Concept explainers

Labor Mix and Yield Variances

Matthews & Bros, is a local landscape construction company. In analyzing financial performance, the cost accountant compares actual results with a flexible budget. The standard direct labor rates used in the flexible budget are established each year at the time the annual plan is formulated and held constant for the entire year.

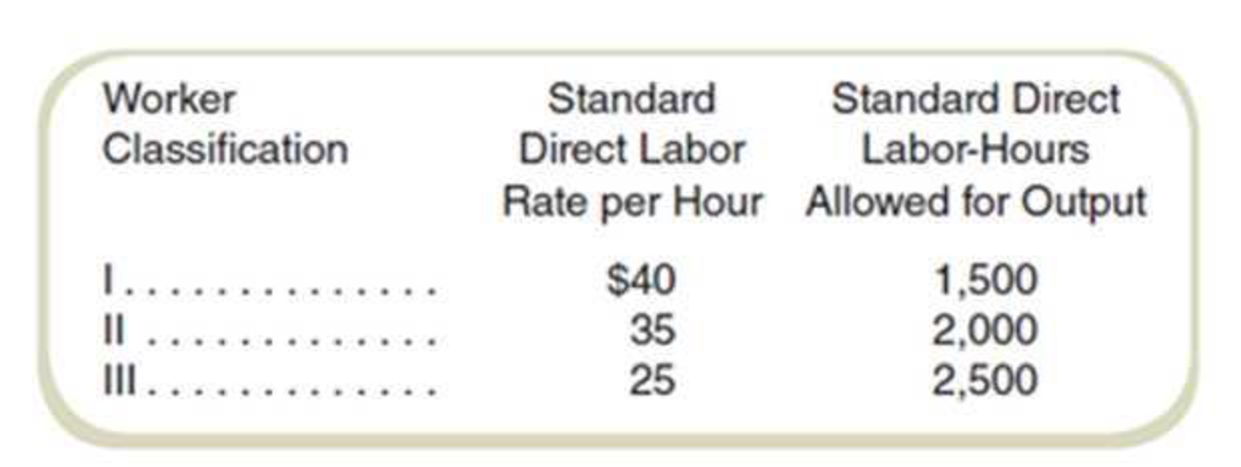

The standard direct labor rates in effect for the current fiscal year and the standard hours allowed for the actual output of work for July are shown in the following schedule:

The wage rates for each labor class increased under the terms of a new contract. The standard wage rates were not revised to reflect the new contract.

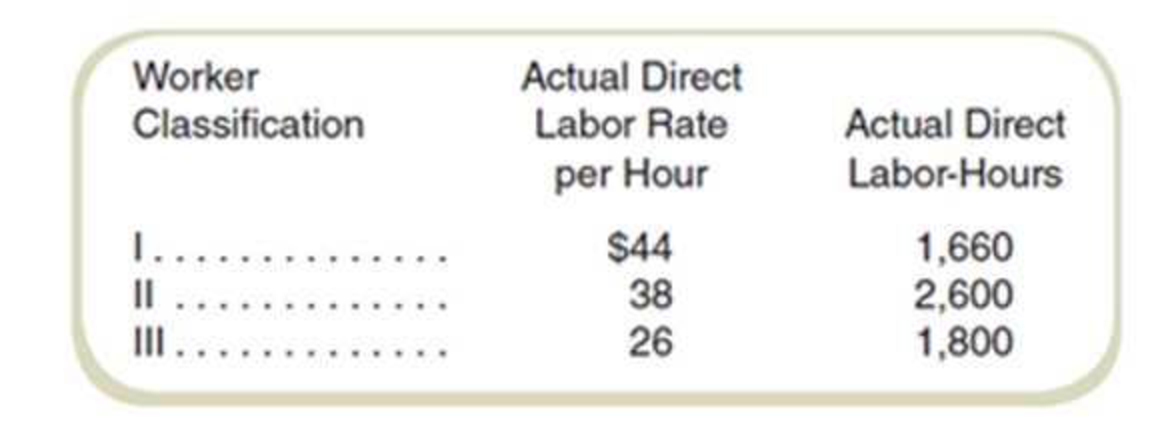

The actual direct labor-hours worked and the actual direct labor rates per hour experienced for the month of July were as follows:

Required

Calculate the dollar amount of the total direct labor variance for July for Matthews & Bros, and break down the total variance into the following components:

- a. Direct labor price and efficiency variances.

- b. Direct labor mix and yield variances.

(CM A adapted)

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Fundamentals of Cost Accounting

- I need help with this general accounting question using the proper accounting approach.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College