Concept explainers

Variable Cost Variances: Materials Purchased and Used Are Not Equal

Griffen Company makes pipe using metal. The company uses a

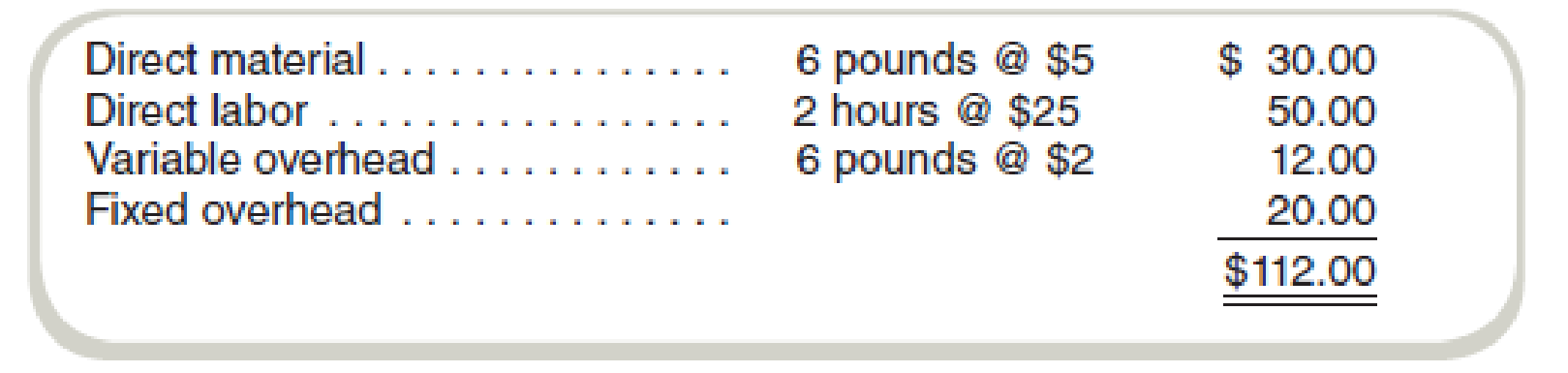

The standard cost sheet for a unit of pipe follows:

August financial results show that the average purchase price of metal was $5.30 per pound. The purchase price variance $34,590 unfavorable. The variable overhead efficiency variance was 8,000 unfavorable. Good output produced totaled 15,000 units.

Required

- a. How many pounds of metal were purchased in August?

- b. What was the direct material efficiency variance in August?

- c. How many pounds of metal were used in August?

- d. Which, if either, of the direct material variances (price or efficiency) would you recommend Griffen management to investigate? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Fundamentals of Cost Accounting

- Botella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forwardGrand Canyon Manufacturing Inc. produces and sells a product with a price of 100 per unit. The following cost data have been prepared for its estimated upper and lower limits of activity: Overhead: Selling and administrative expenses: Required: 1. Classify each cost element as either variable, fixed, or semi-variable. (Hint: Recall that variable expenses must go up in direct proportion to changes in the volume of activity.) 2. Calculate the break-even point in units and dollars. (Hint: First use the high-low method illustrated in Chapter 4 to separate costs into their fixed and variable components.) 3. Prepare a break-even chart. 4. Prepare a contribution income statement, similar in format to the statement appearing on page 540, assuming sales of 5,000 units. 5. Recompute the break-even point in units, assuming that variable costs increase by 20% and fixed costs are reduced by 50,000.arrow_forwardMisterio Company uses a standard costing system. During the past quarter, the following variances were computed: Misterio applies variable overhead using a standard rate of 2 per direct labor hour allowed. Two direct labor hours are allowed per unit produced. (Only one type of product is manufactured.) During the quarter, Misterio used 30 percent more direct labor hours than should have been used. Required: 1. What were the actual direct labor hours worked? The total hours allowed? 2. What is the standard hourly rate for direct labor? The actual hourly rate? 3. How many actual units were produced?arrow_forward

- H.J. Heinz Company uses standards to control its materials costs. Assume that a batch of ketchup (7,650 pounds) has the following standards: The actual materials in a batch may vary from the standard due to tomato characteristics. Assume that the actual quantities of materials for batch 08-99 were as follows: a. Determine the standard unit materials cost per pound for a standard batch. b. Determine the direct materials quantity variance for batch 08-99.arrow_forwardDelano Company uses two types of direct labor for the manufacturing of its products: fabricating and assembly. Delano has developed the following standard mix for direct labor, where output is measured in number of circuit boards. During the second week in April, Delano produced the following results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. 3. Calculate the direct labor yield variance. 4. Calculate the direct labor mix variance.arrow_forwardThe controller at Wesson Company's manufacturing plant has provided you with the following information for the first quarter's operations: Direct materials Fixed manufacturing overhead costs Sales price Variable manufacturing overhead Direct labor Fixed marketing and administrative costs Units produced and sold during the quarter Variable marketing and administrative costs Required: a. Determine the variable cost per unit. b. Determine the variable manufacturing cost per unit. c. Determine the full absorption cost per unit. d. Determine the full cost per unit. e. Determine the profit margin per unit. f. Determine the gross margin per unit. g. Determine the contribution margin per unit. Note: Round your answer to 2 decimal places. a. Variable cost per unit b. Variable manufacturing cost per unit c. Full absorption cost per unit d. Full cost per unit e. Profit margin per unit f. Gross margin per unit g. Contribution margin per unit $ 116 per unit $ 2,540,000 $ 525 per unit $57 per unit…arrow_forward

- The Clark Company makes a single product and uses standard costing. Variable overhead is assigned to production based on direct labour hours. Some data concerning this product for the month of May follow: Labour rate variance:$7,000 FLabour efficiency variance:$12,000 FVariable overhead efficiency variance:$4,000 FNumber of units produced:10,000 Standard labour rate per direct labour hour:$12 Standard variable overhead rate per direct labour hour:$4 Actual labour hours used:14,000 Actual variable manufacturing overhead costs:$58,290 The actual direct labour rate for May in dollars per hour was: Multiple Choice $11.50. $11.75. $12.00. $12.50.arrow_forwardPlease provide solutionarrow_forwardGet the Answer for all Questionsarrow_forward

- Please give tha answer with calculationsarrow_forward1) What is the labor efficiency variance for March? 2) What is the variable overhead rate for March? 3) What is the variable overhead efficiency variance for March?arrow_forwardHonesty Company uses standard costing for each specialized product. The following information is available: Standards: Material 3.0 feet per unit @ P42.00 per foot Labor 2.5 hours per unit @ P75.00 per hour Actual: Production 2,750 units produced during the month Material 8,700 feet used; 9,000 feet purchased @ P45.00 per foot Labor 7,000 direct labor hours @ P79.00 per hour How much is the labor efficiency variance?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning