Public School District is shown by the solid line in the following graph. The dashed line depicts a semi variable-cost approximation of the department’s repair and maintenance cost.

Required:

- 1. What is the actual (curvilinear) and estimated (semivariable) cost shown by the graph for each of the following activity levels?

- 2. How good an approximation does the semi variable-cost pattern provide if the department’s relevant range is 40.000 to 60.000 miles per month? What if the relevant range is 20.000 to 90.000 miles per month?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following activity and cost data that were provided by Hoist Corporation would help in

estimating its future maintenance costs:

Units

Maintenance cost

P1,350

7

P1,590

11

P1,920

15

P2,100

Using the least squares regression method to estimates the cost formula, the expected total

cost for an activity level of 10 units would be closest to:

1. Using the high-low method of cost estimation, estimate the behavior of the maintenance costs incurred by Nation’s Capital Fitness, Incorporated. Express the cost behavior pattern in equation form.

Note: Round coefficient of X to 2 decimal places and other answer to the nearest whole dollar amount.

2.

2. Using your answer to requirement 1, what is the variable component of the maintenance cost?

Note: Round your answer to 2 decimal places.

Use the information below or using Exhibit 12.14 on page 577 in Zelman to answer the following questions.

Calculate the per unit cost of an initial visit using both the conventional and ABC approaches.

Calculate the per unit cost of a regular visit using both the conventional and ABC approaches.

Calculate the per unit cost of an intensive visit using both the conventional and ABC approaches.

Exhibit 12-14

Basic data and calculation of unit costs using a conventional approach

Total Cost by Visit Type

Basic Data

A

B

C

D

Initial

Regular

Intensive

Total

(Given)

(Given)

(Given)

(A + B + C)

1

Number of visits

8,000

26,000

8,600

42,600

2

Direct materials (etc.)

$40,000

$50,000

$65,000

$155,000

3

Direct labor

$100,000

$120,000

$280,000

$500,000…

Chapter 6 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 6 - Describe the importance of cost behavior patterns...Ch. 6 - Define the following terms, and explain the...Ch. 6 - Suggest an appropriate activity base (or cost...Ch. 6 - Draw a simple graph of each of the following types...Ch. 6 - Explain the impact of an increase in the level of...Ch. 6 - Explain why a manufacturers cost of supervising...Ch. 6 - Explain the impact of an increase in the level of...Ch. 6 - Prob. 8RQCh. 6 - Indicate which of the following descriptions is...Ch. 6 - Prob. 10RQ

Ch. 6 - What is meant by a learning curve? Explain its...Ch. 6 - Suggest an appropriate independent variable to use...Ch. 6 - What is an outlier? List some possible causes of...Ch. 6 - Explain the cost estimation problem caused by...Ch. 6 - Describe the visual-fit method of cost estimation....Ch. 6 - What is the chief drawback of the high-low method...Ch. 6 - Explain the meaning of the term least squares in...Ch. 6 - Prob. 18RQCh. 6 - Prob. 19RQCh. 6 - List several possible cost drivers that could be...Ch. 6 - Prob. 21RQCh. 6 - Prob. 22ECh. 6 - The behavior of the annual maintenance and repair...Ch. 6 - WMEJ is an independent television station run by a...Ch. 6 - Jonathan Macintosh is a highly successful...Ch. 6 - Jonathan Macintosh is a highly successful...Ch. 6 - The Iowa City Veterinary Laboratory performs a...Ch. 6 - Chillicothe Meat Company produces one of the best...Ch. 6 - Rio Bus Tours has incurred the following bus...Ch. 6 - Prob. 31ECh. 6 - Prob. 32ECh. 6 - Prob. 33ECh. 6 - Gator Beach Marts, a chain of convenience grocery...Ch. 6 - For each of the cost items described below, choose...Ch. 6 - The following selected data were taken from the...Ch. 6 - Antioch Extraction, which mines ore in Montana,...Ch. 6 - Nations Capital Fitness, Inc. operates a chain of...Ch. 6 - The Allegheny School of Music has hired you as a...Ch. 6 - Prob. 40PCh. 6 - (Note: Instructors who wish to cover all three...Ch. 6 - Refer to the original data in the preceding...Ch. 6 - Shortly after being hired as an analyst with...Ch. 6 - The controller of Chittenango Chain Company...Ch. 6 - Dana Rand owns a catering company that prepares...Ch. 6 - Madison County Airport handles several daily...Ch. 6 - Earth and Artistry, Inc. provides commercial...Ch. 6 - Prob. 48CCh. 6 - Refer to the data and accompanying information in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide a reasoned explanation for the observed sign on the cost driver variable in the maintenance cost regression. What alternative data or alternative regression specifications would you like to use to better capture the above relationship?arrow_forwardData table Month Total Cost Machine Hours January.. 3,420 1,090 February..... S 3,760 1,120 March .... $ 3,532 1,080 April ..... 3,720 1,220 May S 4,800 1,330 June 4,192 1,480 .. %24 %24arrow_forwardYou have been asked to decide about one of two mutually exclusive alternatives (A & B). The following table gives the initial costs, annual savings in labor costs, and the expected life of two pieces of equipment. Plot PW vs. i for each equipment on the same graph and identify the AAIRR from the graph (i for the intersection). Then, highlight the corresponding value of i in yellow in your spreadsheet. High-cost Equipment (A) Low-cost Equipment (B) Initial Cost $137,910 $100,000 Savings in Labor Costs $42,000 / year $32,000 / year Life 5 years 5 yearsarrow_forward

- Using the least-squares method of analyzing costs, answer the following questions and show computations to support your answers. a. What is the estimated variable portion of maintenance costs per labor hour? B.What is the estimated fixed maintenance cost each month? C.Formulate the regression equation D.If it is estimated that 600 labor hours will be used in July, what is the expected total power cost for July?arrow_forward1.Using the high-low method of analyzing costs, answer the following questions and show computations to support your answers. a. What is the estimated variable portion of maintenance costs per labor hour? 2.What is the estimated fixed maintenance cost each month? 3.Formulate the regression equation 4.If it is estimated that 600 labor hours will be used in July, what is the expected total power cost for July? 5.Using the least-squares method of analyzing costs, answer the following questions and show computations to support your answers. a. What is the estimated variable portion of maintenance costs per labor hour? 5a. What is the estimated fixed maintenance cost each month? 5b.Formulate the regression equation 5c.If it is estimated that 600 labor hours will be used in July, what is the expected total power cost for July?arrow_forwardVariable costing income statement for a service company The actual and planned data for Underwater University for the Fall term were as follows: Registration, records, and marketing costs vary by the number of enrolled students, while instructional costs vary by the number of credit hours. Depreciation is a fixed cost. A. Prepare a variable costing income statement showing the contribution margin and operating income for the Fall term. B. Prepare a contribution margin analysis report comparing planned with actual performance for the Fall term.arrow_forward

- The management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. The selling price for the product will be $45 per unit. Probability distributions for the purchase cost, the labor cost, and the transportation cost are estimated as follows: ProcurementCost ($) Probability LaborCost ($) Probability TransportationCost ($) Probability 10 0.2 18 0.25 2 0.74 12 0.35 20 0.35 5 0.26 13 0.45 22 0.1 25 0.3 Compute profit per unit for the base-case, worst-case, and best-case scenarios.Profit per unit for the base-case: $ fill in the blank 1Profit per unit for the worst-case: $ fill in the blank 2Profit per unit for the best-case: $ fill in the blank 3 Construct a simulation model to estimate the mean profit per unit. If required, round your answer to the nearest cent.Mean profit per unit = $ fill in the blank 4 Why is the simulation approach to risk analysis preferable to generating a variety of…arrow_forwardAccounting Questionarrow_forwardThe following activity and cost data that were provided by Hoist Corporation would help in estimating its future maintenance costs: Units Maintenance cost P1,350 7. P1,590 11 P1,920 15 P2.100 Using the least squares regression method to estimates the cost formula, the expected total cost for an activity level of 10 units would be closest to (nearest peso) e.g. 1405.688888, Type 1406 3.arrow_forward

- What is a good response to this classmates post? For this week's discussion, I will answer: What are the purposes of each margin, and what information do they convey? Contribution margin uses the CPV calculation with C=unit margin, P =unit revenue, and V=unit variable cost. The formula is C=P-V. The contribution margin shows the money each product/unit sold makes after removing the unit variable cost. This can be displayed grossly or per unit (Team, 2024). This margin shows what kind of profit and revenue a particular product can generate after covering the fixed costs. Gross margin is calculated by gross margin = revenue-product cost. Subtracting the direct costs (labor and materials) from the company's revenue will allow the company to see what its gross profit is compared to its revenues as a percentage. The main difference is how the costs are classified by function (product vs. period).arrow_forwardHello question is attached, thanks.arrow_forwardThe management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License