Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 44P

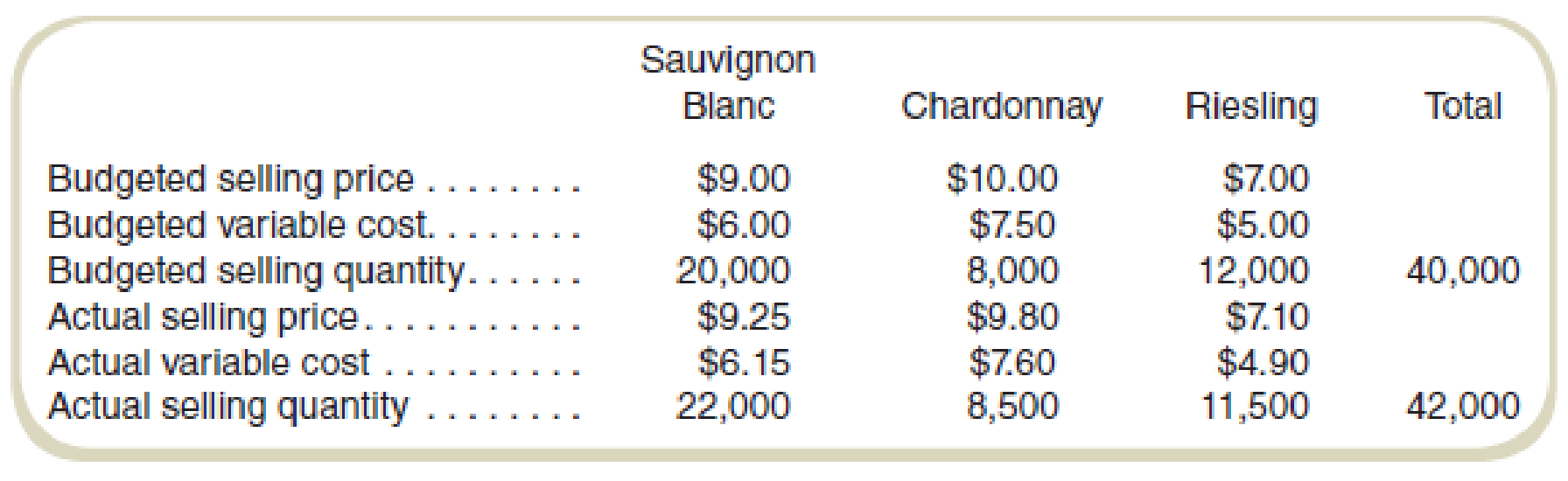

Sales Mix and Quantity Variances

Lake Cellars produces and sells white wine. The following data concern the three varietals of white wine the company currently offers. Sales data for August are given below:

Required

- a. Compute the sales price variance for all three wines.

- b. Compute the activity variance for Lake Cellars for August.

- c. Compute the mix and quantity variances for Lake Cellars for August.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the actual cost of direct material use ?

A company has a defined benefit pension plan for its employees. Discuss the accounting treatment for defined benefit plans and the potential impact on the company's financial statements. What are the risks associated with defined benefit plans? How can the company manage these risks?

What was the amount of inventory purchased during the year?

Chapter 17 Solutions

Fundamentals of Cost Accounting

Ch. 17 - What complication arises in variance analysis when...Ch. 17 - Variance analysis can be useful in a manufacturing...Ch. 17 - How would you recommend accounting for variances...Ch. 17 - What does a manager learn by computing an industry...Ch. 17 - Why is there no efficiency variance for revenues?Ch. 17 - For what decisions would a manager want to know...Ch. 17 - If the sales activity or materials efficiency...Ch. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - What is the advantage of recognizing materials...

Ch. 17 - How could a professional sports firm use the mix...Ch. 17 - Prob. 12CADQCh. 17 - How could a hospital firm use the mix variance to...Ch. 17 - Prob. 14CADQCh. 17 - There is no reason to investigate favorable...Ch. 17 - Prob. 16CADQCh. 17 - Consider a firm in the sharing economy, such as...Ch. 17 - Prob. 18ECh. 17 - Prob. 19ECh. 17 - Prob. 20ECh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Prob. 22ECh. 17 - Industry Volume and Market Share Variances DB Ice...Ch. 17 - Olive Tree Products sold 72,000 units during the...Ch. 17 - Prob. 25ECh. 17 - Sales Mix and Quantity Variances A-Zone Media...Ch. 17 - Prob. 27ECh. 17 - Sales Mix and Quantity Variances The restaurant at...Ch. 17 - Sales Mix and Quantity Variances Chow-4-Hounds...Ch. 17 - Materials Mix and Yield Variances Stacy, Inc.,...Ch. 17 - Materials Mix and Yield Variances Johns...Ch. 17 - Labor Mix and Yield Variances Matts Eat N Run has...Ch. 17 - Flexible Budgeting, Service Organization KB is a...Ch. 17 - Prob. 34ECh. 17 - Prob. 35ECh. 17 - Sales Price and Activity Variances EZ-Tax is a tax...Ch. 17 - Write a memo to the senior manager of EZ-Tax...Ch. 17 - Variable Cost Variances The standard direct labor...Ch. 17 - Refer to the information in Exercise...Ch. 17 - Prob. 40PCh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Industry Volume and Market Share Variances:...Ch. 17 - Industry Volume and Market Share: Missing Data The...Ch. 17 - Sales Mix and Quantity Variances Lake Cellars...Ch. 17 - Analyze Performance for a Restaurant Dougs Diner...Ch. 17 - Nonmanufacturing Cost Variances FSBCU is a...Ch. 17 - Performance Evaluation in Service Industries Bay...Ch. 17 - Refer to the information in Problem...Ch. 17 - Prob. 49PCh. 17 - Refer to the data for the Peninsula Candy Company...Ch. 17 - Materials Mix and Yield Variances Plano Products...Ch. 17 - Pinnuck Products makes a liquid solvent using two...Ch. 17 - Labor Mix and Yield Variances Matthews Bros, is a...Ch. 17 - Refer to the information in Problem...Ch. 17 - Derive Amounts for Profit Variance Analysis...Ch. 17 - Flexible Budget Oak Hill Township operates a motor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- #general accountarrow_forwardHello give general account solutionarrow_forwardCassie Corporation has provided the following information for its most recent month of operation; sales $32,200, beginning inventory $8,050, purchases $16,100 and gross profit $19,800. How much was Cassie's ending Inventory? a. $3,700 b. $6,200 c. $11,750 d. $7,400arrow_forward

- Solve this following requirements on these general accounting questionarrow_forwardGuo Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 950 units. The costs and percentage completion of these units in beginning inventory were: Cost Percent Complete Materials costs $ 8,200 65% Conversion costs $3,000 10% A total of 10,600 units were started and 10,000 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Materials costs $2,39,600 Conversion costs $ 3,77,300 The ending inventory was 90% complete with respect to materials and 80% complete with respect to conversion costs. The cost per equivalent unit for materials for the month in the first processing department is: a. $21.03 b. $22.05 c. $21.75 d. $20.05arrow_forwardGive general account ansarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY