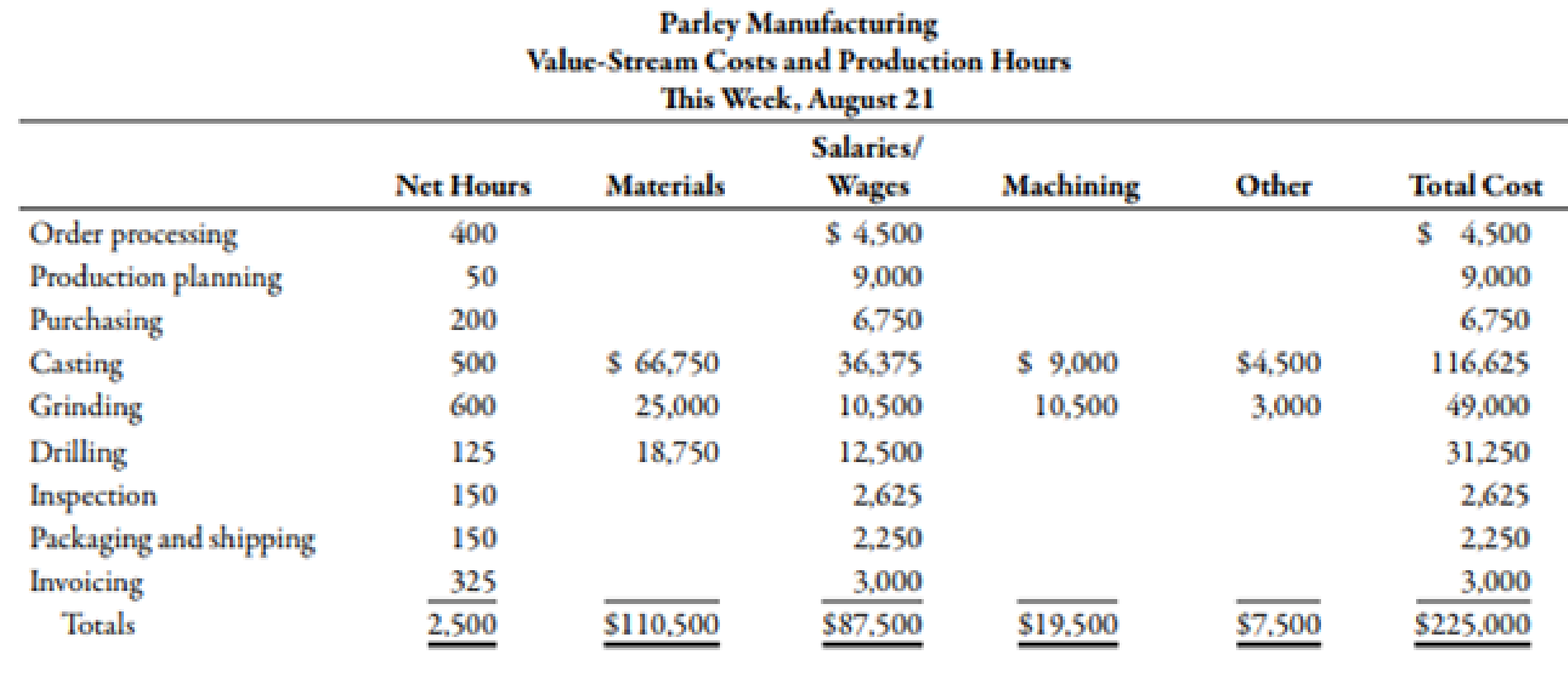

During the week of August 21, Parley Manufacturing produced and shipped 4,000 units of its machine tools: 1,500 units of Tool SK1 and 2,500 units of Tool SK3. The cycle time for SK1 is 0.73 hour, and the cycle time for SK3 is 0.56 hour. The following costs were incurred:

Required:

- 1. Assume that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy.

- 2. Assume that Tool SK1 is responsible for 60% of the materials cost. Calculate the unit cost for Tool SK 1 and Tool SK3, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation.

- 3. Calculate the unit cost for the two models, using DBC. Explain when and why this cost is more accurate than the unit cost calculated in Requirement 2.

1.

Compute unit cost assuming that the value-stream cost and total units shipped apply to a single model.

Answer to Problem 32BEB

Unit cost is $56.25

Explanation of Solution

Value Stream:

Value stream consists of the processes through which a product goes; that is from procurement to delivery. In value stream, all processes are covered whether or not they add value to the product.

Computation of unit cost:

Unit cost can be computed by using formula:

Substitute $225,000 for total value stream cost and 4,000 for total units in the above formula.

In case, there is only one product and all the costs are directly attributable to that product, then unit cost computed would provide accurate result.

Therefore, assuming that the value-stream cost and total units shipped apply to a single model, unit cost is $56.25.

2.

Compute unit cost of both the models in case, Model A is responsible for 60% of the material cost. Comment on accuracy of the results and provide the rationale behind using units shipped instead of units produced.

Answer to Problem 32BEB

Unit cost of model A and B is $72.825 and $46.305 respectively.

Explanation of Solution

Computation of unit cost:

| Particulars | Model A ($) | Model B ($) |

| Units shipped | 1,500 | 2,500 |

| Material cost |

66,300 |

44,200 |

|

Material cost per unit (A) |

44.20 |

17.68 |

| Conversion cost per unit1 (B) | 28.625 | 28.625 |

| Unit cost | 72.825 | 46.305 |

Table (1)

Units shipped are used to compute per unit cost rather than units produced. This is done to encourage the reduction of goods produced, in excess of units to be shipped.

This would happen because value stream cost includes goods that are produced and unit cost would increase if goods shipped are lesser than goods produced.

Therefore, unit cost of model A and B is $72.825 and $46.305 respectively.

Working Notes:

1. Computation of conversion cost per unit:

3.

Compute unit cost for each model using duration based costing.

Answer to Problem 32BEB

Unit cost of model A and B would be $77.634 and $43.328 respectively.

Explanation of Solution

Duration Based Costing:

In duration based costing value stream conversion cost is distributed amongst products in proportion of the cycle time.

Computation of unit cost:

| Particulars | Model A ($) | Model B ($) |

| Units shipped | 1,500 | 2,500 |

| Material cost |

66,300 |

44,200 |

|

Material cost per unit (A) |

44.20 |

17.68 |

| Conversion cost rate per hour1 | 45.8 | 45.8 |

| Cycle time per unit (hours) | 0.73 | 0.56 |

| Conversion cost per unit (B) |

33.434 |

25.648 |

| Unit cost | 77.634 | 43.328 |

Table (2)

Duration bond costing would provide better results when products are not homogeneous and time taken by each type of product varies.

Therefore, unit cost of model A and B would be $77.634 and $43.328 respectively.

Working Notes:

1. Computation of conversion cost rate:

Want to see more full solutions like this?

Chapter 13 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- choose best answerarrow_forwardIngram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage? please provide answerarrow_forwardcorrect answer pleasearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub