Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 45P

Analyze Performance for a Restaurant

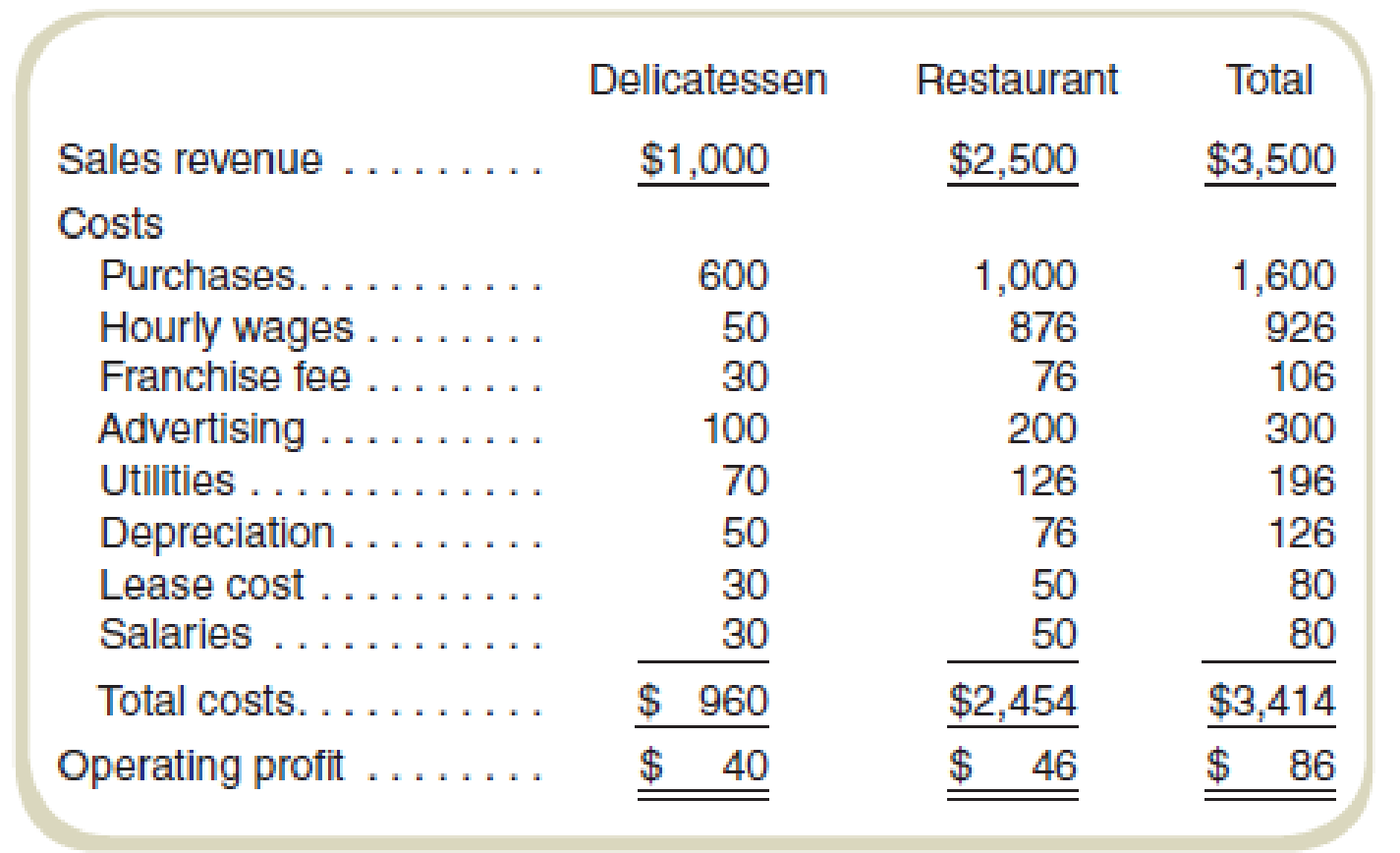

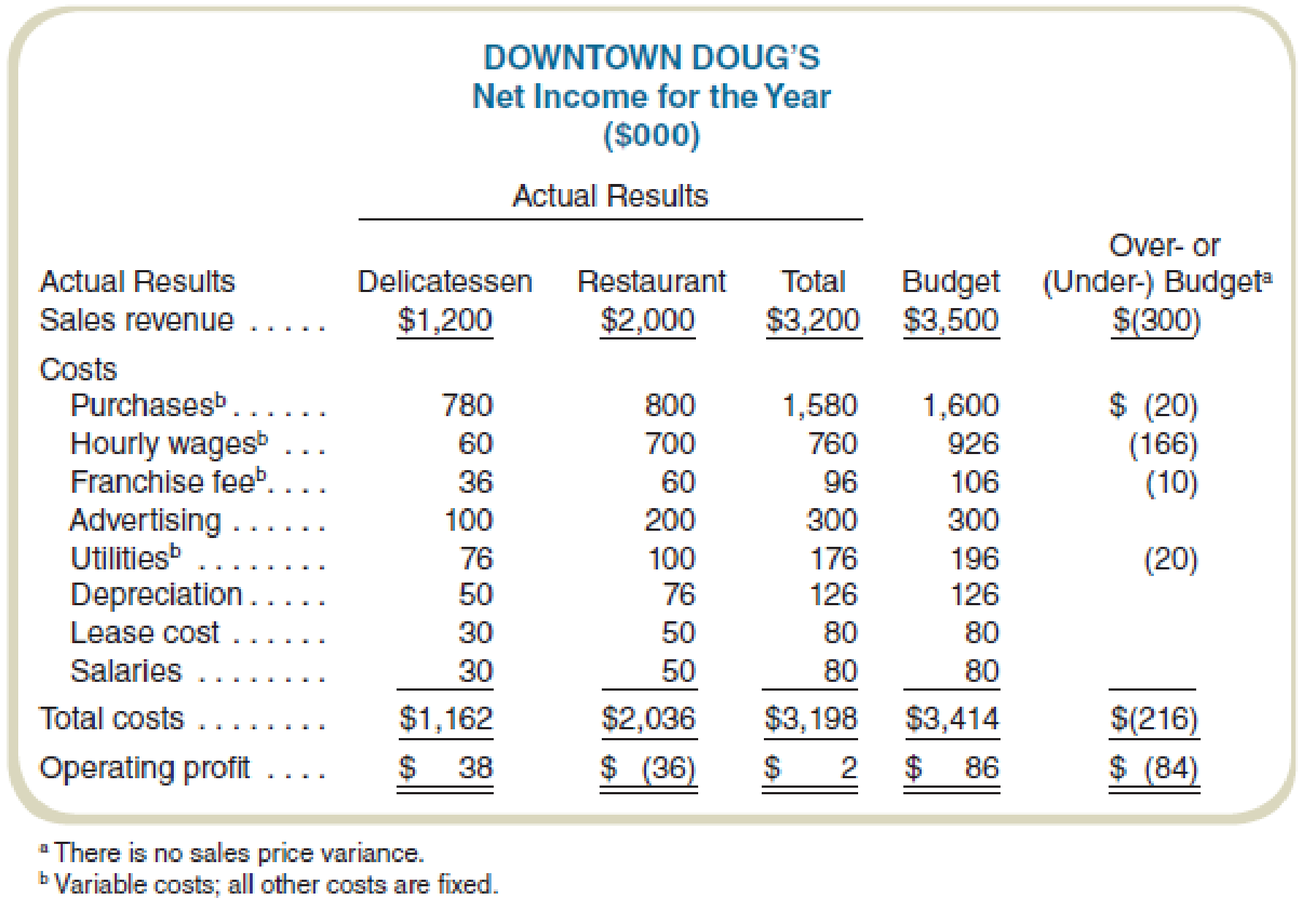

Doug’s Diner is planning to expand operations and is concerned that its reporting system might need improvement. The master

The company uses the following performance report for management evaluation:

Required

Prepare a profit

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Light emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…

Financial accounting

Chapter 17 Solutions

Fundamentals of Cost Accounting

Ch. 17 - What complication arises in variance analysis when...Ch. 17 - Variance analysis can be useful in a manufacturing...Ch. 17 - How would you recommend accounting for variances...Ch. 17 - What does a manager learn by computing an industry...Ch. 17 - Why is there no efficiency variance for revenues?Ch. 17 - For what decisions would a manager want to know...Ch. 17 - If the sales activity or materials efficiency...Ch. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - What is the advantage of recognizing materials...

Ch. 17 - How could a professional sports firm use the mix...Ch. 17 - Prob. 12CADQCh. 17 - How could a hospital firm use the mix variance to...Ch. 17 - Prob. 14CADQCh. 17 - There is no reason to investigate favorable...Ch. 17 - Prob. 16CADQCh. 17 - Consider a firm in the sharing economy, such as...Ch. 17 - Prob. 18ECh. 17 - Prob. 19ECh. 17 - Prob. 20ECh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Prob. 22ECh. 17 - Industry Volume and Market Share Variances DB Ice...Ch. 17 - Olive Tree Products sold 72,000 units during the...Ch. 17 - Prob. 25ECh. 17 - Sales Mix and Quantity Variances A-Zone Media...Ch. 17 - Prob. 27ECh. 17 - Sales Mix and Quantity Variances The restaurant at...Ch. 17 - Sales Mix and Quantity Variances Chow-4-Hounds...Ch. 17 - Materials Mix and Yield Variances Stacy, Inc.,...Ch. 17 - Materials Mix and Yield Variances Johns...Ch. 17 - Labor Mix and Yield Variances Matts Eat N Run has...Ch. 17 - Flexible Budgeting, Service Organization KB is a...Ch. 17 - Prob. 34ECh. 17 - Prob. 35ECh. 17 - Sales Price and Activity Variances EZ-Tax is a tax...Ch. 17 - Write a memo to the senior manager of EZ-Tax...Ch. 17 - Variable Cost Variances The standard direct labor...Ch. 17 - Refer to the information in Exercise...Ch. 17 - Prob. 40PCh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Industry Volume and Market Share Variances:...Ch. 17 - Industry Volume and Market Share: Missing Data The...Ch. 17 - Sales Mix and Quantity Variances Lake Cellars...Ch. 17 - Analyze Performance for a Restaurant Dougs Diner...Ch. 17 - Nonmanufacturing Cost Variances FSBCU is a...Ch. 17 - Performance Evaluation in Service Industries Bay...Ch. 17 - Refer to the information in Problem...Ch. 17 - Prob. 49PCh. 17 - Refer to the data for the Peninsula Candy Company...Ch. 17 - Materials Mix and Yield Variances Plano Products...Ch. 17 - Pinnuck Products makes a liquid solvent using two...Ch. 17 - Labor Mix and Yield Variances Matthews Bros, is a...Ch. 17 - Refer to the information in Problem...Ch. 17 - Derive Amounts for Profit Variance Analysis...Ch. 17 - Flexible Budget Oak Hill Township operates a motor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dont use ai solution general Accounting questionarrow_forwardNeed correct answer general Accountingarrow_forwardYear 0123 Cash Flow -$ 19,000 11,300 10,200 6,700 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability indexarrow_forward

- Sol This question answerarrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What is the impact on Abercrombie & Fitch's financial statements from the write-down of its logo-adorned merchandise…arrow_forwardTherefore the final answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License